A Home for Every Season: How to Match Clients with the Perfect Property

September 22, 2023 — 10 min read

Your client's home is more than a structure or a building—it’s a sanctuary that evolves with the changing seasons of life. So, whether clients are starting a family or just need extra space for a dog, finding the right space can make all the difference.

However, handpicking properties to present is no easy feat; it requires in-depth knowledge of current inventory, a breadth of experience and patience, and a deep understanding of your client’s needs, style, and budget.

From young couples to empty nesters, and everyone in between, we’ve collected expert tips and insights to help you match clients with their perfect property, no matter the season or the client’s phase of life.

The Ever-Changing Landscape of Homeowner Needs

In general, homeowners have different needs at different stages of life

Like each season, each life phase brings unique desires and priorities, and tailoring the home search accordingly can make a world of difference.

Young couples

Young couples taking their first steps into homeownership may seek properties that embody their dreams of starting a life together; they are often first-time homebuyers and prioritize locations that offer vibrant communities and proximity to work and leisure activities.

Here are some key considerations for realtors when showing and selling properties to young couples:

- Young couples seek vibrant communities with proximity to work, leisure activities, and essential amenities like schools, parks, shopping centers, and public transportation

- As young couples may be planning to start a family, they look for homes that provide room for potential growth. Highlighting properties with additional bedrooms or flexible spaces that can be converted into nurseries or home offices can be particularly appealing

- Affordability is a critical factor for young couples, especially first-time homebuyers. Realtors should be prepared to discuss mortgage options that offer flexibility, including low-down payment programs

- Many young couples are environmentally conscious and seek properties with energy-efficient features. Pointing out eco-friendly aspects, such as solar panels, efficient insulation, or energy-saving appliances, can be attractive selling points

RELATED: Tips to Save Energy & Money at Home This Year

- Emphasizing properties with smart home features or excellent internet connectivity is essential for young couples who value modern technology and want their home to be integrated with devices and gadgets

- Realtors should discuss the long-term investment potential of properties with young couples. Explaining how homeownership can build equity and serve as a financial asset over time can be compelling for those looking to secure their financial future.

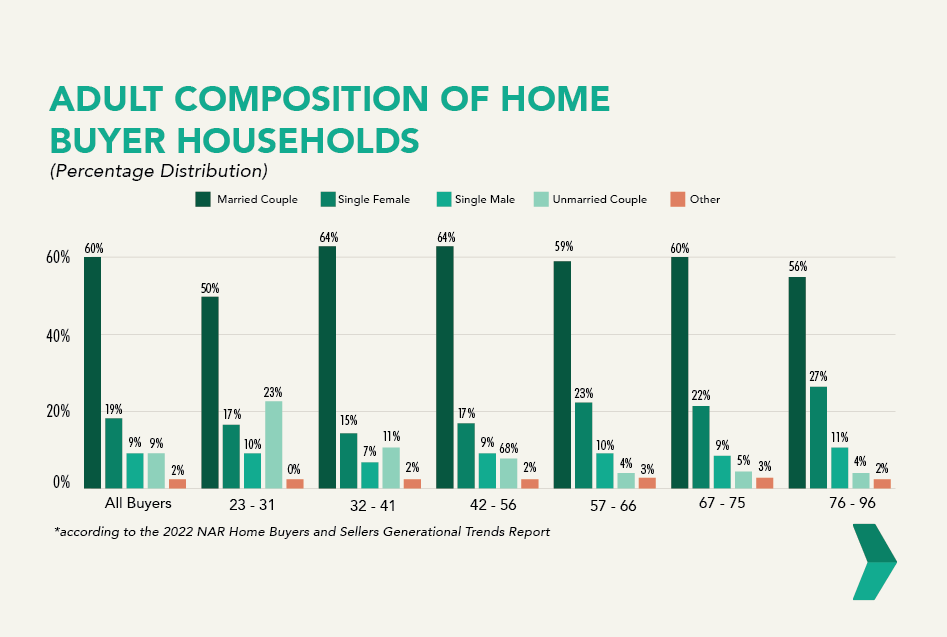

Currently, millennials make up the largest share of young couple homebuyers, with 27% planning to postpone parenthood until they’ve achieved homeownership, according to researchers.

