Mortgages for Heroes: The Veteran’s Essential Guide to Homeownership

Brenden Boliard, Mortgage AdvisorNovember 6, 2023 — 9 min read

The secret is out—today more than ever before, active-duty military members, veterans, and surviving spouses are eligible to take advantage of unique home financing benefits.

These exclusive benefits offer those who have served our nation a path to homeownership that is more accessible and affordable than many other loan options. It's a gesture of gratitude that goes beyond words, and we’re excited to help spread the word.

Currently, more than one million troops and 22 million veterans are eligible to apply for a VA loan, but only 1.9 million of the 16.4 million veterans who own homes obtained their loans through a VA home loan, according to the U.S. Department of Veteran Affairs.

From understanding the history and purpose of VA loans to eligibility criteria, budgeting, and navigating the application process, here’s a breakdown of everything you need to know to help hopeful homeowners take full advantage.

What Sets VA Loans Apart? Top 5 Benefits

VA home loans, short for Veterans Affairs Home Loans, are government-backed mortgage loans designed exclusively for active-duty military members, veterans, and certain eligible surviving spouses. These loans have a unique financing structure and features that make homeownership more attainable, including:

No down payment requirement.

While traditional mortgages often demand a substantial down payment, which can be a substantial financial hurdle, these loans allow eligible borrowers to purchase a home with no money down; this feature makes homeownership significantly more accessible, particularly for first-time buyers or those who may have struggled to save for a down payment.

Fewer closing costs.

These loans often come with fewer closing costs compared to traditional mortgages. Closing costs typically include fees for loan origination, appraisal, credit reports, and more. With a VA loan, some of these costs are limited or may even be covered by the seller, making the overall cost of purchasing a home more affordable for veterans.

- Reduced closing costs can save veterans thousands of dollars at the time of purchase

- Predictable and lower closing costs make budgeting for homeownership more manageable

- Lower upfront costs contribute to financial security and peace of mind during the homebuying process

RELATED: Understanding Closing Costs: Planning for the Financial Aspects of Homeownership

Competitive interest rates.

VA loans are known for offering competitive interest rates that are often lower than those available in the conventional mortgage market. These favorable rates can result in substantial long-term savings for veterans.

- Lower interest rates translate to more affordable monthly mortgage payments

- Over the life of the loan, veterans can save significant amounts in interest payments

- Competitive rates make homeownership more attainable, even for those on a tight budget

No mortgage insurance required.

Unlike conventional loans, this home financing option does not require private mortgage insurance (PMI), which is typically mandated for borrowers who make a down payment of less than 20% on a conventional mortgage.

- Eliminating PMI can save veterans hundreds of dollars each month, reducing the overall cost of homeownership

- Without the burden of PMI premiums, monthly mortgage payments are more manageable

- Veterans can qualify for higher loan amounts without the added expense of PMI

Higher debt-to-income ratios accepted.

VA loans tend to be more flexible than traditional mortgages when it comes to debt-to-income (DTI) ratios, making it easier for veterans to qualify.

- Veterans with higher DTI ratios may still qualify for VA loans, allowing them to borrow more for their home purchase

- Flexibility in DTI ratios accommodates veterans with varying financial situations, including those with student loans or other debts

- Veterans who might have been denied by conventional lenders due to DTI concerns may find approval through VA loans

RELATED: 10 Facts You May Not Know About VA Home Loans

What Do Borrowers Need to Get Started? 5 Steps to Prepare

Before diving into the mortgage application process, it's crucial to gather the necessary documents to streamline the application and approval process. In general, here are the key documents borrowers will need:

Proof of military service.

If you are currently serving on active duty, you must submit an original statement of service signed by the adjutant, personnel officer, or commander of your unit or higher headquarters. This statement should include your name, social security number, date of entry into your current active duty period, and any periods of time lost. For more information, click here.

It also typically involves providing a Certificate of Eligibility (COE), which verifies the borrower's military service and eligibility for the VA loan program. The COE can be obtained through the VA's eBenefits portal, by mailing in a request form, or by working with a VA-approved lender who can access it electronically, like PacRes. The borrower is responsible for providing a DD214 or Reservist DD256.

Financial documents (income, debts, assets).

Lenders need to assess a borrower’s financial health to determine their ability to repay the loan; applicants will need to provide documents such as pay stubs, W-2 forms, and tax returns to verify income.

- Information on existing debts, including credit card balances, auto loans, and student loans, will be required; this helps lenders calculate debt-to-income ratio.

- Documenting assets, such as savings and investment accounts, is also important, as it demonstrates a borrower’s ability to cover potential expenses.

RELATED: How Debt to Income (DTI) Ratio Can Affect a Borrower's Mortgage

Credit report and score.

It’s important to have the borrower receive a copy of their credit report and review it for accuracy, as errors can impact their number, and consequently, their mortgage terms; typically, a higher credit score results in more favorable terms.

Calculating budget.

It’s essential for borrowers to understand their complete financial situation before starting the mortgage process. Consider these factors:

- The borrower’s DTI ratio is a crucial metric used to assess a borrower’s ability to manage additional debt; it’s calculated by dividing monthly debt payments by gross monthly income.

- Owning a home involves more than just mortgage payments; borrowers will also have property taxes, homeowner's insurance, maintenance costs, and potentially HOA fees.

