Your Guide to Early Retirement: 5 Simple Steps to Help You Succeed

Rodd Miller, CMA, Branch Manager/ Sr. Mortgage Advisor/Reverse Division ManagerFebruary 27, 2023 — 7 min read

You have a sense of the age at which you want to retire, and you’ve made plans based on that—but what if you have to retire sooner than you expect? While early retirement is nothing new, the pandemic had a big impact on how people think about work and their long-term finances. Whether due to downsizing, vaccine mandates, different health issues, or the desire for additional time outside the office, the number of retirees has grown by 3.5 million over the past couple of years, according to experts. Those numbers make one thing clear: with enough time, the right resources, and healthy spending habits, it’s possible to achieve your long-term financial goals whether you retire tomorrow or years from now.

What is Early Retirement?

Generally, early retirement occurs at any age before 65, the minimum age to qualify for Medicare benefits. Currently, men retire at an average age of 64, while women retire at an average age of 62, according to researchers. However, early retirement isn’t for everyone, and it isn’t just the lack of Medicare benefits that early retirees have to plan for—below, we outline five simple steps you can take ahead of time to prepare yourself (and your wallet) for early retirement.

Think Through Pension and Social Security Benefits

For many of today’s retirees, Social Security and pensions are the primary vehicles of income for retirement. While you may be able to collect these payments early, it will result in you receiving smaller monthly benefits. The full retirement age is 66 if you were born from 1943 to 1954; it increases gradually if you were born from 1955 to 1960 until it reaches 67. For anyone born in 1960 or later, full retirement benefits are payable at age 67.

Make a Post-Retirement Budget Before Taking Early Retirement

For early retirement, you will need to ensure that your retirement savings will be enough to cover expenses. To do this, add up your potential monthly income from pensions, Social Security, and savings; then, compare that to your expected monthly expenses if you were to retire five years earlier than expected and are eligible to receive Social Security and pension benefits.

How much income with you need?

This number will be specific to the individual and their lifestyle and spending habits, but generally, it will include:

- Monthly mortgage payments or rent

- Interest payments on other debt

- Vacations or trips

- Major purchases or home repairs

- Entertainment and recreational activities

- Out-of-pocket costs for medical care

- Charitable giving

- Taxes

Additionally, you should always have a plan in case of potential snafus—there may be unexpected life events or home repairs, or you may not pay off your mortgage by the date you intended to. If it looks like expenses may be higher than your early-retirement income, you may want to:

- Retire at a later date

- Save more now to fill potential gaps in the future

- Reduce your budget so there’s less of a gap in the future

- Determine if you’re open to consulting or part-time work and explore opportunities

- Determine if a reverse mortgage is right for you

Today’s reverse mortgage has evolved into a versatile retirement planning tool," according to Rodd Miller, reverse division manager for PacRes. "For example, it can be used to delay Social Security income until age 70, resulting in an increased monthly benefit."

It’s also utilized by wealth managers as part of a coordinated withdrawal strategy to prolong, and oftentimes grow, a retirement portfolio. Other uses are to fund long-term care, avoid capital gains on the sale of a primary residence, or to simply serve as a “buffer asset” when immediate access to funds is a necessity. It’s no longer the loan of last resort, but rather a pro-active planning device to enhance one’s retirement.

In some of these cases—like if you suddenly need money for home repairs—a cash-out refinance may be the best tool to help. Talk with your neighborhood Mortgage Advisor if you’d like to learn more, or check out this blog.

Re-Evaluate Your Spending Habits Before Taking Early Retirement

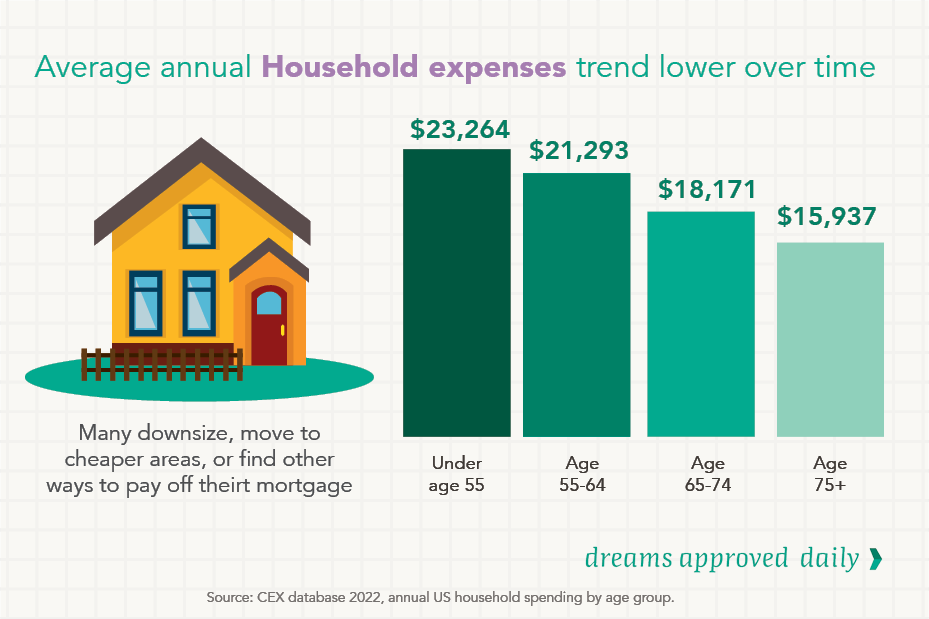

Now that you have a post-retirement budget, it may be time for a reality check: where’s your money going and why? This forethought will help ground your spending habits for retirement and make it easier to adjust ahead of schedule. For instance, if you’re willing to downsize and move to a less expensive home or neighborhood, you may be able to reduce your mortgage payment, property tax, and insurance payments while also freeing up equity to invest to provide additional monthly income down the road.