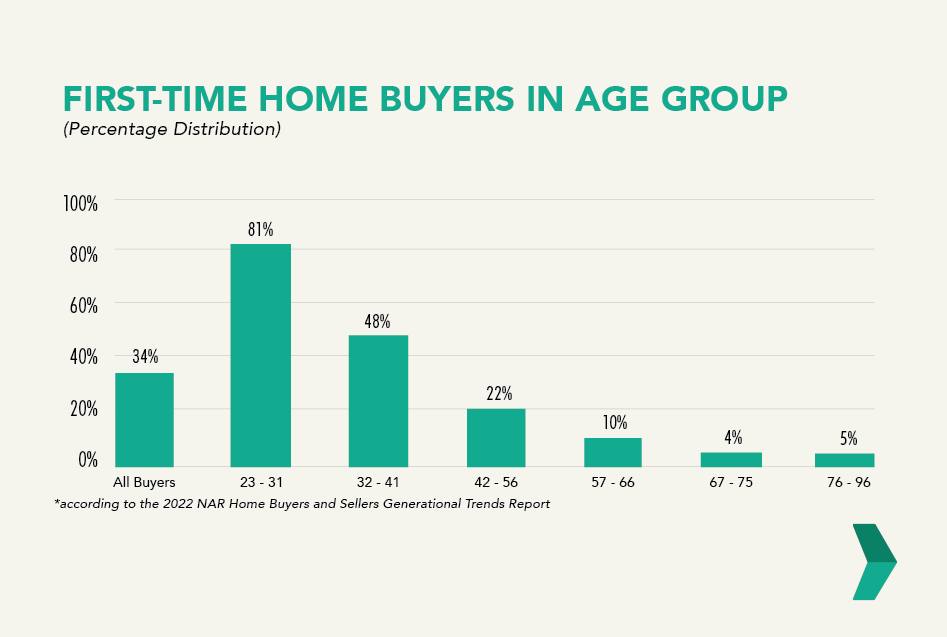

They also make up the largest share of first-time homebuyers at 81 (younger millennials) and 48 percent (older millennials), respectively.

Growing families

Growing families have distinct needs when searching for their ideal home; as their families expand, they require properties that can comfortably accommodate kids and provide a safe and nurturing environment.

Here are some key considerations for realtors when showing and selling properties to growing families:

- Growing families prioritize spacious homes with multiple bedrooms and ample living areas; a flexible layout that allows for easy expansion and adapts to changing family dynamics can be highly desirable

- Access to quality schools and educational resources is a top concern for families with children. Realtors should be knowledgeable about the school districts in the area and be prepared to highlight properties located within highly regarded school zones

RELATED: The Significance of School Districts When Buying a Home

- Growing families seek neighborhoods that are safe, family-friendly, and offer community amenities such as parks, playgrounds, and recreational facilities. Emphasizing properties in such neighborhoods can be appealing to these buyers.

- Homes with spacious yards or proximity to green spaces are attractive to growing families. These outdoor areas offer ample space for children to play and for families to enjoy outdoor activities together

- As families grow, so does their need for storage and organization; properties with ample storage space, built-in cabinets, and functional closets can be a significant selling point.