- Borrowers should think about their long-term financial goals, such as retirement or education expenses, and make sure that homeownership aligns with their broader financial plans.

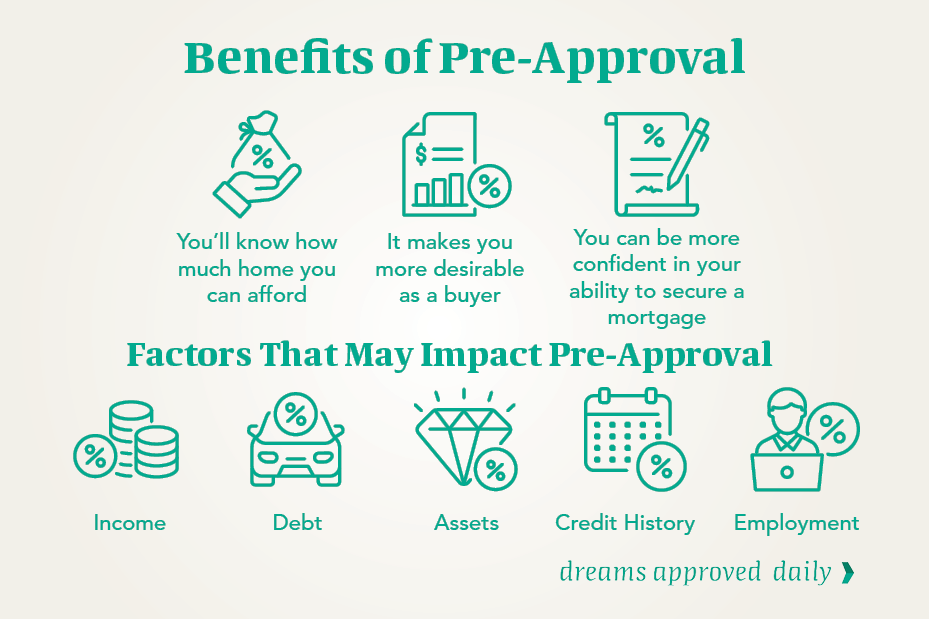

Getting pre-approved.

This is the next big step in the mortgage application process, and it offers several key advantages:

- It provides borrowers with a realistic understanding of the loan amount they qualify for; this can help them narrow down their home search to properties within their budget.

- In a competitive real estate market, a pre-approval letter demonstrates that a buyer is serious and qualified. It can also give a buyer an edge when multiple offers are on the table.

- Finally, it expedites the closing process—your client won’t have to scramble to secure financing after making an offer, making their offer more appealing to sellers.

Click here to help a client get started or learn more—it's a proactive step that can make all the difference in helping them secure their dream home!

What Else Should Borrowers Know? 3 Tips for Long-Term Success

Homeownership is a long-term commitment, and to ensure a successful and rewarding experience, borrowers should keep several key factors in mind.

It’s important to make timely payments. Timely payments keep the borrower in good standing with their lender and have a positive impact on credit score.

They have access to exclusive resources and support services. Borrowers, especially veterans with a VA loan, have access to a wealth of exclusive resources and support services. These offerings extend beyond the initial loan approval and include:

- Education & counseling services. Borrowers can take advantage of resources provided by government agencies and nonprofit organizations. These services offer guidance on homeownership, budgeting, and financial planning, ensuring borrowers have the tools to make informed decisions and weather financial challenges.

- Home loan guaranty services. Should a client encounter unexpected financial difficulties, the VA’s Home Loan Guaranty program offers assistance to help avoid foreclosure.

- Disability compensation & housing adaptions. For veterans living with disabilities, these programs can provide financial support and help make home more accessible and accommodating.

Refinancing options are available. Your client’s finances may evolve over time, so it’s important that they’re aware of refinancing options at their disposal, including:

Interest Rate Reduction Refinance Loan (IRRRL)

This is also known as the VA Streamline Refinance. Veterans can take advantage of lower loan term years or a lower interest rate to reduce monthly mortgage payments and potentially save money over the life of the loan. Click here to learn more.

Biggest Benefits of a VA Streamline Refinance:

- Lower monthly payments.

- No need for an appraisal or credit check.

- Faster and simpler loan process.

- No upfront or down payment required.

- Potential for a reduced interest rate.

- Option to switch from an adjustable-rate to a fixed-rate mortgage.

- Flexible loan term adjustments.

- No penalties for early loan repayment.

Cash-Out Refinance

This approach enables veterans to access a portion of the equity they've built up in their home over time, unlocking a range of potential benefits, from debt consolidation to home improvements or other long-term financial objectives.

Biggest Benefits of a Cash-Out Refinance

- Access to cash: By refinancing for more than you owe, you can receive the difference in cash.

- Lower interest rates and simplified monthly payments: Secure a lower interest rate than other borrowing options, such as personal loans or credit cards. Reduce your number of monthly payment obligations, which can simplify your finances and make it easier to manage expenses

- Tax-deductible interest: Interest paid on a cash-out refinance may be tax-deductible. This can further reduce costs and make it a smart financial move for many homeowners

Help Clients Achieve Their Goals Faster

PacRes Mortgage has custom-fit loan options designed to meet the needs of borrowers from all different walks of life. Reach out to your neighborhood Mortgage Advisor if you or a client have questions or want to explore options. Click here to receive a customized quote today.

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.