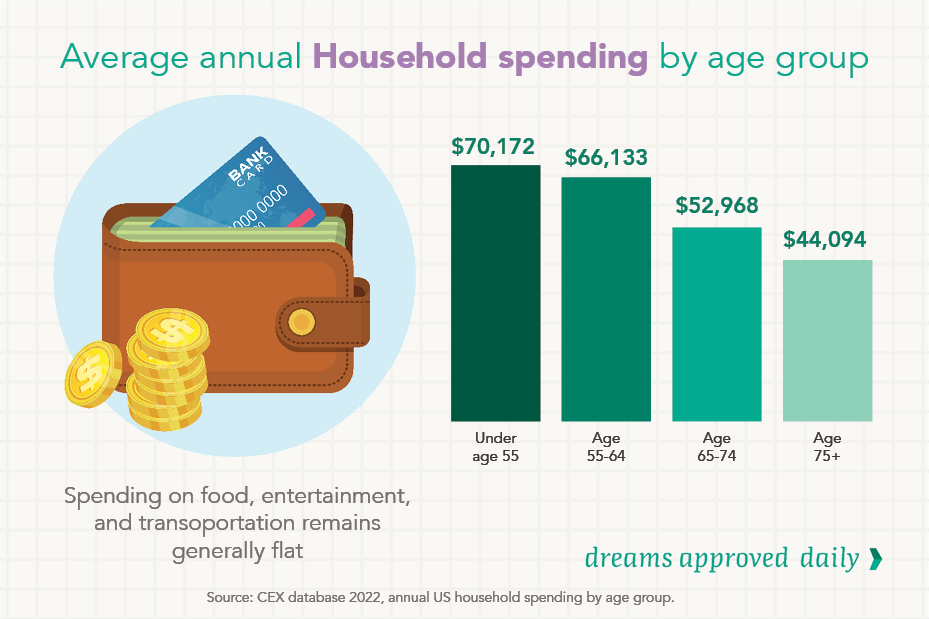

For many soon-to-be retirees, the decision to downsize and their spending habits are wrapped up in a much bigger question: what kind of a retirement lifestyle can you afford? Some expenses will decrease, but others may actually increase. If you know what your yearly income is, you can start to plan ahead by assuming you'll spend about 80% of the income you’ll be making before you retire every year in your retirement, according to experts.

Make a Savings and Investment Plan Before Taking Early Retirement

Saving and investing in retirement will require you to strike a balance between growing your income and taking steps to protect it.

For many, this involves having a couple of years’ worth of living expenses in a liquid and stable investment vehicle, such as a money market account, a short-term bond, or certificate of deposit (CD). It may be a good idea to divide the rest of your savings between stocks, long-term bonds, and other fixed-income investments. In general, the more money you have coming in right now, the smaller a percentage of your working income you may need to replace when you stop working.

If you’re not able to retire yet but want to start saving now, one easy way to do that is to make sure that you’re enrolled in a 401K, if available. Some employers will match contributions or raise your savings rate each year, if instructed. However, the government does put a cap on how much you are allowed to set aside each year; you can find the most up-to-date numbers here.

If you have additional questions about finances or want additional guidance, it may be best to connect with a financial advisor. Reach out today for recommendations in your neighborhood.

RELATED: 3 Smart Money Habits to Help You Save for Your Future

Don’t Forget About Health Insurance

Even if you make a big move, such as downsizing, unexpected medical costs could drain your savings in the years between early retirement and the age you’re eligible to receive Medicare benefits. If retiring early means losing employer-sponsored health insurance, you will need to find alternative coverage until you can apply for Medicare at age 65.

Many retirees opt to continue employer-sponsored coverage through COBRA (Consolidated Omnibus Budget Reconciliation Act). COBRA is not an insurance company; rather, it’s a law that requires employers to offer their former employees the option to temporarily continue their health insurance coverage at their own expense.

Other options include enrollment through the Health Insurance Marketplace or joining a partner’s health insurance plan. Keep in mind, there may be discounted coverage available through certain organizations, such as AARP.

What’s Your Next Move?

There are a lot of factors to consider if you’re planning to retire early—much more than we could ever cover in a single blog. Reach out to your neighborhood Mortgage Advisor if you have questions or want to learn more, or check out our other blogs here.

Contents not provided by, or approved by FHA, HUD or any other government agency. At the conclusion of a reverse mortgage, the borrower must repay the loan and may have to sell the home or repay the loan from other proceeds; charges will be assessed with the loan, including an origination fee, closing costs, mortgage insurance premiums and servicing fees; the loan balance grows over time and interest is charged on the outstanding balance; the borrower remains responsible for property taxes, hazard insurance and home maintenance, and failure to pay these amounts may result in the loss of the home; interest on a reverse mortgage is not tax deductible until the borrower makes partial or full re-payment.

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.