Mortgage Options After Retirement

June 24, 2019 — 5 min read

If you're near or at retirement age, you've probably heard the mortgage myth that your loan options decrease after retirement. Or you might have even heard a rumor that homeowners over 62 can't qualify for any mortgage loan at all.

Both of these worries are just that--worries. Age does not affect your ability to get a loan. However, loan options and the loan application process to look a little different after retirement. Let's talk about what you need to know.

The Facts

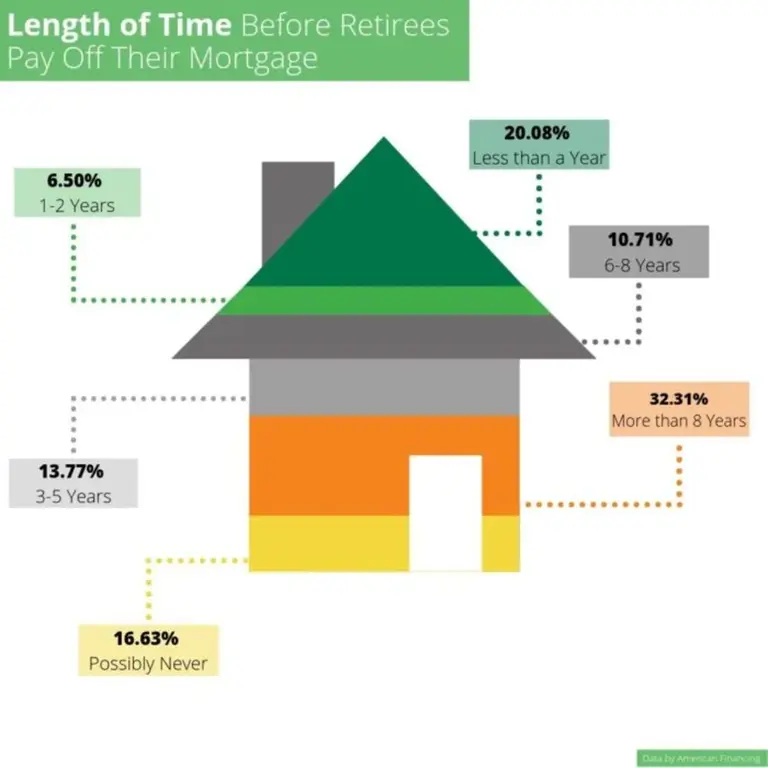

Did you know a recent surveyshows 44% of homeowners between the ages of 60 and 70-years-old will bring their current mortgage into retirement? Thirty-two percent of these homeowners predict it will take them more than eight years to pay off the mortgage. Seventeen percent believe they may never pay it off.

If so many homeowners are in the same boat, why is there speculation about qualifying for a mortgage after retirement? Under the Equal Credit Opportunity Act, lenders cannot discriminate against borrowers based on age. However, it's still important for seasoned buyers to show they have good credit, limited debt, and enough ongoing income to repay the mortgage. Demonstrating the ability to repay the mortgage looks a little different after retirement than when the borrower was living off of a salary.

For example, borrowers who derive their source of income from distributions of their 401(k) or IRA account(s) must document that this source will be expected to continue for at least three years after the date of the mortgage application. Most retirement accounts will have a "defined expiration date" simply because they involve the depletion of an asset.

Regardless of whether or not the income source has a defined expiration date, most lenders will require retirees to document the continued receipt of their income with one or all of the following:

- Letters from the organization providing the income

- Copies of retirement award letters

- Copies of signed federal income tax returns

- IRS W-2 or 1099 forms

- Proof of current receipt

Reverse Mortgage Refinance

If you are 62 years of age or older, you may be eligible for a Home Equity Conversion Mortgage (HECM), also known as a reverse mortgage. A HECM gives you the option to take advantage of the equity you've built up in your home over the years you've owned it and turn it into money you can use today.

A reverse mortgage refinance is a loan insured by the Federal Housing Administration (FHA) and is designed for clients 62 years or older. Unlike a typical mortgage, where an individual makes regular payments to the lender, a reverse mortgage does not require monthly mortgage payments. Instead, the equity in your home is converted to cash which the borrower can receive monthly, or in one lump sum.

The lender charges interest on the amount of equity, which is then added to the borrowed amount. When the last borrower moves out of the home or passes away, the loan becomes due. The loan can simply be paid back by selling the home, and the funds owed go to the lender.

Details to remember about reverse mortgages:

- Adjustable or fixed-rates available

- No monthly mortgage payment required

- Use the equity in your home as a source of income (with a HECM)

- The amount owed cannot exceed the value of the home

The Benefits of Reverse

You'll never owe more than the value of your home with a reverse mortgage, regardless of how much you borrow. If the balance is less than your home's value at the time of repayment, you or your heirs keep the difference.

A reverse mortgage refinance is great for those who:

- Don't plan to move

- Can afford the cost of maintaining their home and keep up with property taxes/insurance

- Want to access the equity in their home to supplement their income in retirement

With this option comes additional benefits such as continuing to live in your current home while keeping the title. You'll also have the opportunity to leave the remaining home equity to heirs once the mortgage is paid off.

Whether you're looking to refinance today or just need more details, our Mortgage Advisors are here to help. Fill out the contact form below!

Contents not provided by, or approved by FHA, HUD or any other government agency.

At the conclusion of a reverse mortgage, the borrower must repay the loan and may have to sell the home or repay the loan from other proceeds; Charges will be assessed with the loan, including an origination fee, closing costs, mortgage insurance premiums and servicing fees; The loan balance grows over time and interest is charged on the outstanding balance; The borrower remains responsible for property taxes, hazard insurance, and home maintenance, and failure to pay these amounts may result in the loss of the home; Interest on a reverse mortgage is not tax- deductible until the borrower makes partial or full re-payment.

Keywords:

Categories

Archives

Recent Posts

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.