How to Build a Good Credit Score and Maintain It

February 13, 2023 — 7 min read

How is a credit score calculated? Whatever goes into it, having a high enough number is essential to securing a mortgage and achieving the dream of homeownership; plus, it will help you get a better interest rate on that loan! Use these tips to understand how to build a good credit score and maintain it for years to come, whether you’ve just started building credit, or just want to see your score increase.

First Off, What’s a Credit Score?

Your credit score ranges from 300 to 850 and helps lenders evaluate how much of a risk it is to lend you money; in short, it’s one measure of how responsible you are with your finances as you are building credit. Your specific number is based off outstanding credit, payment history, and public records; in general, the higher your credit score, the more likely you’ll be to qualify for mortgage funds.

How Is My Credit Score Calculated?

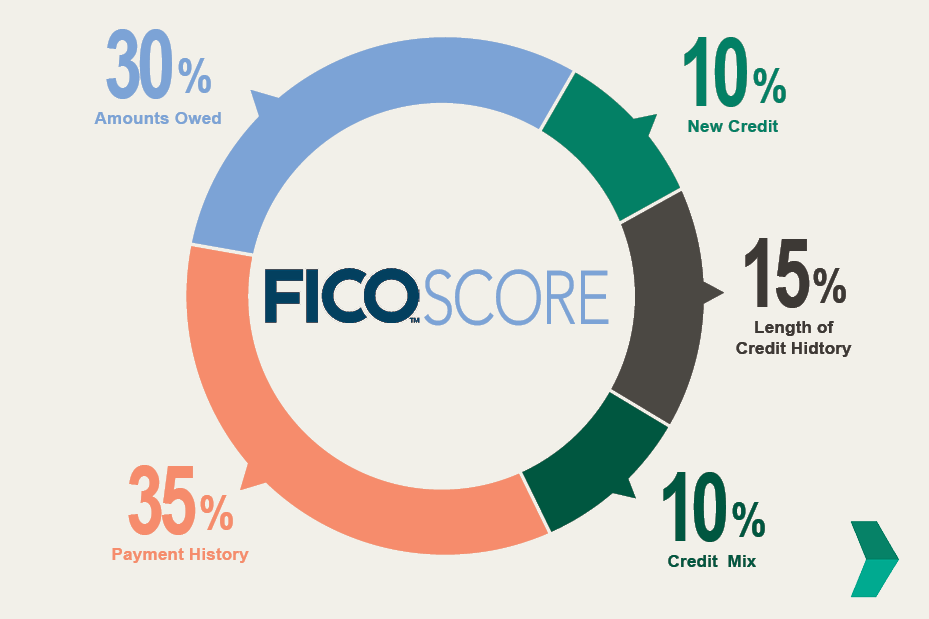

Payment history. This accounts for about 35 percent of your credit score. Basically, it shows your lender whether you’re in the habit of making payments on time and how recently payments have been missed; payments made over 30 days late will typically be reported. If you’re building credit, keep this in mind: the higher your number of on-time payments, the higher your score will be!

Amount owed. This refers mostly to loans and credit cards; it accounts for about 30 percent of your score and is based on the entire amount you owe, the number and types of accounts you have, and the amount of money owed compared to the amount of credit you have available. In general, high balances and hitting your credit card limit will translate into a lower score, while smaller balances may raise it if you make payments on time. New loans with little payment history may drop your credit score temporarily.

Length of credit history. This accounts for about accounts for 15% of your score; in general, scoring models examine the average age of your credit when factoring in the length of your credit history. That’s why some people may want to consider keeping accounts open and active.

Credit mix. This accounts for about 10% of your score. Just like your diet, having a healthy mix of accounts, such as a home loan and a retail and/or credit card, may help improve your score.

New credit. This accounts for about 10% of your score. If you’ve opened or applied to open new accounts recently, it may suggest financial problems, which could translate into a lower score; however, scoring models are created to recognize that recent loan activity does not mean a consumer is necessarily a danger.

RELATED: Signs That You’re Ready to Become a Homeowner

How Can I Build a Good Credit Score and Maintain It?

Now that we’ve answered the question, “how is a credit score calculated?”, there are a number of easy habits you can adopt if you’re wondering how to build a good credit score and keep it on the up. This will give you a better shot to receive financial opportunities, including higher credit limits and lower interest rates.

How to build a good credit score and maintain it:

Start early. Remember that payment history accounts for around 35 percent of your score. This means the earlier you’re able to get started, the better. It may be best to start small to ensure potential lenders recognize that you plan to live within your means when you apply for credit.

Don't open too many new accounts at once. Each time you open a new credit account, it has the potential to have a negative impact on your credit score. It may be best to start small to ensure lenders recognize that you plan to live within your means.

Pay bills on time. This is the most important factor in determining your credit score. If you tend to be forgetful, try setting up automatic payments or reminders to help ensure you never miss a payment.

Keep credit utilization low. Generally, your credit utilization ratio, or the amount of credit you’re using compared to your credit limit, should be no more than 30%.

Get a loan with a co-signer. Asking a family member or friend to cosign on a loan is a great way to begin establishing credit. However, keep in mind that the primary loan holder and cosigner share equal responsibility for the debt, and the loan will appear on both parties’ records.

Check credit reports regularly. When building credit, it’s important you take steps to ensure that all of the information on your credit report is accurate and up to date. You can get free copies of your credit reports here.

To make things easier, remember that you can file a dispute with the credit reporting company and directly with the creditor using the same documentation. The Consumer Financial Protection Bureau (CFPB) has provided sample letters and instructions for how to submit a dispute.

RELATED: Buying a House with a Friend: Is Co-Ownership a Good Idea?

Adding a co-borrower to your mortgage, whether the co-borrower will occupy the home or not, will most likely improve your chances of getting a mortgage to purchase a home. Government loans such as FHA, USDA, and VA require the co-borrower to be related to the borrower, whereas conventional loans do not. If the co-borrower's credit score is higher, it may improve your rate, depending on the type of financing you're using to purchase your home. They may also reduce your debt-to-income ratio, which could help reduce the interest rate when purchasing your home.

How Can I Rebuild a Low Credit Score?

If you've had credit issues in the past, it can be challenging to get approved for a mortgage. But it's not impossible! However, you must have patience—rebuilding credit takes time, and there are no shortcuts or secrets. In addition to the tips above, keep these actions top in mind as you work to increase your number.

Consider debt consolidation. Debt consolidation involves combining multiple debts into a single monthly payment with a lower interest rate. If you stick to a plan to pay down your debt, it is likely to raise your credit score over the long term.

Consider a secured credit card if you don’t qualify for a regular credit card. Most secured credit cards have a small initial credit limit and require you to deposit an amount equal to the credit limit in an account as collateral. If you consistently make timely payments, you may be eligible for an increased credit limit and a refund of your deposit.

Consider working with a credit repair company. These companies can help you dispute errors on your credit report and negotiate with creditors to remove negative marks.

Plan ahead for major purchases. By having a high credit score, borrowers can get lower interest rates and higher credit limits. It's important to plan ahead and allow at least 6 months to improve your credit score before making a large purchase, such as a home or a car.

RELATED: 3 Smart Money Habits to Help You Save for a Home

Want to Learn More About Building Credit?

Regardless of if you are building credit from scratch or taking steps to increase your score, your neighborhood Mortgage Advisor has the knowledge and expertise to help. Reach out to get started today, or check out our other recent blogs. Please see a credit professional for more information.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.