Breaking Down Barriers to Homeownership for Millennials and Gen Z

Casey Henderson, Mortgage AdvisorApril 17, 2023 — 6 min read

Maybe it’s time to address the elephant in the market? Owning a home, a long-time cornerstone to many people’s long-term financial goals, has grown elusive to some young homebuyers in recent years. In addition to the coronavirus pandemic, economic factors like student debt, wages not keeping up with inflation, and a competitive housing market have made it difficult for millennial and Generation Z (Gen Z) homebuyers to get their foot in the door when it comes to investing in real estate to build long-term wealth.

Despite historically low rates, the future of homeownership is uncertain for young homebuyers. However, while these challenges may seem daunting, there are still plenty of opportunities for hopeful buyers to achieve their dream of owning a home.

Economic Challenges Facing Young Homebuyers

In case you didn’t know, the largest elephant ever recorded weighed about 24,000 pounds. That number, unfortunately, is far less than the average federal student loan debt per person, which sits at just under $38,000. In fact, according to the Federal Reserve, U.S. residents owe more than $1.7 trillion in student debt; of those residents, younger generations are shouldering a significant portion of this debt.

To make matters worse, wages have failed to keep up with inflation in recent years, which has made it difficult to save up for a down payment or save up to achieve another long-term financial goal. These economic factors make it challenging for younger generations to qualify for a mortgage and secure the necessary financing for a home purchase. As a result, many young homebuyers are turning to alternative options, such as co-ownership, or a non-traditional loan product, such a non-qualifying mortgage, or not considering home ownership altogether.

The Impact of Those Economic Challenges

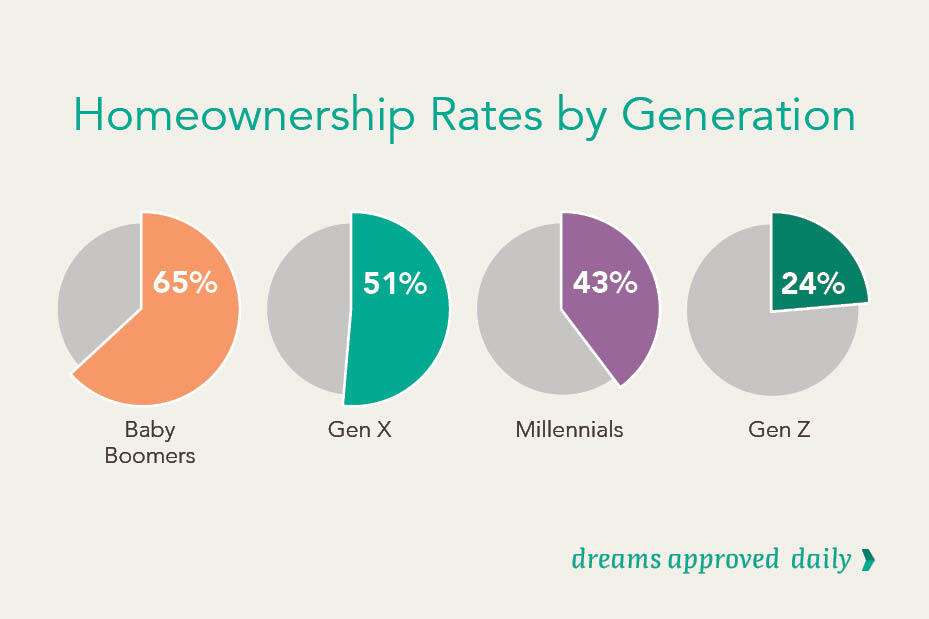

Currently, the homeownership rate for millennials sits at around 43 percent, compared to 51 percent for Gen X and 65 percent for baby boomers at the same age. The homeownership rate for Gen Z sits even lower at around 24 percent.

Millennials are typically considered to be those born between 1981 and 1996; Gen Z refers to those born between 1997 and 2012. Gen X includes people born between 1965 and 1980; baby boomers were born between 1946 and 1964.

Without access to homeownership, these generations may face greater financial insecurity and an inability to build long-term wealth; additionally, the lack of affordable housing options in many metropolitan areas has resulted in longer commutes, higher transportation costs, and increased economic inequality. This can lead to decreased economic mobility and a widening wealth gap between generations.

How Young Homebuyers are Adapting and How PacRes Can Help

One approach is to explore an alternative financing option, like an FHA loan or a down payment assistance program. These products are designed to help hopeful homebuyers overcome the hurdle of a large down payment.

Others search for a home in less expensive areas or in areas with a lower cost of living, or they choose to purchase fixer-upper properties that require renovations or repairs. Fixer-upper properties can be a more affordable option than purchasing a move-in ready home. PacRes Mortgage offers several loan options designed for these properties, including Fix & Flip Loans and 203K Rehab Loans.

Still, others may explore opportunities to invest in real estate through rental properties or “house hacking”, where they purchase a property with the intention of renting out a portion of it to generate income. PacRes Mortgage offers unique loan options for investors and house hackers alike, from conventional to jumbo.

Finally, some house hunters have embraced more creative options, like living in a tiny home or a co-living space. Living in a tiny home, which is typically under 500 square feet, has grown popular as an affordable and environmentally-friendly housing option. Additionally, tiny homes can be placed on smaller plots of land, which can be less expensive than larger parcels.

RELATED: What is the ‘Tiny Home’ Movement?

Co-living spaces, on the other hand, offer residents the opportunity to share communal living areas and expenses while also enjoying their own private living spaces. Plus, co-living spaces often come equipped with amenities that might be costly for individuals to access on their own, such as a gym or a communal kitchen.

However, living in a tiny home or a co-living space may not make sense for everyone. Tiny homes, for example, are not always legal in every city or state, and zoning laws can make it challenging for individuals to find a place to park their tiny home. Click here to check if tiny homes are legal in your state or neighborhood.

PacRes Mortgage understands the unique needs of today’s young homebuyers and offers a wide range of resources and loan products to support your unique lifestyle and long-term financial goals. Whether you’re exploring alternative financing options, looking for a fixer-upper property, or are interested in investing in real estate, your neighborhood Mortgage Advisor is here to help you move through every step of the mortgage process with confidence. Click here to get started today with a customized quote.

RELATED: Your Home Loan Timeline from Offer Through Closing

How Homeownership Builds Long-Term Wealth

Homeownership may feel like a big financial hurdle, but it can pay off significantly in the long run!

One of the biggest advantages of owning a home is that it can build long-term wealth; while this may require a significant upfront investment, it can pay off down the road through equity buildup, appreciation in home value, and tax benefits.

Homeowners may increase their equity by making monthly payments that go towards paying down the principal balance of their mortgage. This equity can be used for future investments, home improvements, or even as a retirement asset.

Additionally, as the value of the property appreciates, homeowners can realize greater profits if they decide to sell their home or borrow against the increased equity. In this way, homeownership provides a place to live and offers the potential for significant wealth accumulation.

RELATED: 5 Tax Breaks for First-Time Homeowners

Ready to Secure a Strong Financial Future?

Let’s work together to ensure your long-term wealth and financial stability. Reach out to your neighborhood Mortgage Advisor if you have questions or want to take next steps. Check out our blog for tips and advice for current and hopeful homeowners.

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.