< Back to News & Insights

The Low Down on Gift Funds

November 16, 2015 — 2 min read

Gift Funds for Mortgage

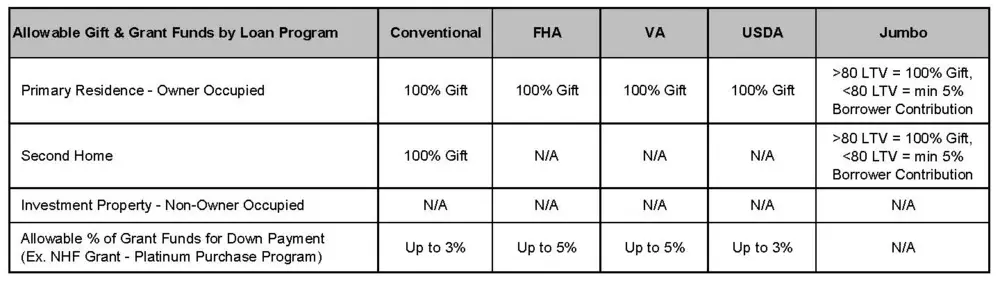

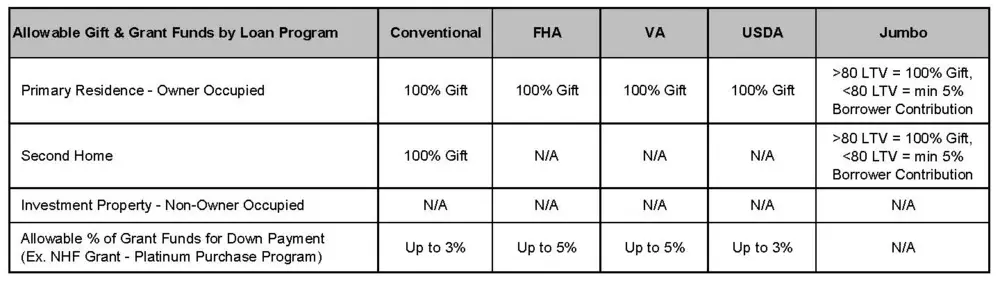

First-time homebuyers needing help with their down payment often find it in the form of gift or grant funds. Many loan programs allow for 100 percent gift funds, requiring little-to-no borrower contribution of their own funds. Just like a borrower's income needs to be verified, so do any gift funds used to finance a home. There are certain regulations that need to be followed any time a borrower receives a gift, and each loan program has its own stipulations. Acceptable gift fund donors include:- A borrower's relative

- A domestic partner

- A borrower's employer or labor union

- A charitable organization

- A homeownership assistance program that supports low and moderate-income families and first-time homebuyers

- The donor's relationship to the borrower

- The donor's name, address and phone number

- The dollar amount of the gift

- A statement that funds are considered a gift with no implied repayment to the donor by the borrower

- Proof the gift is the donor's own funds

- Documentation of funds transferred to the borrower and receipt of funds by borrower

*Loan program requirements vary. Additional terms and conditions may apply. Call for details.

Have questions about gift funds or grant funds to close? Contact us today!

Categories

Archives

Recent Posts

Getting started >

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

{ include "_components/button" with {

primary: false,

value: "Let's go get it",

link: '/mortgage-loans',

icon: true

} %}

What our clients say >

I felt like I was treated like family, great communication and helping me with any questions I had.

Getting started >

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Find an advisor >

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.