Boo-lieve it or Not: The Haunting Truth About 30-Year Fixed Mortgages

Magda Moor, CMA, Mortgage AdvisorOctober 19, 2023 — 10 min read

There’s a surprising connection between one of the most popular dogs and 90 percent home loans today—can you guess what it is?

It may have missed the front page, but for the first time in decades, the Labrador Retriever is not the most popular breed; now, the French Bulldog reigns supreme, ending the lab’s 31-year run as the United States’ “go-to” dog.

Similarly, the last few decades have ushered in a new era of mortgage lending with unique options designed to fit all walks of life, from first-time buyers, to seasoned homeowners and investors.

From FHA and non-qualifying, to renovation and reverse, we offer many different mortgage options to accommodate the diverse needs of today's homeowners, no matter their finances or long-term goals.

So, whaddya say? Let’s dig into details to sniff out the “pawfect” loan solution for your life and long-term goals.

What Is a 30-Year Fixed Mortgage?

Like hot dogs and apple pie, it’s no mystery why the 30-year fixed-rate mortgage is a classic—it has stood the test of time and is widely accepted as a standard option for homebuyers looking for predictability and long-term financial planning.

Pros of a 30-year fixed-rate mortgage

- Lower payments. Opting for a 30-year term divides your home's cost across three decades, granting extra time for loan repayment. Consequently, your monthly payments are less by almost a third compared to a 15-year mortgage by almost a third less on the same property.

- More flexibility. Some lenders offer the option to make principal-only payments each month, leading to long-term savings by decreasing the interest you'll pay. During months with surplus funds, you can choose to make larger payments, accelerating your mortgage payoff.

- Predictability. You can rely on your mortgage payment to stay unchanged, regardless of economic uncertainties or increasing interest rates.

- You may be able to buy a more expensive home. You may be able to purchase a more expensive living space, as spreading your loan payments out over the maximum number of years impacts your debt-to-income ratio.

RELATED: How Debt to Income (DTI) Ratio Can Affect Your Mortgage

Cons of a 30-year fixed-rate mortgage

You shouldn’t select a 30-year fixed mortgage just because it’s popular or just because a friend or a family member recommended it—after a little research and discussion with your neighborhood Mortgage Advisor, you may realize that another loan option is a better fit for your life, wallet, or long-term goals.

- You’ll Pay More in Interest. With a 30-year mortgage, the interest rate is often higher compared to shorter-term loans; that’s because it takes the lender a longer time to get back the borrowed money. To protect against unexpected inflation during the loan period, lenders may set a slightly higher rate.

- It Will Take Longer to Pay Off. Opting for a 30-year mortgage means selecting one of the longest repayment terms available; in addition to paying more than you would with a shorter loan term, you will be committing to a lengthier journey toward fully owning your home.

- It Will Take Longer to Build Equity. As you chip away at the principal, you gradually gain ownership of your home, which is referred to as equity. Yet, with a 30-year fixed rate, the process of building equity happens at a more gradual pace. That’s because a smaller portion of your monthly payments goes towards reducing the principal balance compared to a shorter loan term.

Alternatives to a 30-Year Fixed-Rate Mortgage

While the 30-year fixed offers many benefits, it's important to acknowledge that it may not align with everyone’s needs or financial goals. Each person or family comes with distinct financial considerations, future plans, and risk preferences. This underlines the significance of collaborating with a neighborhood Mortgage Advisor who can take the time to understand these unique factors and recommend mortgage options that align perfectly with your homeownership goals.

15-Year Fixed-Rate Mortgage

This option condenses your repayment timeline into a shorter period compared to traditional 30-year mortgages, translating to higher monthly payments, but a shorter repayment period due to the compressed schedule. The reduced repayment period means you'll pay less in overall interest costs, allowing you to own your home outright in half the time. Additionally, building equity occurs at a faster pace, granting you more financial security and the freedom to fully own your home sooner.

Adjustable-Rate Mortgage (ARM)

Generally, ARMs start with an initial fixed rate, usually lower than that of comparable fixed-rate mortgages. This initial rate remains consistent for a predetermined period, often ranging from a few months to several years. Following this initial phase, the interest rate adjusts at regular intervals, typically annually. While the potential for lower initial payments is an advantage, it's essential to consider your long-term plans. ARMs are often more suitable for individuals who intend to sell their homes or refinance before the rate adjustment kicks in.

