Maximize Your Tax Refund: 6 Smart Ways to Invest in Your Future

Carl Thulin, Mortgage AdvisorApril 3, 2023 — 8 min read

Got a tax refund burning a hole in your pocket? It may be tempting to splurge on the extra guac, but take a moment to consider how investing your refund may be a better option this year. If you’re on track to receive a tax refund, now is the time to figure out how to make the most of it to achieve your long-term financial goals. Whether you want to use it to pay down mortgage debt, build an emergency fund, pay for home improvements, or start a retirement account, there are easy ways to make your refund work harder for you!

Use Your Tax Refund to Pay Down Mortgage Debt

It may make sense to use at least part of your refund to pay down mortgage debt; not only will this help you save money on interest payments, but it will also help you achieve full homeownership more quickly. When you make extra payments, it will reduce the principal balance faster, which means you'll end up paying less interest over the life of the loan; plus, paying off your mortgage sooner will give you a sense of financial security and confidence.

In addition, paying down your conventional mortgage could be your ticket to eliminating private mortgage insurance (PMI), the insurance you must carry if you put down less than 20 percent on your home.

RELATED: What You Need to Know About Mortgage Insurance

Different Ways to Pay Down Mortgage Debt

If you’re receiving a tax refund this year and you’re considering using it to pay down mortgage debt, there are two ways to go about it:

Refinance

Refinancing means swapping your old mortgage for a new one of the same amount. Using your tax refund to pay the fees can get you lower interest rates and smaller monthly payments for the rest of your mortgage.

Make a one-time payment toward your principal

By making a lump sum payment towards your principal, you can decrease the amount you owe on your mortgage and shorten your loan period; however, it may not lower your monthly payments. If you're aiming to reduce your monthly payment, refinancing is a better alternative.

RELATED: Tips to Help Manage Monthly Mortgage Payments Like a Pro

Use Your Tax Refund to Build an Emergency Fund

Don't let unexpected expenses catch you off guard—in addition to using your tax refund to pay down mortgage debt, you can use it to kickstart an emergency fund to be prepared for things like unexpected home repairs. Even a small amount can make a big difference, and your tax refund could cover a week or even a month's worth of expenses. Protect your home investment and gain peace of mind by keeping the following tips in mind when creating an emergency fund:

Establish a weekly savings target

Building savings of any size is easier when you’re able to consistently put money away. Having a weekly goal can help provide the motivation you need to stay focused while building an emergency fund, especially if you're just starting out.

Create a system for making consistent contributions

Setting up automatic recurring transfers is one of the simplest ways to do this—one other approach is to allocate a fixed amount of money each day, week, or payday period; try to set a specific amount, and if you can occasionally save more, you'll notice your savings increasing faster.

Monitor your progress

Figure out the best method for you to monitor your emergency fund savings on a regular basis. This could be an automatic alert of your account balance or keeping a record of your ongoing contributions. By monitoring your progress, you can experience a sense of satisfaction and motivation to continue with your savings efforts.

RELATED: 3 Smart Money Habits to Help You Save for a Home

Use Your Tax Refund to Pay for Home Improvements

While your tax refund may not be enough to cover the cost of a complete kitchen remodel or bathroom renovation, it can help you tackle smaller home improvement projects you've been wanting to do. In fact, investing in certain upgrades can save you money in the long run, making your refund go further. Consider replacing old appliances with energy-efficient models or upgrading a drafty entry door to improve insulation. Smaller improvements, like replacing a dated backsplash, updating faucets, or adding a fresh coat of paint, can also have a big impact on your home.

Additionally, making energy-efficient upgrades, such as installing new windows or upgrading your insulation can save you money on your monthly utility bills.

RELATED: Money Matters: Funding Options for Your Home Improvement Project

Use Your Tax Refund to Start or Add to Your Retirement Savings

It's easy to think of retirement as a distant event, but time passes quickly. So, how can you prepare ahead of time with extra funds? 401K or 403(b) plan, increase your contributions by the amount of your refund; if you're already maxing out your contributions, consider contributing to an individual retirement account (IRA), which you can use to purchase stocks or mutual funds to add to your retirement savings.

What’s the difference between a traditional IRA and a Roth IRA?

A traditional IRA allows you to deduct contributions from your income at tax time, but withdrawals are taxed; on the other hand, Roth IRA doesn't allow for deductions, but withdrawals are tax-free. Choosing between the two options may depend on your expected tax bracket in the future. If you anticipate a lower tax bracket when you retire, a traditional IRA may make the most sense for retirement savings; however, if you expect a higher tax bracket, a Roth IRA might be the better choice.

