What is a Non-Qualifying Mortgage (Non-QM)? Your Complete Guide

Tim McBratney, CMA, Sr. Mortgage AdvisorOctober 17, 2022 — 6 min read

Short for non-qualifying mortgage, a non-QM loan is a good option for borrowers with less than perfect credit or income that falls outside guidelines set by standard mortgage programs. Whether you're self-employed, a real estate investor, or a hopeful first-time buyer, these loans can help you finance your homeownership dream without having to jump through unnecessary hoops. In this blog, we'll show you how to leverage a non-QM loan to take a confident next step towards your long-term financial goals.

What is a Non-Qualifying Mortgage (Non-QM)?

In short, a non-qualifying mortgage is a mortgage that doesn't conform to the consumer protection provisions of the Consumer Financial Protection Bureau. For instance, if you have a debt-to-income (DTI) ratio that does not allow to qualify for a standard mortgage, irregular income, or don't meet the income verification requirements set out in Dodd-Frank Act, you may not be eligible for a qualified mortgage. Recent data from CoreLogic concludes that the three main reasons borrowers seek out non-QM loans are:

- Limited documentation

- DTI ratio of greater than 43%

- Interest-only loans

What is a Qualifying Mortgage?

To make sure you understand what a non-qualifying mortgage is, let's review the parameters of a qualified mortgage, including:

- The loan term must be 30 years or less

- The total points and fees charged must be 3% or less of the loan amount

- The lender must verify and document the assets and income the borrower will use to repay

- The loan can't have negative amortization, be interest-only, or have a balloon payment

- The borrower must have a debt-to-income (DTI) ratio of 43 percent or less unless granted by the agency's Automated Underwriting System (AUS).

These parameters, called the ability-to-repay (ATR) requirements, were created to make sure that borrowers don't end up with a loan they can't afford. If they did, it would put them at risk of foreclosure. However, some borrowers still have difficulty verifying their income or employment because they don't earn regular wages. That's where non-QM loans come in handy.

When you apply for a non-QM loan, your lender will review your credit, income, and assets, and must still ensure you have the ability to repay the loan; however, the lender may accept alternative documentation that isn't allowed for a qualified mortgage, like a bank or a profit-and-loss statement.

