Unlock Potential: How a HELOC Can Help You Invest in Real Estate

April 24, 2023 — 7 min read

Investing in real estate can be a powerful way to build long-term wealth, but coming up with the funds can be a big obstacle for aspiring investors. That's where a Home Equity Line of Credit (HELOC) loan can come in handy. You can use this home finance option to tap into the equity you’ve built up in your primary residence, then leverage those funds to purchase an investment property or make improvements to an existing property.

However, while HELOCs can be a helpful way to get started in real estate investing, it’s important to understand potential risks and downsides to determine if it’s the right choice for your investment goals.

What Is a Home Equity Line of Credit (HELOC)?

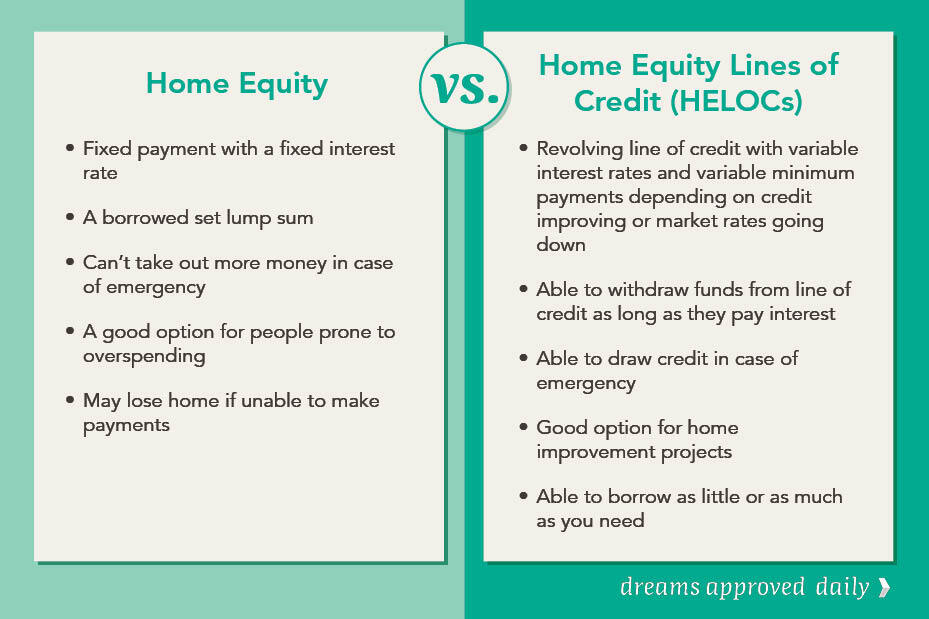

Home equity lines of credit products are different from traditional home equity loans. Here’s how:

While a home equity loan provides a one-time lump sum payment to be repaid in fixed installments with a fixed rate, a home equity line of credit (HELOC) offers a revolving line of credit that enables you to borrow funds up to a predetermined limit as needed.

In addition to real estate investing, a HELOC could be a fantastic loan option if you’re looking for assistance:

- Paying for home improvements or upgrades

- Paying for weddings or other important celebrations

- Paying for big purchases, such as a new vehicle

- Paying off or consolidating debt

- Paying for medical expenses

- Paying for school

- Starting a business

- Taking a dream vacation

RELATED: What’s a HELOC & How Does It Work? Everything You Need to Know

Important Note: HELOCs often come with lower rates than other types of loans, and the interest may be tax deductible; however, it's important to consult a tax professional regarding interest deductions, as tax rules may change. Click here to learn more about our HELOC loan product.

How to Use a HELOC to Invest in Real Estate

Knowing how to leverage a HELOC for an investment property is essential knowledge for those seeking a competitive advantage in real estate—when managed correctly, it can turn into an ideal wealth-building strategy.

To get started, you’ll need to determine how much equity you have in your primary residence. Then, you can use that equity to build up a portfolio of cash-flowing assets separate from your home.

