Strategies to Pay Off Your Mortgage Early: Achieving Financial Independence Sooner

July 3, 2023 — 8 min read

Owning a home is an exciting achievement, but have you considered the value of paying off your mortgage early? By strategically tackling your mortgage, you can fast-track your journey to financial independence, freeing up funds for other long-term financial goals. However, before paying off your mortgage early, it’s important to understand the implications, potential downsides, and other areas where your money may be better spent, like refinancing to consolidate high-interest debt. Use these expert tips from mortgage professionals to help manage your payments wisely and pave the way to a brighter and stronger financial future.

Components of a Mortgage Payment

Typically, a mortgage payment consists of four components: principal, interest, taxes, and insurance (PITI). The principal portion is the amount that pays down your outstanding loan amount. Interest is the cost of borrowing money; the amount you pay is based off your current mortgage rate and balance. Taxes are the property assessments collected by your local government; typically, lenders collect a portion of these taxes from your payments and hold the funds in an escrow account until they are due. Finally, insurance offers financial protection from risk; like property taxes, homeowner’s insurance is typically held in an escrow account and paid on your behalf to the insurance company.

Homeowners insurance is required in case your property is damaged by fire, wind, theft, or other hazards. To get a feel for a potential payment, it’s best to use a rule of 0.36% (0.0036 as a factor) of the loan amount—for instance, if you are borrowing $400,000, you would multiply this by 0.0036 to obtain the annual amount, resulting in $1,440. To determine the monthly payment, you would divide the annual figure by 12, resulting in $120 per month.

RELATED: What is Homeowners Insurance? The First-Time Homebuyer’s Guide

Mortgage insurance, on the other hand, protects the lender in case a borrower fails to repay their mortgage. It’s mandatory on conventional loans when the down payment is less than 20% and is also required on FHA and USDA loans.

RELATED: What You Need to Know About Mortgage Insurance

What are the Benefits of Paying Off Your Mortgage Early?

Paying off your mortgage early comes with a wide range of benefits that could have a big impact on your future financial well-being. Here are a few potential advantages to keep in mind:

Interest savings

One of the primary benefits of paying off your mortgage early is the substantial amount of interest you can save. By reducing the loan term and paying off the principal balance sooner, you minimize the overall interest that accrues over time. This could save you tens of thousands or even hundreds of thousands of dollars.

Debt-free homeownership

Paying off your mortgage early grants you the freedom of owning your home outright. It eliminates the burden of monthly mortgage payments, providing a sense of security and financial peace of mind.

Increased cash flow

With your mortgage paid off, a significant portion of your monthly income that would have gone towards mortgage payments becomes available for other purposes. This increased cash flow can be directed towards various financial goals, such as saving for retirement, investing in other assets, funding education, or pursuing your passions.

Financial independence

Paying off your mortgage early accelerates your journey toward financial independence. Without the burden of mortgage debt, you have more control over your financial future. You have the freedom to make choices based on your values and goals, rather than being tied to mortgage obligations.

Legacy and future generations

By paying off your mortgage early, you leave a valuable asset to your loved ones. Additionally, without the burden of a mortgage, you can allocate resources toward estate planning and other aspects of building a strong financial future for your family.

RELATED: Interest Rate Hacks to Help Reduce Monthly Payments

How to Pay Off Your Mortgage Early

Make extra payments to reduce your principal balance

The first way to do this is through biweekly mortgage payments. Instead of making a single monthly payment, you can split it in half and make biweekly payments. By doing so, you end up making the equivalent of 13 monthly payments in a year instead of 12. This approach not only helps you pay off your mortgage faster but also saves a significant amount in interest over time.

The second approach involves making extra monthly payments towards the principal or annual principal-only payment. By consistently paying more than the required amount, you can significantly reduce the total interest paid over the life of the loan. However, it's important to communicate with your lender to ensure that these additional payments are applied correctly to reduce the principal balance. Make it clear that the extra payment should not be considered an advance payment for the following month but as a direct reduction of the principal amount.

Pro Tip: In the early years of your mortgage, the majority of your monthly payment goes towards interest instead of the principal balance; by reducing the principal early on, you not only save on the interest for that particular month but also reduce the interest that compounds in the following months.

Refinance your mortgage

By refinancing, you have the opportunity to secure a lower interest rate or shorten the loan term, potentially saving you a significant amount of money in the long run. However, it's important to consider the implications—while a shorter loan term can expedite your mortgage payoff, it may also result in higher monthly payments, which could strain your budget.