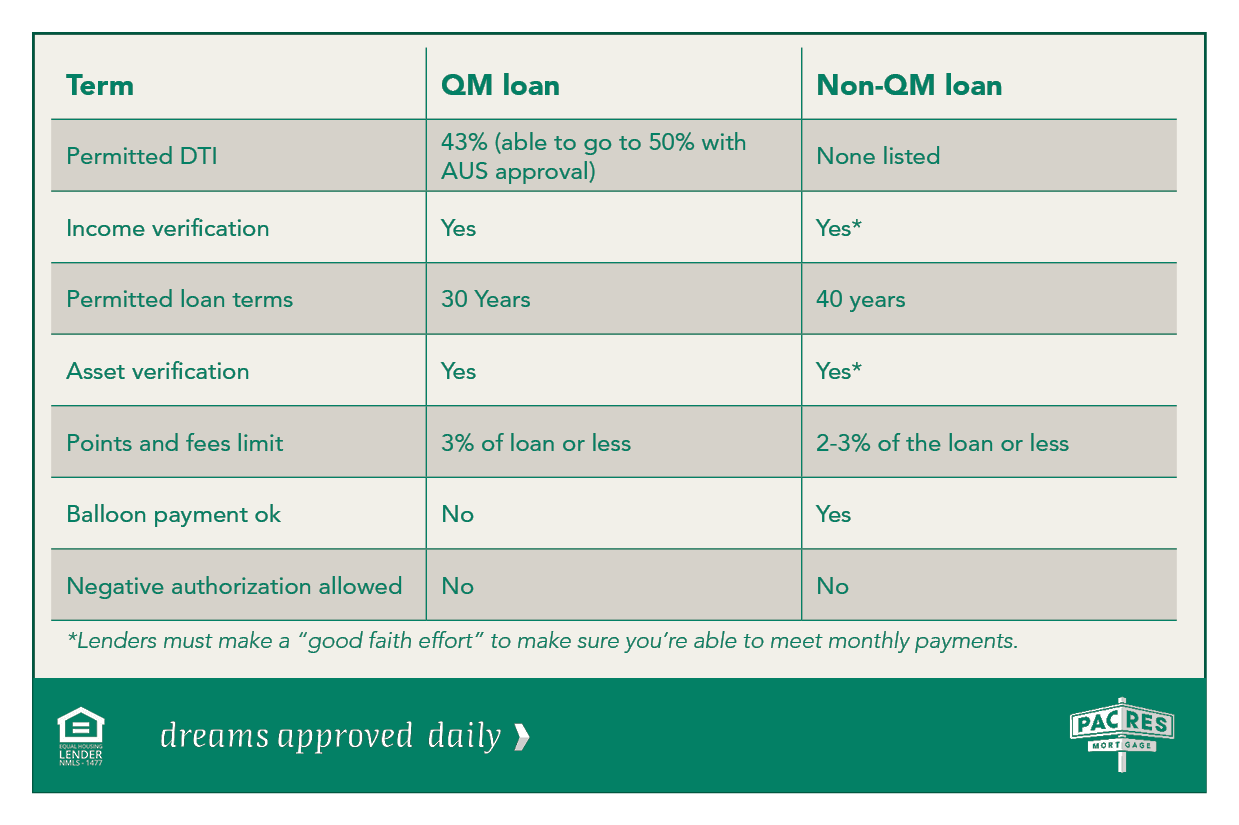

Comparing Qualified to Non-Qualified Mortgages

When you apply for a qualified mortgage, the lender will ask for documents that prove the income and assets you're claiming and your current debt obligations. With a non-QM loan, the lender may accept alternative income documents in lieu of paystubs and W-2 forms.

Who Qualifies for a Non-QM Loan?

Perhaps a better question is ... who doesn't qualify for a non-QM loan? This product is designed to provide people who wouldn't normally meet standard lending requirements with a way to secure financing for a new home, including:

- People who are unable to provide sufficient documentation regarding their finances and employment history. Usually, these people are self-employed or have jobs that don't produce a regular financial paper trail, such as a musician, contractor, or a dog walker.

- People with less than perfect credit history. If you fall below a lender's credit threshold, a non-QM loan may be an appealing alternative.

- People with high debt. Getting out of debt can take years--however, a non-qualified mortgage may help these borrowers purchase a house while helping to get their debt under control.

- Retirees. People who are retired may have significant money in the bank or retirement accounts, but not very much income.

- Non-U.S. citizens. They may not have the credit history or tax records needed to receive a qualified mortgage.

What's the Difference Between a Non-QM Loan and Subprime Loans?

Subprime loans, which caused the housing crisis in 2008, are no longer used and still carry a negative connotation for many borrowers. Now, more than a decade later, non-QM loans are growing popular in today's mortgage market, but some worry they're just subprime loans with a fresh coat of paint.

Non-qualified mortgages aren't subprime, but they're similar in that they don't conform to the usual underwriting guidelines of qualified mortgages. Additionally, non-QM loans still have to abide by the Ability-to-Repay (ATR) rule in most cases.

This rule states that a lender must make a reasonable, good-faith determination of a consumer's ability to repay a residential mortgage loan according to its terms. That means reviewing things like assets, employment, credit history, and monthly expenses, which was not required with subprime loans.

Can I Improve My Chances of Receiving a Qualified Mortgage?

With a non-QM loan, expect to pay higher fees and a higher interest rate than you would with a qualified mortgage. If that's a game changer, try some of these steps to improve your chances of qualifying for a qualified mortgage.

Boost Your Credit Score. In addition to paying bills on time, make sure to pay off your credit card balances each month, you're eligible to receive free credit reports every year. It's a good idea to review that in detail to ensure everything is accurate and actually belongs to you.

Find a Co-Signer. Have a family member or a friend who is willing to cosign a mortgage with you? Their income could help you meet qualified mortgage requirements.

Bigger Down Payment. With a higher down payment, you'll have a smaller loan amount and a lower monthly payment. This could help you qualify for a standard mortgage.

Find a Side Second Job. If you can document income from a second job, a gig, or something similar for at least two years, it may count towards your qualifying income.

Qualify with Rental Income. Generally, rental income may be counted when applying for a mortgage. However, like other sources of income, it must be documented and meet qualifying guidelines.

Still Have Questions?

Taking time to find the right loan can save you thousands of dollars over time. To learn more, or if you're ready to take the next steps, contact your local Mortgage Advisor today. Check out our blog for more helpful homeowner tips and resources.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.