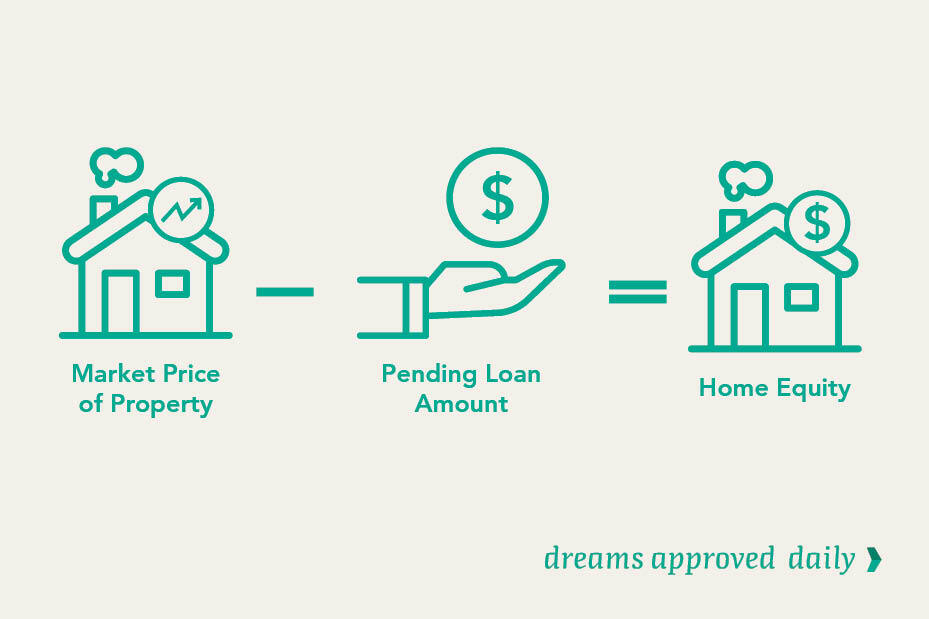

To calculate equity, subtract the amount you owe on your mortgage from how much your home is worth—the difference between what you owe and your home’s value is your equity!

Next, before signing any paperwork, ask yourself these questions:

- What is your goal for investing in real estate—are you looking for long-term rental income, or short-term gains through flipping properties?

- What is your risk tolerance? Real estate investing can come with risks, such as market fluctuations, property damage, and tenant issues.

- What is your plan for paying back the HELOC? It's important to have a clear strategy in place for paying off the loan, whether through rental income or other means.

- How will you manage the property? Will you be managing it yourself or hiring a property manager?

- Have you researched the specific real estate market you're interested in? Understanding market trends and potential for appreciation can help you make informed investment choices.

From there, consider these important next steps:

- Figure out how much you can borrow with your HELOC. Don't forget to factor in interest, fees, and your ability to pay it back.

- Look for properties that fit your investment goals. Think about location, condition, rental income potential, and how much it might appreciate over time.

- Make an offer on a property you like. Consider the asking price, your budget, and any repairs or renovations needed. Be ready to negotiate and have a backup plan.

- Get the property appraised to make sure you're not paying too much.

- Close the deal by signing the agreement, transferring funds, and getting the keys. Read everything carefully and ask questions if you're not sure.

Want to speak with a mortgage professional about your specific situation? Click here to speak with your neighborhood Mortgage Advisor today.

How to Qualify for a HELOC to Invest in Real Estate

Keep three key requirements in mind if you’re considering using a HELOC to invest in real estate: your credit score, debt-to-income ratio, and the amount of equity you have in your home.

Understand Your Credit Score

If you're applying for a HELOC, your lender will scrutinize your credit score. That’s because it provides a basic understanding of creditworthiness and the level of risk involved in lending to you. The higher your score, the better your chances of being approved for a HELOC.