Properly timed, ARMs can help you take advantage of lower interest rates early on while benefiting from the flexibility to adapt to changing financial situations.

RELATED: Fixed-Rate vs Adjustable-Rate Mortgages

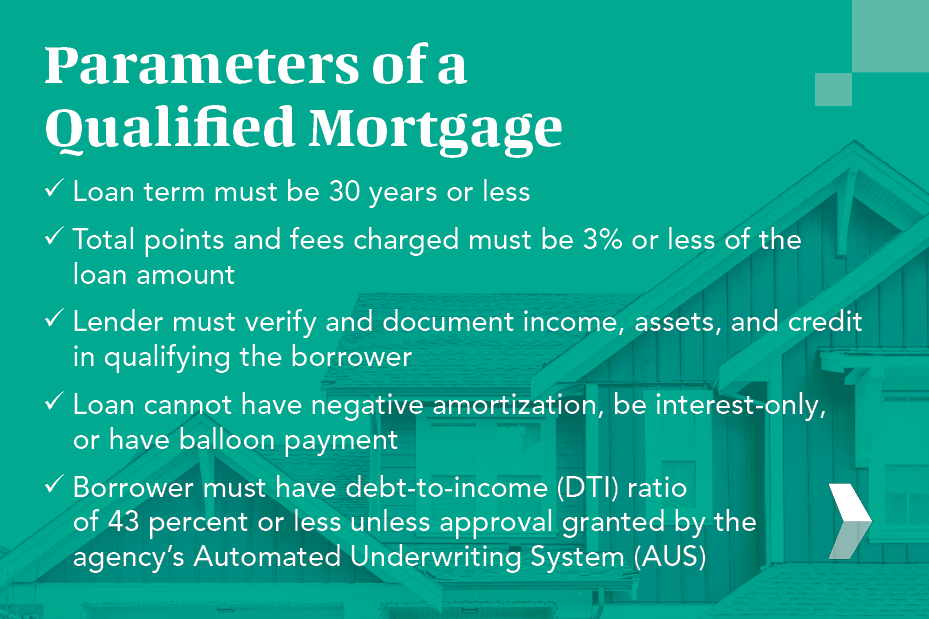

Non-Qualifying Mortgage (Non-QM)

Non-Qualifying Mortgages (Non-QMs) stand out as a versatile choice that caters to people with unique financial situations. Unlike traditional qualified mortgages that adhere to strict guidelines, these loans offer more flexibility, opening doors to homeownership for those who might not fit the standard lending criteria. This encompasses a broad range of borrowers, from self-employed workers, to those with complex financial portfolios. Click here to learn more.

Non-QM loans come in various forms, each designed to accommodate specific scenarios, including:

- Bank Statement loans. Perfect for self-employed individuals or freelancers whose income patterns might not align with traditional payroll structures, this loan option utilizes bank statements to verify income, enabling you to secure a mortgage based on actual cash flow.

- Asset Depletion loans. Tailored for individuals with substantial assets but limited traditional income, these types of loans consider your total financial portfolio to determine your qualifications. This can provide a solution for retirees or those with significant wealth.

- Debt Service Coverage Ratio (DSCR) loans. These loans focus on rental properties and evaluate the property's ability to generate rental income to cover mortgage payments.

RELATED: What is a Non-Qualifying Mortgage (Non-QM)? Your Complete Guide

FHA Loans

FHA loans, backed by the Federal Housing Administration, offer an accessible path to homeownership for a broad range of buyers, particularly those who may face challenges in securing a conventional mortgage. One of the standout features of FHA loans is the lower down payment requirement, which can be as low as 3.5% of the home's purchase price.

Additionally, FHA loans have more flexible credit requirements, making them a more realistic option for borrowers who are still building their credit. While this loan option may provide an easier entry point into homeownership, it's important to note that mortgage insurance is required, which adds to the total cost of the loan. Click here to learn more.

What are the benefits of an FHA loan?

- Smaller down payment, often 3.5% of the purchase price, aiding affordability

- Because FHA loans are government-backed, they come with less stringent credit requirements

- Reduced closing costs compared to conventional loans, assisting cash-limited buyers

- Sellers can contribute up to 6% of the home's price towards an FHA buyer's closing and pre-paid costs

RELATED: What are Seller Contributions & When Are They Make Sense?