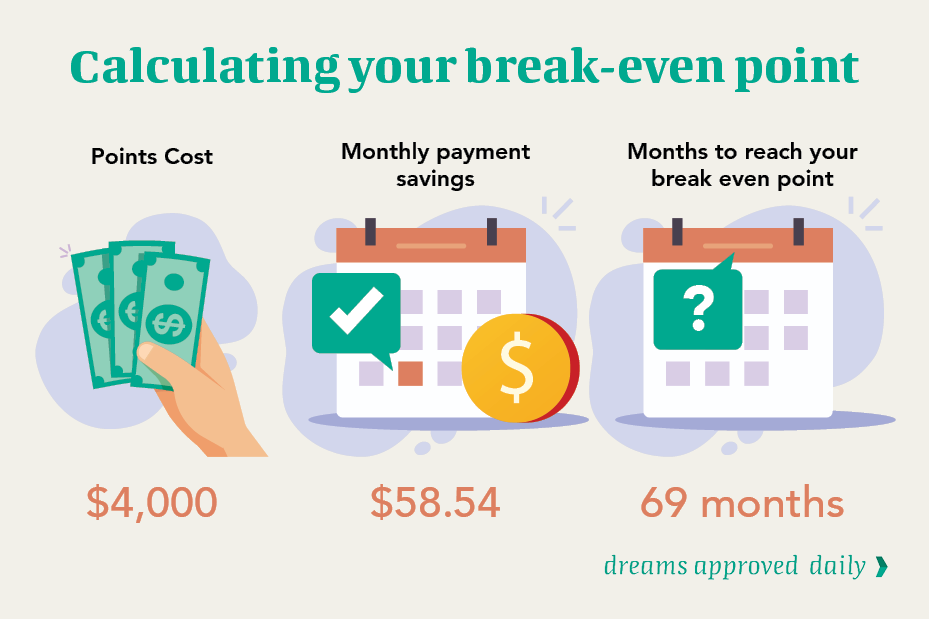

It's important to also consider the costs associated with refinancing, such as closing costs and fees. These expenses can vary and it's crucial to carefully evaluate them against the potential benefits of refinancing. Calculate the breakeven point—the time it takes for the savings from refinancing to offset the costs—to determine if refinancing makes sense for you.

RELATED: Your Guide to Early Retirement: Simple Steps to Help You Succeed

Round up your mortgage payments

If you’re looking for something that requires a little less commitment, one simple yet effective strategy is to round up your payments instead of sticking to the exact minimum payment amount. For example, if your monthly mortgage payment is $943, round up to $1,000; while these additional dollars may seem insignificant at first, over time, they can have a significant impact.

Is There a Downside to Paying off My Mortgage Early?

While the idea of paying off your mortgage early may seem enticing, it's essential to consider the pros and cons before making a choice. Here are a few potential downsides to keep in mind:

Opportunity cost

By allocating a large amount of your financial resources toward paying off your mortgage early, you may miss out on other investment opportunities. In fact, if your interest rate is relatively low, it could be more financially savvy to invest those extra funds elsewhere, such as in a diversified portfolio or retirement accounts. Additionally, if you have multiple high-interest debts, such as credit card debt or personal loans, consolidating them into a single, lower-interest loan may be the smarter financial move.

Lack of liquidity

By directing a substantial portion of your available funds towards paying off your mortgage, you might find yourself low in liquid assets, which may make it challenging to handle unexpected expenses or take advantage of other investment opportunities. It's crucial to maintain an emergency fund and consider your overall financial picture before committing to an early mortgage payoff.

Tax considerations

Paying off your mortgage early could impact your tax situation. The mortgage interest deduction is a valuable tax benefit for homeowners, as it allows you to deduct mortgage interest paid from your taxable income. By paying off your mortgage early, you may lose out on this deduction, which could result in higher tax liability. Consult with a tax professional to hear more.

RELATED: Maximize Your Tax Refund: 6 Smart Ways to Invest in Your Future

Prepayment penalties

Some mortgages may have prepayment penalties, which are fees charged by the lender if you pay off your mortgage early or make significant additional payments. These penalties can offset some of the financial benefits of an early mortgage payoff.

Ready to Get Started?

Paying off your mortgage early can offer numerous benefits, including interest savings, debt-free homeownership, increased cash flow, financial independence, and the ability to leave a valuable asset for future generations. Reach out to your neighborhood Mortgage Advisor to explore options today, or check out additional blogs here.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.