RELATED: Your Guide to Finding a Family-Friendly Neighborhood

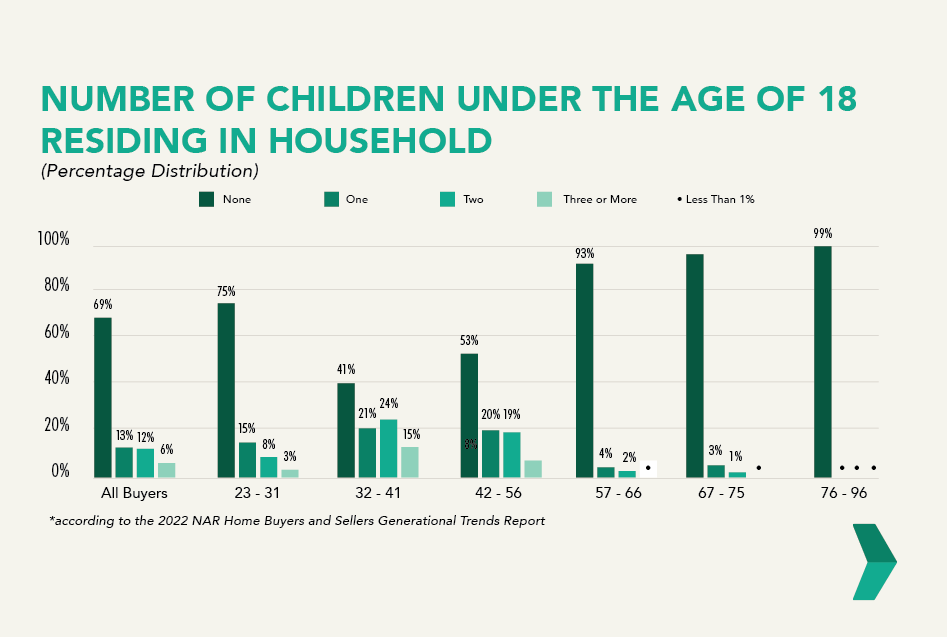

Currently, about 31 percent of all buyers have children under the age of 18 living at home, according to the National Association of Realtors.

Empty nesters

Empty nesters are in a different phase of life compared to young couples and growing families. These are individuals or couples whose children have grown up and left home. Primarily, empty nesters are looking to downsize or find a home that better suits their changing needs.

When showing and selling properties to empty nesters, realtors should consider the following factors:

- Empty nesters want to reduce maintenance and create a more manageable living space; realtors should showcase properties that offer low-maintenance features and easy upkeep

- Empty nesters may prefer single-level homes or properties with main-floor master suites for ease of mobility and comfort

- Many empty nesters value convenience and desire properties located near amenities such as healthcare facilities, entertainment venues, restaurants, and shopping centers

- Empty nesters often look for neighborhoods that offer a sense of community and opportunities for social engagement. Properties in age-restricted communities or those close to recreational centers can be particularly appealing

RELATED: Buying a Home as an Empty Nester: Tips and Tricks for Downsizing

- Empty nesters may be more financially secure than young couples or growing families, but they are also focused on maximizing their investments. Realtors should discuss how the property can fit into their long-term financial plans