RELATED: How to Build a Good Credit Score and Maintain It in 2023

Understand Your Debt-To-Income Ratio

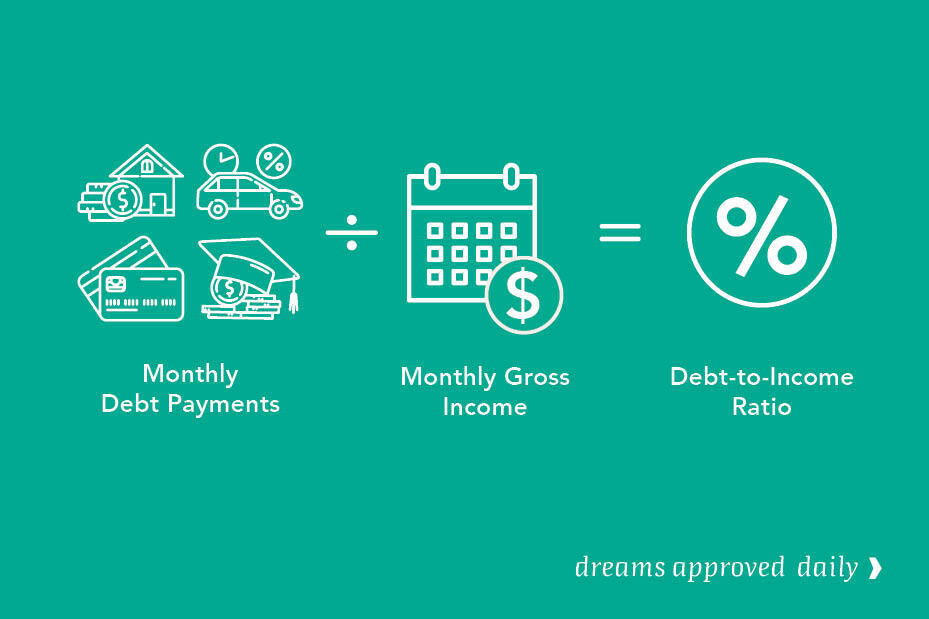

If you're planning to borrow money, having a solid credit score isn't the only thing that matters; you'll also need to demonstrate that adding another loan won't throw off the balance between your income and your existing debt. To assess your ability to handle additional debt, lenders will look at your debt-to-income ratio. This measures the percentage of your income that goes toward paying off debt. Different lenders may have different minimum debt-to-income ratios that they're willing to accept.

RELATED: How Debt to Income (DTI) Ratio Can Affect a Borrower's Mortgage

Use the information below to calculate your debt-to-income ratio, or contact your neighborhood Mortgage Advisor for assistance by clicking here.

Understand Equity

When it comes to qualifying for a HELOC, having equity in your home is the most crucial element; as long as your home's value exceeds your outstanding mortgage balance, you'll have equity, which means you've satisfied the primary qualification criteria for a HELOC.

RELATED: Unlocking Your Home's Hidden Money: A Beginner's Guide to Home Equity

HELOC vs Cash-Out Refinance: Comparing Pros and Cons for Real Estate Investors

While a HELOC can be a helpful way to fund real estate investing, it’s important to consider alternatives before deciding if it's the right choice for you. One alternative is a cash-out refinance, which involves replacing your existing mortgage with a new, larger mortgage that allows you to cash out the equity in your home.

Both cash-out refinancing and home equity lines of credit can be useful tools for real estate investors looking to access their home equity to invest in more properties or make improvements to existing ones.

However, if you’re wondering which is better for aspiring real estate investors, it will depend on your current finances and long-term goals. Here are some key factors to consider if you’re trying to figure out which is best for you:

- Interest rates. HELOCs typically have variable interest rates, which can be lower than cash-out refinance rates in the short term, but may increase over time. Cash-out refinances generally have fixed interest rates, which can provide more stability over the long term. Click here to learn more about our cash-out refinance loan product.

- Closing costs. Both options come with closing costs, but cash-out refinances tend to have higher fees. If you plan to use the funds for a short-term investment, a HELOC may be more cost-effective.

- Cash flow. HELOCs can give you more flexibility in terms of when and how much you borrow, which can be helpful if you need funds for ongoing expenses or unexpected costs.

Want to Explore More Loan Options?

Your neighborhood Mortgage Advisor is here to help you through every step of your real estate investment journey, and beyond. Reach out today, or check out additional blogs here.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.