What Are the Tax Benefits of Owning a Home?

December 26, 2022 — 8 min read

If you recently bought a home, or if you’re considering buying one in the near future, it’s time to learn more about what that involves—yes, you may have the freedom to paint the walls whatever color you’d like, but you must also learn how to navigate the responsibilities and tax benefits of owning a home.

From knowing the difference between a standard deduction vs. an itemized deduction to learning more about different kinds of homeowner tax deductions you may come across, here’s everything you need to know about the tax benefits of owning a home.

Tax Benefits of Owning a Home: How do Homeowner Tax Deductions Work?

Tax deductions lower your taxable income by reducing the dollar amount you owe—they do this by permitting you to subtract specific expenses from your income. There are two types of tax deductions:

Standard deductions, the most common choice, are flat amounts that the federal tax system permits you to deduct. If you choose to take the standard deduction, you won’t need to provide the government evidence of your expenses. However, with an itemized deduction, you’re allowed to pick and choose from individual tax deductions instead of taking out the flat-dollar amount.

Itemized deductions aren’t as popular and standard deductions because they require more paperwork on your part—however, depending on your finances, you may be able to receive more money back by itemizing deductions. Before making anything official, it’s a good idea to speak with a tax professional about the different homeowner tax deductions available to you and what makes the most sense for your life.

Top 7 Homeowner Tax Deductions to Consider

Keep in mind, itemizing your taxes isn’t meant to be tricky or complicated. It’s a benefit offered by the government to encourage homeownership. Here are five of the largest and most common tax deductions to potentially put cash back into your pocket or your home.

Deduct Property Taxes & Some Local Taxes

Did you know that you can deduct up to $10,000 of your annual total payments for property taxes, state income tax, or state and local sales tax? To do so, you must claim the deduction during the year the taxes were paid. However, if you pay your property taxes in installments into an escrow account—like many homeowners—you can only deduct the property taxes when the cash in the account is used to pay them. Keep in mind, the $10,000 cap applies if you’re single or married and filing jointly; for married taxpayers filing separately, the limit is $5,000.

Deduct Mortgage Points

When you apply for a mortgage loan, you may have the option of extra fees to “buy down” your rate. In general, these extra fees come in the form of mortgage points at the time of purchase. One point is equal to one percent of the total loan amount.

The government considers mortgage points as pre-paid interest, and you’re allowed to deduct them accordingly. However, in some scenarios, such as a mortgage refinance, you may have to spread out the deduction over the life of the mortgage.

Deduct Private Mortgage Insurance

Generally, you have to pay mortgage insurance if you put down less than 20 percent of your home’s purchase price. This is in addition to the monthly mortgage payment.

While many homeowners pay for mortgage insurance, not everyone is aware that it’s possible to claim it as a tax deduction. However, it’s important to note that eligibility requirements have fluctuated a lot in previous years. One thing to remember—the mortgage insurance premium deduction is not permanent in our tax code, but it has been extended every year since the early 2000s.

