Year-End Financial Checkup: Assessing Your Mortgage & Debt Goals

Lynden Carnahan, Sr. Mortgage AdvisorDecember 4, 2023 — 9 min read

Hands off the champagne! Before we celebrate the new year, let’s take a moment to reflect on the past and toast to a strong financial future ahead, despite close to $8,000 in average U.S. household credit card debt this year.

Like the bubbly beverage, finances can feel effervescent, with highs and lows keeping us on our toes throughout the year. That’s why it's essential to set aside time to conduct a thorough review of your budget and long-term goals. Just as a captain meticulously charts a course before embarking on a long journey, this review ensures you navigate the financial seas with confidence and purpose.

Ready to set sail?

Review Your Mortgage Goals

Begin your year-end financial checkup by reflecting on the progress made in mortgage payments. Have you been consistently chipping away at your principal? If not, can you figure out why? Have your goals changed during the year? If so, revise them and record them with pen and paper.

Next, identify the money goals you’d like to set for the new year. For example, you may want to focus on paying off your mortgage faster, building an emergency fund, consolidating debt, or investing in your retirement. These goals should be specific, measurable, achievable, relevant, and time-bound.

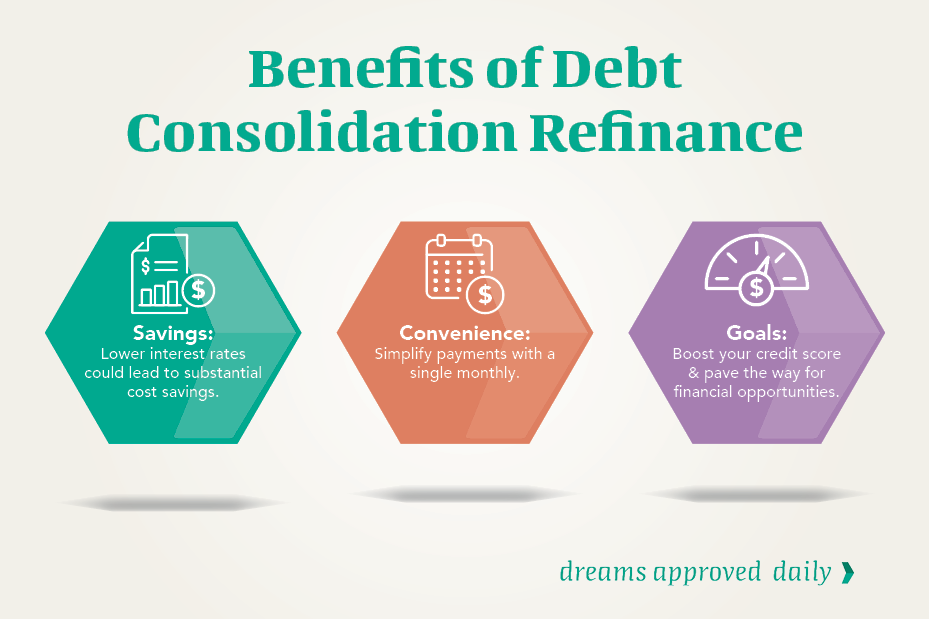

Consider debt consolidation as a strategy to manage high-interest debts more effectively into the year.

Consolidating debts through refinancing can simplify your payments and potentially reduce your interest rates, especially if you’re juggling multiple high-interest debts such as credit card balances, student or personal loans, or outstanding medical bills.

LEARN MORE: Bargain Haunting? Refinance to Create Breathing Room in Your Budget

How debt consolidation works:

Single monthly payment. One of the primary benefits of debt consolidation is that it condenses all your debts into a single payment. Instead of tracking different due dates, minimum payments, and rates, you only have to worry about one payment.

Lower interest rates. One of the primary goals of debt consolidation is to secure a lower interest rate than what you were paying on each individual debt. If you have high-interest credit card debt, consolidating it into a lower-interest loan can save you a significant amount of money in interest payments over time. With a reduced interest rate, more of your payment goes towards the principal amount, helping you pay off the debt faster.

Improved credit score. Managing your debts more effectively through consolidation can positively impact your credit score. Timely payments and a lower credit utilization ratio (the total amount of credit you're using compared to your total available credit) can enhance your creditworthiness, making it easier to qualify for specific financial products and rates in the future.

RELATED: How to Build a Good Credit Score and Maintain It

Fixed vs. variable rate. When consolidating debts, you can often choose between fixed and variable interest rates. Fixed rates remain constant over the life of the loan, providing predictability in your monthly payments; variable rates, on the other hand, may start lower but can fluctuate, potentially increasing your payments over time. Choosing the right type of interest rate depends on your financial stability and risk tolerance.

RELATED: Which is Best? Fixed-Rate vs Adjustable-Rate Mortgages

Evaluate Your Expenses & Adjust Accordingly

Understanding the extent and impact of your expenses and financial obligations is a fundamental step in financial management. Start by meticulously reviewing your monthly expenditures, leaving no stone unturned. This detailed analysis should encompass essential elements such as mortgage payments, utility bills, groceries, and discretionary spending.

It’s important to sort expenses into distinct categories to allow for a granular understanding of where your money is going. It's not merely about knowing how much is spent—rather, it’s about about dissecting the spending patterns. For instance, how much of the budget is allocated to dining out, entertainment, or impulse purchases?

