Here’s How Buying a Home Can Set You Up for Financial Success

May 29, 2023 — 7 min read

Owning a home can be a major financial goal for many people, and for good reason—it’s a safe and easy investment that can provide long-term financial stability.

For first-time homebuyers, the idea of taking on a mortgage and investing in a property may seem daunting, but it’s important to stay focused on the big picture: beyond the down payment and monthly mortgage dues, there are big financial benefits to reap that make homeownership a smart choice.

From building equity to taking advantage of the potential for tax benefits and stable monthly housing costs, now may be the perfect time to take the plunge—here are the top ways we believe purchasing a property today can help set first-time buyers up for major financial success down the road.

RELATED: Buying a House as a Single Person: Your Go-To How-To Guide

Owning a Home Builds Net Worth Through Home Equity

For many first-time buyers, this is the most compelling reasons to buy a home. If you build up enough home equity, you can significantly add to your net worth over time. In short, here’s how it works:

When you purchase a home, every mortgage payment you make pays down your loan balance and increases the percentage of the home you own; as the value of your home appreciates, your equity increases, too.

With renting, you're essentially throwing money away on monthly payments that never result in equity. Plus, rent prices may increase, and landlords may choose not to renew your lease. Owning a home gives you more control over your living situation and financial future.

RELATED: Breaking Down Barriers to Homeownership for Millennials and Gen Z

Here’s an example to help drive home the point:

John and Jane live in the same city and each pay $1,500 per month for housing; John rents a one-bedroom apartment, while Jane owns a two-bedroom condo.

At the end of the year, John will have paid $18,000 in rent and have nothing to show for it in terms of building equity or net worth; However, Jane will have made the same $18,000 in mortgage payments, but a portion of that money went towards paying down her loan balance and building home equity.

Assuming Jane's condo appreciates over time, she may end up selling it for more than she paid for it, which will add to her net worth. In this scenario, even though John and Jane were paying the same amount per month for housing, Jane was building equity and increasing her net worth, while John was not.

Owning a Home Can Mean Major Tax Benefits

If you’re a homeowner, you may be eligible for tax benefits that could help you save a lot of money. One of the most significant is the ability to deduct mortgage interest and property taxes from your income taxes; essentially, this means that the amount you pay in mortgage interest and property taxes can be deducted from your taxable income, which reduces your overall tax bill.

When it comes to filing, homeowners have the option to take the standard deduction or itemize deductions. The standard deduction is a flat amount set by the federal tax system; it’s the most commonly chosen option and allows homeowners to deduct a set amount without providing evidence of expenses. On the other hand, if you go for an itemized deduction, you have the flexibility of selecting from individual tax deductions instead of relying on a fixed amount.

RELATED: What Are the Tax Benefits of Owning a Home?

For instance, if you paid $10,000 in mortgage interest and property taxes last year and are in the 25% tax bracket, you could potentially save $2,500 on your taxes; these tax savings can help increase wealth and give you more financial flexibility in the long run.

Remember: The tax benefits of owning a home can vary depending on individual circumstances. It's always best to consult a tax professional to determine your eligibility and how much you could potentially save.

Owning a Home Means You Benefit from Appreciation

One other attractive benefit of homeownership is the potential for appreciation. Homes generally appreciate over time, which means the longer you own your house, the more it may be worth. This appreciation in value can provide significant financial benefits in the long run—in fact, according to data from the National Association of Realtors, the median home price in the United States has increased by more than 50 percent over the past decade or so.

Keep in mind, however, that home values can also decline due to factors outside of your control, such as a downturn in the real estate market or a decrease in the desirability of the neighborhood. It's important to do your research and make a well-informed decision before investing in a property. Reach out to your neighborhood Mortgage Advisor today if you have questions.

Owning a Home Mean Fixed Housing Costs

As a homeowner, you have the peace of mind of knowing that your housing costs will stay the same, which can be a significant advantage over renting. While rent prices may increase each year and leave renters struggling to keep up, homeowners in general can budget with certainty, knowing their mortgage payment will remain the same throughout the life of their loan. Even with an adjustable-rate mortgage, the rate changes are usually gradual and predictable; this stability in housing costs allows homeowners to plan for the future and make other financial decisions with confidence.