Budget-Friendly Solutions for Every Phase

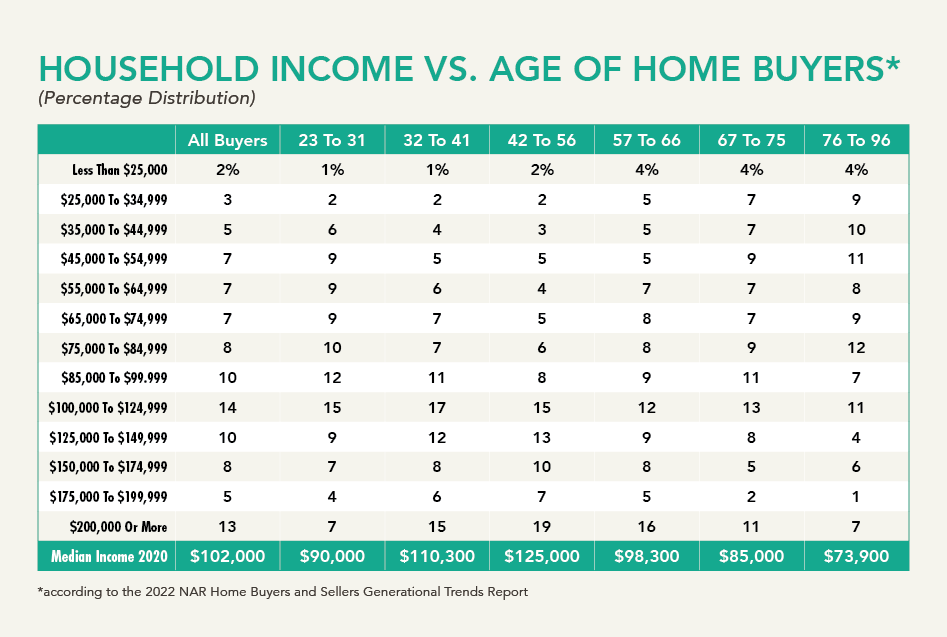

Ensuring that property choices align with clients’ financial capabilities helps clients find suitable homes and sets them on a path toward long-term financial stability and success.

Highlight the significance of aligning property choices with financial capabilities

Understanding and respecting the financial limitations of clients is crucial in creating a positive and successful homebuying experience. Realtors should have open and honest discussions with clients about their budget and financial goals. By setting realistic expectations from the outset, real estate partners can focus on properties that are within their clients' reach, avoiding unnecessary disappointments and wasted time.

Discuss strategies for matching budget-conscious clients with suitable homes

For budget-conscious clients, strategic property selection is key. Realtors can provide valuable insights into neighborhoods that offer a good balance between affordability and desirable amenities. Recommending properties in up-and-coming neighborhoods or areas with potential for growth can be advantageous for clients seeking long-term investment value without breaking their budget.

Additionally, discussing the possibility of fixer-upper properties with renovation potential can be an appealing option for some budget-conscious clients. Renovating a property over time allows them to customize the space while gradually building equity in the home.

RELATED: What’s a Renovation Loan & How Do I Take Advantage?

Provide insights into mortgage considerations that support clients' long-term financial goals

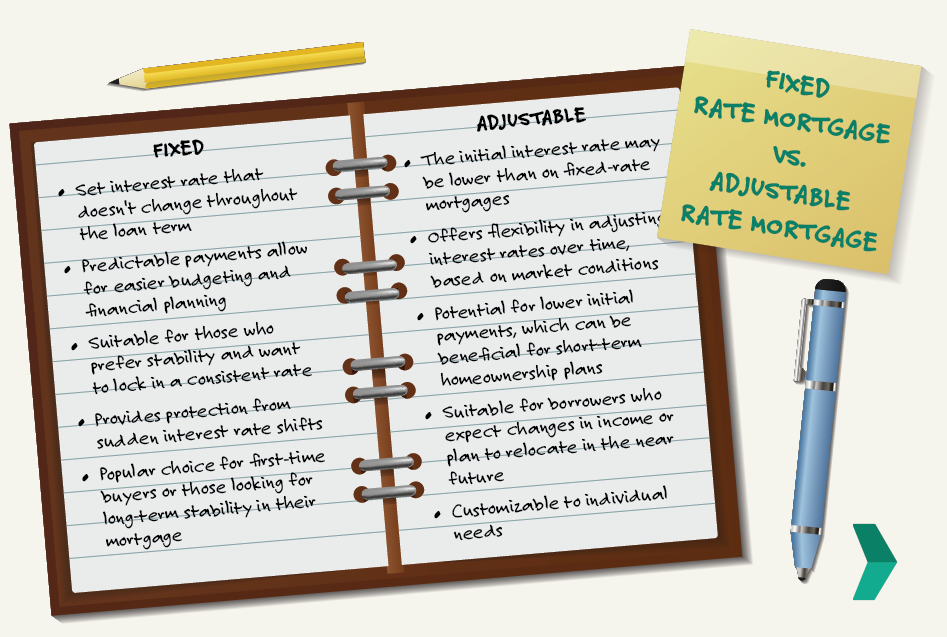

Explaining the benefits of various mortgage programs, such as fixed-rate mortgages for stability or adjustable-rate mortgages for flexibility, can help clients make informed decisions.