Homeowners might find they are overspending in non-essential areas while neglecting crucial aspects of their budget, such as emergency savings or investments. By pinpointing these patterns, you are better equipped to make informed decisions about where to cut back, reallocate funds, or negotiate better deals, ensuring that every dollar is utilized effectively. This can act as a financial compass, of sorts, guiding you toward smarter habits and paving the way for a more secure financial future.

Here’s how to get started tracking your monthly expenses:

Manual method. Many people prefer a hands-on approach when it comes to managing their finances. Whether it's a simple spiral notebook in your bag or a binder where you organize your expense records, these uncomplicated methods often require nothing more than pen and paper. The crucial aspect here is to meticulously record every instance where money leaves your wallet; include the amount spent, the date of the expense, and a brief description of the purchase.

The binder method involves keeping all your expense notes, receipts, bank statements, and expense worksheets neatly organized in one central location. This system makes it easier to reconcile activities on a weekly, monthly, or even yearly basis.

Calendar method. Maintain a dedicated financial calendar and use it to record your daily, weekly, and monthly expenditures as they happen. By employing this technique, you can quickly identify patterns in your spending habits and pinpoint areas where you can cut costs. For instance, you might observe a surge in expenses over weekends, coinciding with increased take-out orders and movie streaming for family leisure.

This method becomes particularly valuable if your bills cluster around a specific paycheck period. By tracking your expenses on a calendar, you can align your spending with your income, mitigating the risk of overdraft fees or finding your account empty toward the end of the month.

Spreadsheet system. Creating expense tracker spreadsheets from scratch using programs like Microsoft Excel or Google Sheets empowers you to design a customized table with rows and columns. This tailored setup allows you to categorize, store, and automatically calculate your personal spending in a timeframe that works for you.

- Color coding. You can color code different spending categories, making it visually intuitive to discern various expense types at a glance.

- Highlight variances. Identify expenses that exceed your expectations, helping you recognize areas where you might be overspending.

- Graphical representation. Visualize spending trends over specific periods, enabling you to grasp your financial habits and make informed adjustments.

- Filtering options. Filter expenses by type to identify patterns, allowing you to understand your spending behaviors more comprehensively.

Use an app. If you prefer a more automated approach, pending trackers and budget apps are available to simplify the process for you. However, the challenge isn’t in locating an app; it lies in finding the one that suits your specific needs.

Some apps offer more advanced features, like the ability to create distinct spending categories and link them directly to your bank, credit card, or other financial accounts. By doing so, these apps can automatically categorize your spending, providing useful assistance for occasional one-time purchases that might slip your mind. Moreover, some apps enable you to establish watchlists, set alerts, and impose spending limits.

RELATED: How Much House Can I Afford? The Answer Is Different for Everyone

Set New Budget and Investment Goals

Every individual and family has unique financial needs, and there are various budgeting methods to choose from. One widely embraced approach is "proportional budgeting," a popular method that divides after-tax income into three categories: allocating approximately 50% for fixed and essential expenses (needs), 30% for discretionary expenses (wants), and dedicating the remaining 20% towards savings or debt repayment.

Needs

These are unavoidable expenses, such as monthly bills, that constitute a significant portion of your spending. Essential necessities typically include:

- Housing: This includes your mortgage or rent, homeowners or renters insurance, and property tax if not already included in your mortgage payment.

- Transportation: This category encompasses your car payment, expenses related to gas, maintenance, auto insurance, and public transportation costs.

- Healthcare: Essential healthcare expenses include health insurance premiums and any out-of-pocket medical costs.

- Utilities: This includes expenditures on electricity, natural gas, water, sanitation/garbage services, internet, and either your cell phone or landline.

- Basic necessities: Money spent on groceries, toiletries, haircuts, and other indispensable items fall into this category.

- Childcare: Expenses associated with child care services, ensuring the well-being of your children.

Wants

These costs are often trickier to include in a budget due to their variable nature and encompass a wide range of items and experiences, such as:

- Clothing, jewelry, etc.

- Dining out, special home-cooked meals (such as steaks)

- Alcohol

- Tickets for movies, concerts, and events

- Memberships to gyms or clubs

- Travel expenses (such as airline tickets, hotels, and rental cars)

- Subscription services (cable, streaming packages)

- Indulgences in self-care, like spa visits and pedicures

- Home decor purchases

Savings & Debt Repayment

This category includes funds designated to securing your future, contributing to your retirement, building an emergency fund, and eliminating any high-interest debt; it may also include payments beyond the minimum requirement on favorable debts such as student loans and mortgages.

- Emergency fund: A financial safety net to cover unexpected expenses or emergencies.

- Savings account: A dedicated account for planned future expenses or financial goals.

- 401(k): Retirement savings plan offered by employers, often with contributions from both the employee and employer.

- Individual Retirement Account (IRA): A personal retirement account that allows you to save for retirement with potential tax benefits.

- Other investments: Various investment vehicles like stocks, bonds, or mutual funds, aimed at growing your wealth over time.

- Credit card payments: Clearing off outstanding credit card balances or refinancing to reduce debt and interest charges.

Regardless of the specific ratio that suits your lifestyle, adhering to a budget can significantly enhance your ability to achieve your goals. Whether it's that dream vacation you've always longed for or the new car you've been eyeing, having a clear understanding of your spending patterns empowers you to make adjustments when necessary and achieve ambitious financial objectives, like paying off significant debt or saving for a down payment on a house, more easily.

Questions About Your Mortgage & Investment Goals?

The key to accomplishing your long-term financial goals? Start with a plan and partner with your neighborhood Mortgage Advisor to break it down into simple, manageable steps. Check out additional blogs here, or click here to receive a customized quote.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.