Interest Rate Hacks to Help Reduce Monthly Payments

Wendee Silva, CMA, Sr. Mortgage AdvisorMarch 13, 2023 — 6 min read

Interest rates aren’t what they used to be—in fact, just a few years ago, they dropped dramatically; after that, they stayed lower to help stabilize the economy in the face of the coronavirus pandemic. Now, in a mostly post-pandemic world, we’re facing one of the highest increases in inflation in decades, as indicated by the annual Consumer Price Index coming in at more than 9 percent last year.

Fortunately, current rates and your current monthly payments aren’t set in stone. In fact, there are strategies you can employ today to help reduce monthly payments and make purchasing a home more affordable, even in a rising rate environment.

Interest Rate “Hack” #1: Use a Temporary Buydown to Reduce Monthly Payments

More buyers are using unique programs like temporary buydowns to save hundreds on their monthly mortgage payments. In fact, many sellers are benefitting from these programs, too, as it helps them sell their listed properties.

What’s a temporary buydown?

A temporary buydown is a financing option that temporarily lowers interest rate payments for the first one, two, or three years of a home loan; this can make the mortgage more manageable for a homebuyer and provide peace of mind. If interest rates decrease, the homebuyer can refinance to take advantage of the lower rates.

In most cases, the party financing the buydown will make a single, large payment into an escrow account at the time of closing. The borrower will then make monthly payments based on the lower, or "bought down," rate; at the end of the buydown period, the buydown funds collected at closing will have been exhausted, and the buydown period ends.

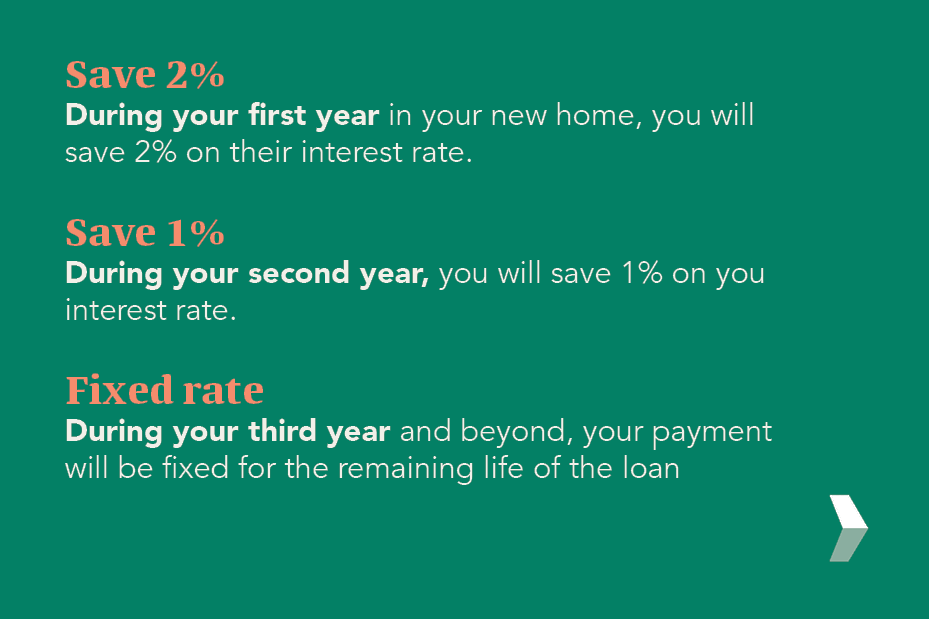

PacRes Mortgage offers a 1-year and a 2-year buydown option that will lower a borrower’s mortgage interest rate by two percent the first year and one percent the second year if the 2-year buydown is chosen; it will revert to the original rate during the third year of the mortgage term.

How does a temporary buydown benefit the seller?

Typically, temporary buydowns are financed by home builders and sellers as a closing cost that is equal to the interest savings for the buyer. For the seller, a temporary buydown may speed up the selling process and could result in a higher profit for them than reducing the home price alone.