LEARN MORE: The Pros and Cons of Fixed-Rate vs. Adjustable-Rate Options

Moreover, emphasizing the importance of pre-approval and working with a reputable lender can give clients an edge in a competitive market; a pre-approved client demonstrates seriousness and financial readiness to sellers, increasing the likelihood of a successful offer.

LEARN MORE: Understanding the Pre-Approval Process: Everything You Need to Know

Furthermore, discussing the impact of interest rates on monthly payments and the overall cost of homeownership can help clients understand the significance of securing a favorable interest rate.

LEARN MORE: Navigating Interest Rate Changes: How Realtors Can Help Clients Plan Ahead

The Best Mortgage Option for Each Season of Life

Young couples

For young couples just starting their journey into homeownership, mortgage options that offer flexibility and affordability are key. Low down payment programs, such as FHA or VA loans, can be particularly attractive to help ease the financial burden of purchasing their first home. Additionally, fixed-rate mortgages are popular among young couples as they provide stability and predictable monthly payments, allowing them to budget more effectively for their future.

What are the benefits of an FHA loan?

- Low down payment (as low as 3.5%)

- Minimum 620 credit score required

- Non-occupant co-borrowers may be on the loan

- 100% of the down payment can be from gift funds

- Seller can pay closing costs up to 6%

- Qualification with less than two-year rental history

What are the benefits of a VA loan?

- No down payment option

- No monthly mortgage insurance required

- Lower interest rates than conventional products

- Limited closing costs

- Lifetime benefit

Growing families

On the other hand, growing families often require mortgages that can adapt to their changing needs. Adjustable-rate mortgages (ARMs) or a 2-1 Buydown may be appealing to growing families as they plan for future expenses, such as expanding their home or saving for their children's education. Additionally, jumbo loans may be suitable for larger families or those looking for spacious homes to accommodate their growing needs.

RELATED: Buydown Mortgage vs. ARM: Which is Best in a Rising Rate Environment?

Empty nesters

For empty nesters, mortgage considerations often revolve around financial security and optimizing their assets. Refinancing options, such as cash-out refinancing, can be beneficial for empty nesters who wish to tap into their home equity for other investments or to fund their retirement.

What are the benefits of a Cash-Out Refinance?

- Access to cash: By refinancing for more than you owe, you can receive the difference in cash

- Lower interest rates and simplified monthly payments: Secure a lower interest rate than other borrowing options, such as personal loans or credit cards

- Tax-deductible interest: Interest paid on a cash-out refinance may be tax-deductible

Reverse mortgages provide an opportunity for individuals aged 62 and above to access funds based on the equity in their homes. This type of loan allows borrowers to receive payments from the lender, which are typically repaid when they sell the house or cease to use it as their primary residence.

What are the benefits of a Reverse Mortgage?

- No monthly mortgage payment; the loan becomes due when the homeowner sells or no longer occupies the house as a primary residence

- Access home equity without having to sell the house or take out a traditional mortgage; this can be a useful way to supplement income

- May be a good option for seniors with less-than-perfect credit or limited income

- There are several payout options, including a lump sum, a line of credit, or monthly payments

- Money received from a reverse mortgage is not subject to income tax

To qualify for a reverse loan, applicants must meet specific criteria, including:

- Must be 62 or older, depending on the state*

- Have substantial equity in their home

- Must be able to cover ongoing costs associated with owning a home, such as taxes, insurance, and homeowner’s association fees

- Must be able to keep up with property maintenance

- Must receive third-party HECM counseling

LEARN MORE: Nearing Retirement? Here's How a Reverse Mortgage Could Help

Step Confidently into the Next Season of Life

Ready to make a confident next move? Your neighborhood Mortgage Advisor is here to help you navigate the next step in your homeownership journey. Reach out today to learn more or click here to explore homeownership insights and additional blogs.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.