VA Loans

VA loans are exclusive benefits offered to military veterans, active-duty service members, and eligible spouses. These loans present highly favorable terms, including the option for a zero-down payment and competitive interest rates.

These loans are a powerful tool to assist veterans and their families in achieving the dream of homeownership with financial advantages that can't be found in traditional mortgages. Click here to learn more.

USDA Loans

USDA loans, backed by the U.S. Department of Agriculture, offer several notable advantages for prospective homebuyers in rural or some suburban areas with low-density population areas. Eligible applicants may build, rehabilitate, improve, or relocate a dwelling as a primary residence in an eligible rural area and may borrow 100 percent of the appraised value. Click here to learn more.

What are the benefits of a USDA loan?

- No down payment option, making homeownership more accessible and cost-effective

- Relaxed credit requirements for easier qualification

- Lower interest rates, leading to substantial long-term savings

- Seller contributions to closing costs are permitted

- Affordable monthly private mortgage insurance costs

Jumbo Loans

Catering to a specific niche in the housing market, jumbo loans are designed for properties with a price tag that exceeds the limits of conventional loans. It provides a means for homeowners to tap into the high-end real estate market and access their dream homes. Click here to learn more.

What are the benefits of a jumbo loan?

- Jumbo loans may be obtained when the loan amount exceeds the conforming or high balance loan limit by $1

- Jumbo loan amounts can go up to $3 million

- Jumbo loans may be obtained with as little as a 20 percent down payment

RELATED: Jumbo vs. Conforming Residential Loans: What’s the Difference?

Home Renovation Loans

If you’re considering updating, expanding, or remodeling your home, a home renovation loan may be the perfect choice. This loan option can be used to fund home purchase and renovation costs and is based on the value of the property after the renovation is completed, rather than its current value. Click here to learn more.

When does a home renovation loan make sense?

- If you're thinking of selling soon, a renovation loan can fund the improvements that can make your home more appealing to potential buyers

- If your current home isn't meeting your needs anymore, a home renovation loan can assist you in making the necessary changes. This could mean adding a new room, revamping your kitchen, or upgrading a bathroom

- Home renovation loans can provide the funds for energy-efficient upgrades, like new windows, insulation, or solar panels

RELATED: Top Funding Options for Your Home Improvement Project

Down Payment Assistance

Down payment assistance programs were created to help first-time homebuyers cover the costs associated with purchasing a home, such as the down payment and closing costs.

We collaborate with counties all over the country to provide more than five hundred down payment assistance programs. Click here to learn more.

What are the benefits of down payment assistance?

- Lower upfront costs for more affordable homeownership

- Help with down payment and closing costs

- Loans or grants secured against the property

- Potential loan or grant forgiveness

- Resources for understanding home buying and financing

- For various groups, like first-timers, veterans, low-income, and rural residents

- Boosts stable homeownership and local community stability

Who can qualify for down payment assistance?

- First-time homebuyers

- Individuals with incomes below area median levels

- Borrowers with little to no money saved for a down payment

- Homebuyers living in rural areas

- Veterans and active military personnel

- Individuals with disabilities

- Homebuyers who meet credit and other eligibility requirements as determined by the program

Reverse Loans

Reverse mortgages offer an innovative approach to homeownership for those who are 62 years or older. This financial tool allows eligible homeowners to convert a portion of their home equity into cash, providing supplemental income during retirement years. Unlike traditional mortgages, where homeowners make monthly payments to the lender, a reverse mortgage pays the homeowner, either as a lump sum, regular payments, or a line of credit. Click here to learn more.

In general, when does a reverse loan make sense?

- You intend to stay put for a while and don’t plan to move

- You can afford home upkeep, property taxes and insurance

- You want to access home equity to supplement retirement income

RELATED: What’s Dad’s Retirement Plan? When a Reverse Mortgage Makes Sense

Your Next Steps

No matter where you’re coming from or what you’re working towards, we want to help you embrace your homeownership dream with a home financing option custom-fit for your life. Reach out to your neighborhood Mortgage Advisor to get started, or click here to receive a customized quote today.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.