RELATED: How Temporary Buydowns Help Borrowers and Sellers

Interest Rate “Hack” #2: Use Discount Points to Reduce Monthly Payments

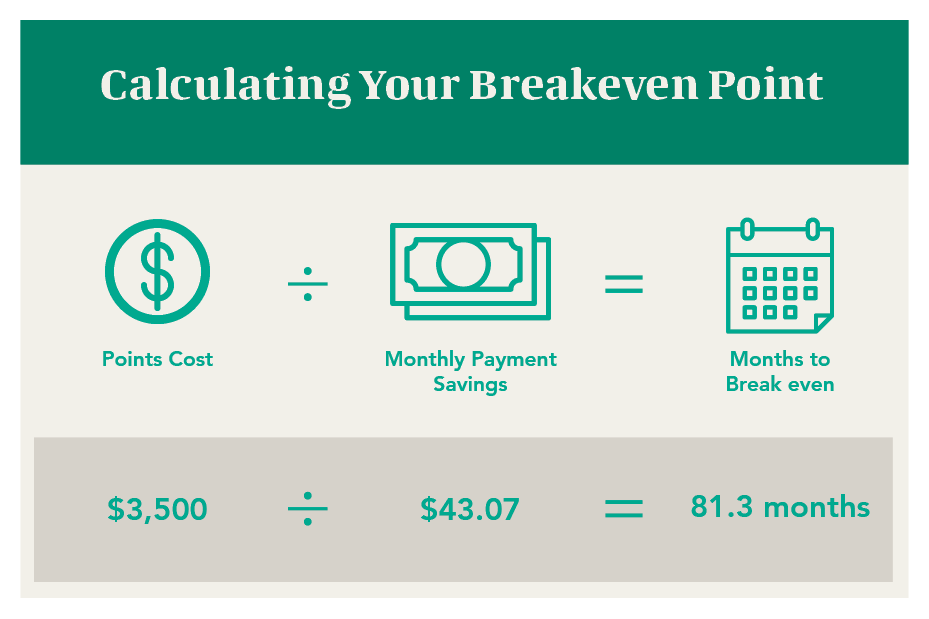

One other way to obtain a lower interest rate is to pay discount points, which will reduce the rate by a small percentage for the entire loan term and lead to lower monthly payments. While this takes some cash upfront, it may reduce your monthly payments significantly. In general, one point is equal to 1% of the loan amount; so, if you were to purchase two points on a $300,000 loan, it would cost you $6,000. For every discount point purchased, it will lower your interest rate by .250 percent to .375 percent, on average.

Consider purchasing points only if you plan to live in your home for long enough to recoup the cost. You can determine this by figuring out your breakeven point, which is the point at which the savings from the discount points exceeds the cost.

Discount points vs. temporary buydown

Temporary buydowns, on the other hand, only last for the first one or two years of a loan but may result in a significantly lower rate and lower initial monthly payments.

When deciding between discount points and temporary buydowns, it's important to consider your long-term goals. If you plan to stay in your home for a long time, discount points may be a better option, as they will result in long-term savings. However, if you're looking for a short-term solution to reduce monthly payments, a temporary buydown may be a better fit.

It's always best to consult with a mortgage professional to determine which option will be the best for you—if you have questions or would like to learn more, please reach out to your neighborhood Mortgage Advisor today.

Interest Rate “Hack” #3: Consider an adjustable-rate mortgage, a government-backed loan, or a shorter loan term

When exploring your mortgage options, don't limit yourself to the standard 30-year mortgage loan—while it's a popular choice, it may not be the most cost-effective for your long-term financial goals. Shorter-term loans, such as 15-year fixed-rate loans, typically have lower interest rates and overall costs, but the monthly payments are higher compared to longer-term loans.

If you're planning to stay in your home for a shorter period of time, like three to ten years, you may want to consider an adjustable-rate mortgage (ARM); this mortgage product offers lower initial rates to reduce monthly payments but may increase the payment down the road. Your adjustable rate is determined by the terms of your loan and market conditions.

It's important to plan ahead for the date when the rate may adjust to a potentially higher payment. However, it may be possible to refinance out of an adjustable-rate mortgage before the fixed-rate period ends, depending on your circumstances.

RELATED: 2-1 Buydown Mortgage vs. ARM: Which is Better?

Interest Rate “Hack” #4: Make a Bigger Down Payment to Reduce Monthly Payments

When it comes to buying a home, one important factor to consider is your loan-to-value ratio (LTV). This ratio compares the amount you borrow to the value of the home, and it can play a significant role in the interest rate you receive.

Generally speaking, a higher LTV (which happens when you make a smaller down payment) increases the risk for the lender. Conversely, a lower LTV (achieved with a larger down payment) reduces the lender's risk and can lead to a lower interest rate. However, as with most things, there are pros and cons to consider if you’re thinking about making a bigger down payment to reduce monthly payments.

Benefits of making a big down payment:

- Carry a lower loan balance

- Avoid mortgage insurance if the down payment is 20% or above

- Have more loan options at your fingertips

Disadvantages of making a big down payment:

- You risk depleting your savings

- Despite a large down payment, you may not get a better interest rate

- May still have to pay mortgage insurance if less than a 20% down payment

PacRes Mortgage offers a variety of low- and no-down payment options, including FHA, USDA, VA, HomeOne, and HomeReady. Click here to learn more.

Ready to Take a Confident Next Step?

It may not feel like it, but you’ve taken a big step towards achieving your goal of a lower monthly payment just by reading this blog. Connect with your neighborhood Mortgage Advisor today or check out our blog

for additional resources.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.