Use Your Tax Refund to Pad Your Health Savings Account (HSA)

If you have a health savings account, you can use it to save money and pay for qualified medical expenses without being taxed. The funds in the account grow tax-free and can function as a sort of 401(k) for future health needs if you choose to invest it. To be eligible for an HSA, your health plan must meet specific criteria, including a high deductible, which is the amount you pay before insurance coverage starts.

There are annual maximum contribution limits set by the IRS for HSAs, depending on the type of coverage you have and your age. If you have self-only or family coverage and are 55 or older, you may be able to contribute more to your HSA. It's important to be aware of these limits before making contributions.

For the year 2023, the contribution limits for HSA are set at $3,850 for self-only coverage and $7,750 for family coverage. Individuals aged 55 and above are allowed to make an extra catch-up contribution of $1,000.

Use Your Tax Refund to Invest in Real Estate

The home-buying season starts to pick up around the time most people start receiving their tax returns—putting yours towards a home purchase can speed up the process and lower overall costs. Here are some popular ways to use your tax refund to invest in real estate:

Put it towards a down payment.

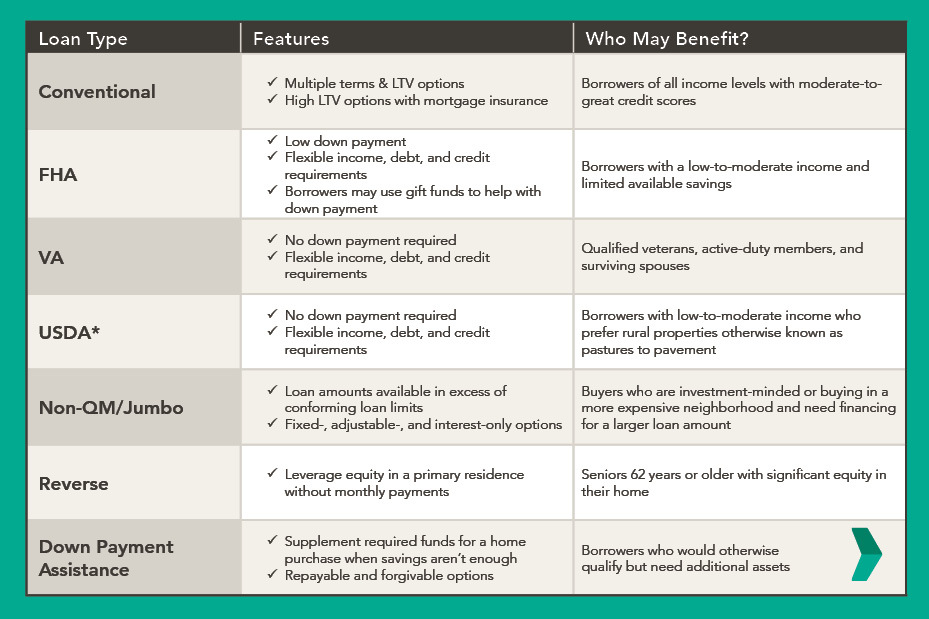

Your tax refund can be used to supplement your down payment and increase your chances of getting approved for a mortgage. This can also help you avoid paying private mortgage insurance. Check out our loan options below to discover the best fit for your life:

Have questions or see a loan option that may make sense for you? Reach out to your local Mortgage Advisor to take a confident next step!

RELATED: Low- and No-Down Payment Mortgage Options

Use it as an earnest money deposit.

When you make an offer on a home, you may need to put down an earnest money deposit to show that you are serious about buying the property; your tax refund can be used for this deposit, which is usually a small percentage of the purchase price.

Use it to cover home inspections.

Home inspections are a necessary part of the home-buying process and can uncover issues that need to be addressed before closing. Your tax refund can be used to cover the cost of these inspections.

Use it to cover closing costs.

Closing costs can add up quickly and typically range from 2% to 5% of the home's purchase price; your tax refund can be used to cover these costs, which can include fees for the loan, title, appraisal, and more.

RELATED: Here’s How Your Tax Refund Could Help You Buy a Home

Whether you decide to use your tax refund to pay down mortgage debt, build an emergency fund, make home improvements, start or add to your retirement savings, pad your health savings account or purchase a home, your tax refund can help you take the first steps towards reaching your long-term goals. By carefully considering your options and setting specific goals, you can make the most of your tax refund and secure a more stable financial future for yourself and your family.

We’re Here for You Every Step of the Way, and Beyond

Want to explore ways to manage your mortgage and achieve your long-term financial goals? Connect with your neighborhood Mortgage Advisor by clicking here, or check out our other blogs for additional resources.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.