Owning a Home Gives You Control Over Your Living Space

Owning a home offers a level of personalization and freedom that renting can’t match; as a homeowner, you have the power to make your living space uniquely your own, from painting the walls to remodeling the kitchen, installing new flooring, or knocking down walls to create an open-concept living space. Unlike renters, you’re not subject to limitations set by a landlord, and you don't have to worry about losing your security deposit if you make changes to the property.

RELATED: Sayonara, Shiplap: Decorating Trends on the Way Out in 2023

Additionally, you don't have to worry about a landlord suddenly deciding to sell the property or not renewing your lease; you can settle into your space, customize it to your liking, and have peace of mind knowing it's yours to keep for as long as you want.

Owning a Home Can Give You Space for Additional Income

Owning a home can offer more than just a place to live; it can also provide opportunities for additional income. One popular way to do this is to is to rent out a spare room or space, which can be done through third-parties—such as Airbnb or Vrbo—or through traditional rental agreements. This added income can help homeowners earn extra money to help cover their mortgage, pay household expenses, or save for the future. Moreover, as a homeowner, you have the flexibility to decide when and how often to rent out the space. However, it's important to note that there are regulations and legal considerations to keep in mind before renting out a space in your home.

RELATED: Investment Properties vs. Second Homes: Pros & Cons to Consider

Owning a Home Provides a Sense of Community

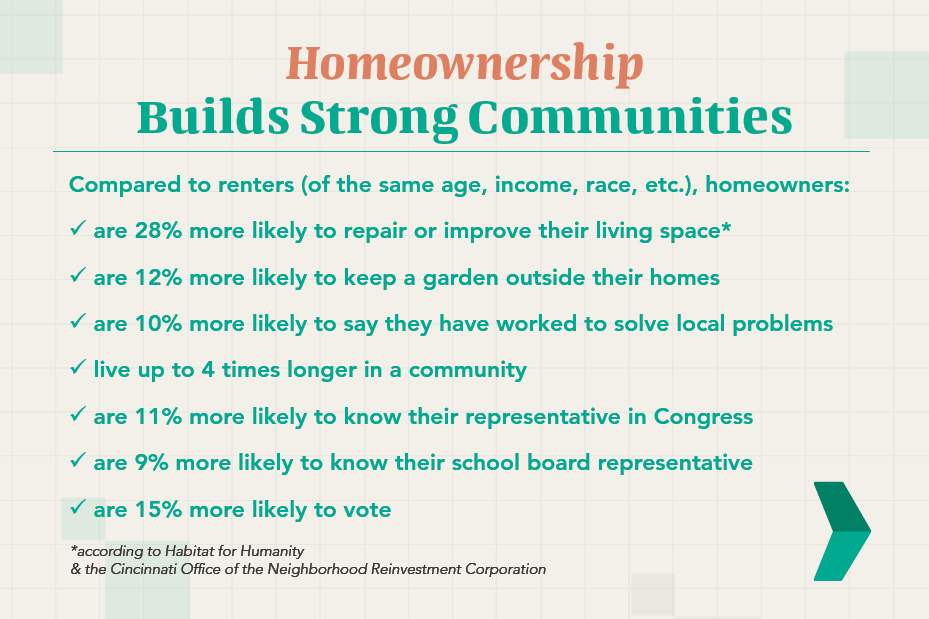

Homeowners have the opportunity to cultivate a sense of community and belonging that can be difficult to achieve as a renter. Owning a home can make you feel more invested in your neighborhood and more connected to the people around you—indeed, homeowners may find themselves attending block parties, neighborhood events, and other gatherings that bring neighbors together. Additionally, homeowners report feeling a greater sense of pride and responsibility towards their homes and their community—see for yourself in the numbers below:

RELATED: From Stranger to Friend: How to Make Friends in a New Neighborhood

Ready to Explore What You Can Afford?

If you’re ready to own a home, the first step is getting pre-approved—click here to connect with your neighborhood Mortgage Advisor, or visit our blog for additional homebuying insights.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.