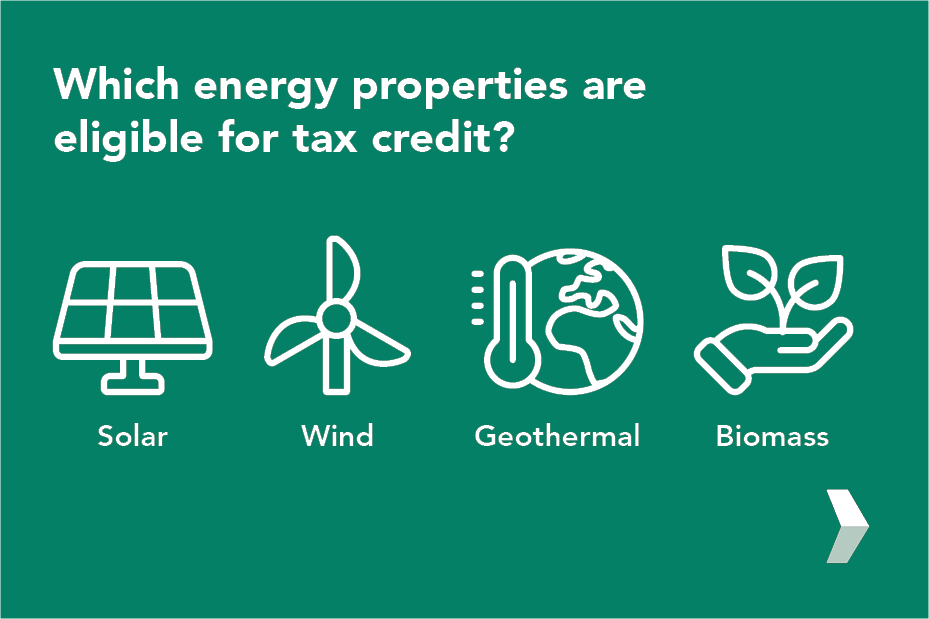

Deduct Environmentally-Friendly Home Upgrades

For those interested in saving energy, there’s an extra incentive in the form of tax savings. If you’ve taken steps to reduce your carbon footprint at home, such as installing solar panels on your roof, an updated insulation system, or one of the other home improvements below, you may be eligible to deduct some related expenses. More common upgrades, such as installing a new water heater or outside doors, are now common enough that they’re no longer eligible.

Deduct Capital Gains When Selling Your House

There are potential tax benefits if you’re selling your home, too. If you’ve sold your home and have a capital gain (a profit), you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you’re filing jointly.

But there are conditions—for instance, you must have used the house as a primary residence for at least two of the past five years. Plus, the profit isn’t simply the difference between what you paid for the property and the amount you sold it for. You will also need to account for other factors, like the costs of purchasing and selling your space and spending on significant improvements.

Self-Employed? You Can Deduct Home Office Costs

Over the past several years, there’s a good chance you or someone you know have had to set up a home office, even if only temporarily. Now, you may be wondering—does working from home come with tax breaks? In most cases, if you’re an employee working remotely, and not a business owner, you won’t qualify for the home office tax deduction.

The home office deduction permits qualifying taxpayers to deduct certain home expenses on their tax return. However, generally speaking, you must meet one of these criteria to qualify:

- Exclusive & regular use: You must use some of your living space for your business on a regular basis. The living space may be a house, apartment, condo, mobile home, boat, or similar structure, or a structure on your property, such as a barn, greenhouse or garage.

- Principal place of business: Your home office must be the principal site for your business or a place where you frequently meet with clients and/or customers. Exceptions may include daycare and storage facilities.

Deduct Electric Vehicle Charging Equipment

You may have known that there are tax credits available for purchasing an electric vehicle, but did you know there’s also a credit available for installing a vehicle recharging station on your property?

The U.S. federal tax credit is worth 30% of the costs of the qualifying equipment up to $1,000. Additionally, beginning in 2023, the credit will apply to bi-directional charging equipment. This type of equipment allows you to charge an electric vehicle's battery or direct electricity from the battery back to the electric grid.

Homeowner Costs You Can’t Deduct

As you can see, there are numerous tax benefits to owning a home—unfortunately, we’re not allowed to deduct all the expenses of running a house. Here’s a roundup of some of the largest expenses you can’t deduct:

- HOA fees

- Home insurance premiums

- Utility costs

- Rent for living on the property before closing

- Transfer taxes or stamp fees

- Refinance costs (loan assumption, credit report, appraisal fees)

- Depreciation

- Down payments and/or earnest money

- Wages for domestic assistance

When comparing standard deductions to itemized deductions, remember—the majority of taxpayers may not have enough itemized deductions or itemizing to make sense. The important thing to be honest about your finances. If you’re still feeling unsure or want to walk through specifics, be sure to reach out to a local tax professional.

Tax Benefits of Owning a Home: How Do Tax Credits Work?

In addition to homeowner tax deductions, there are also tax credits. If you’re considering buying a home this next year, you may qualify for one of the following:

First-time homebuyer tax credits. If you’ve never owned a home before, you qualify as a first-time buyer—you may be able to receive a tax credit if you:

- Haven’t owned a principal residence in the past three years.

- You’re a single parent of a displaced homemaker who has only shared ownership of a home with a spouse.

- You have only owned a home that isn’t permanently connected to a foundation.

- You have only owned property that didn’t fit state, local, or model building codes and couldn’t be fixed to comply for less than the cost of a new home.

Mortgage interest credit. If you’re still building your income, this tax credit was created to help you afford a home. Those who claim this credit are provided a mortgage credit certificate from the government. The credit converts a part of the mortgage interest you pay into a non-refundable tax credit.

Want Some Help?

Owning a home not only brings many trips to home improvements stores, but also many new financial responsibilities. If you have questions about the tax benefits of owning a home, don’t hesitate to reach out to your neighborhood Mortgage Advisor, or explore our blog for additional information and resources.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.