How Temporary Buydowns Help Borrowers and Sellers

November 28, 2022 — 5 min read

In a rising rate environment, it may be challenging for buyers who are saving up to buy their first home or looking to graduate into a larger or more expensive property. It may also pose challenges for the seller. The truth is, neither buyers nor sellers win when interest rates go up. While there are different strategies to manage higher rates--adjustable-rate mortgage (ARM) products or co-buying a house--one option that is often overlooked is to use a temporary buydown upfront to help the buyer achieve a lower monthly payment down the road. Different lenders offer different buydown options, but two of the most common include a 2-1 buydown and a 3-2-1 buydown. We'll talk more about the number of seller concessions it takes to make these buydowns work.

How Does a Temporary Buydown Work?

In a temporary buydown, a borrower pays a lump sum to reduce the interest rate on their mortgage for a specific period of time at the beginning of the loan term. The funds are collected at closing and placed into an escrow account to cover the difference between the reduced payment rate and the fully indexed note rate. This is an ideal option for buyers looking to ease into their mortgage with lower monthly payments at first.

Who Benefits from a Temporary Buydown?

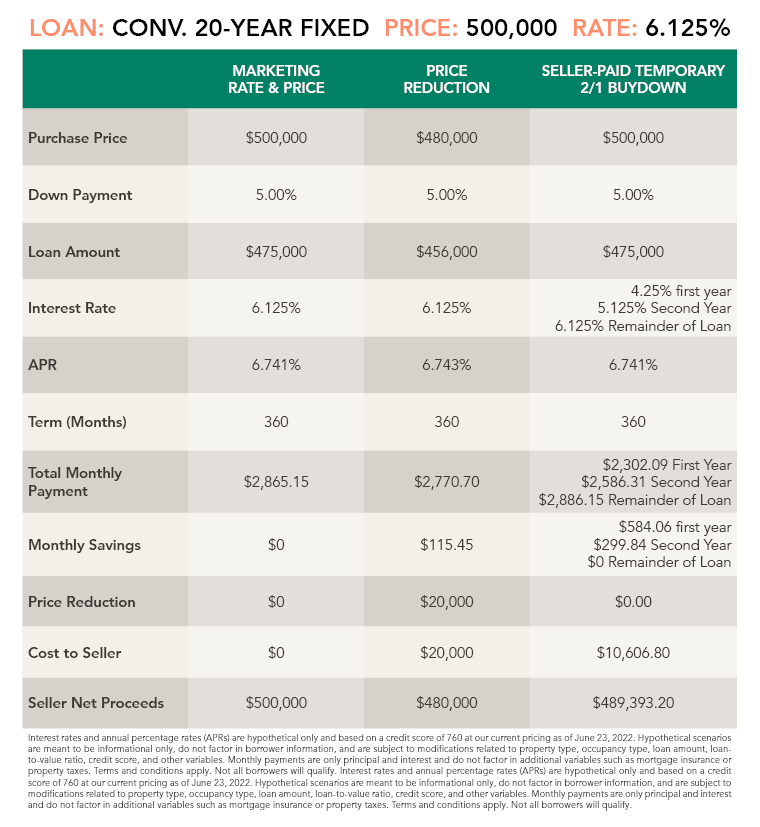

For the seller, a temporary buydown offer will cost less than a price reduction, and it may entice additional buyer interest (see graph below). This is a useful option for those who are in a hurry to sell, or in some cases, if supply is outpacing demand in the current housing market.

For the buyer, a temporary buydown allows them to set their sights on a higher-priced home. It also gives them flexibility in their budget for homeowner expenses and gives them the flexibility to plan their budget for the next few years. Unlike an adjustable-rate mortgage (ARM), borrowers with a temporary buydown have a more predictable loan payment schedule.

While a borrower may agree to buy down the rate by any amount and for any length of time, the most common buydown agreement calls for the interest rate to be reduced by a certain number of percentage points and increase every year until it reaches the undiscounted rate.

Benefits of a Temporary Buydown

Sellers often choose to offer a temporary buydown option to make their homes more enticing to buyers. Home builders may also offer this type of financing when selling properties in new developments.

Pay less money upfront. You'll receive a lower rate (and subsequently, make lower monthly payments) for the first two years of owning your home, which means your monthly payments will be lower, which gets you into a house earlier than your budget may have allowed.

Ease into making your full monthly mortgage payments. If you're a new homeowner, this gives you more wiggle room to become more comfortable with the process and to set aside cash for other big purchases associated with purchasing a home, such as a refrigerator or a mattress.

Save money during the first years of homeownership. Owning a home comes with a lot of expenses, and some of them are unexpected. Save the difference in your rate during these first two years or use it to achieve short- or long-term financial goals.

Potential Drawbacks of a Temporary Buydown

There's a high upfront cost. This option only makes sense if the seller or the builder agrees to contribute the funds to make the buydown work; if the builder or seller will not contribute the funds, the buyer will have to pay significant upfront point(s) to reduce the rate on their mortgage.

Additionally, If the buyer's financial situation changes unexpectedly, they may need to figure out a way to sell the property to avoid the increasing interest rates.

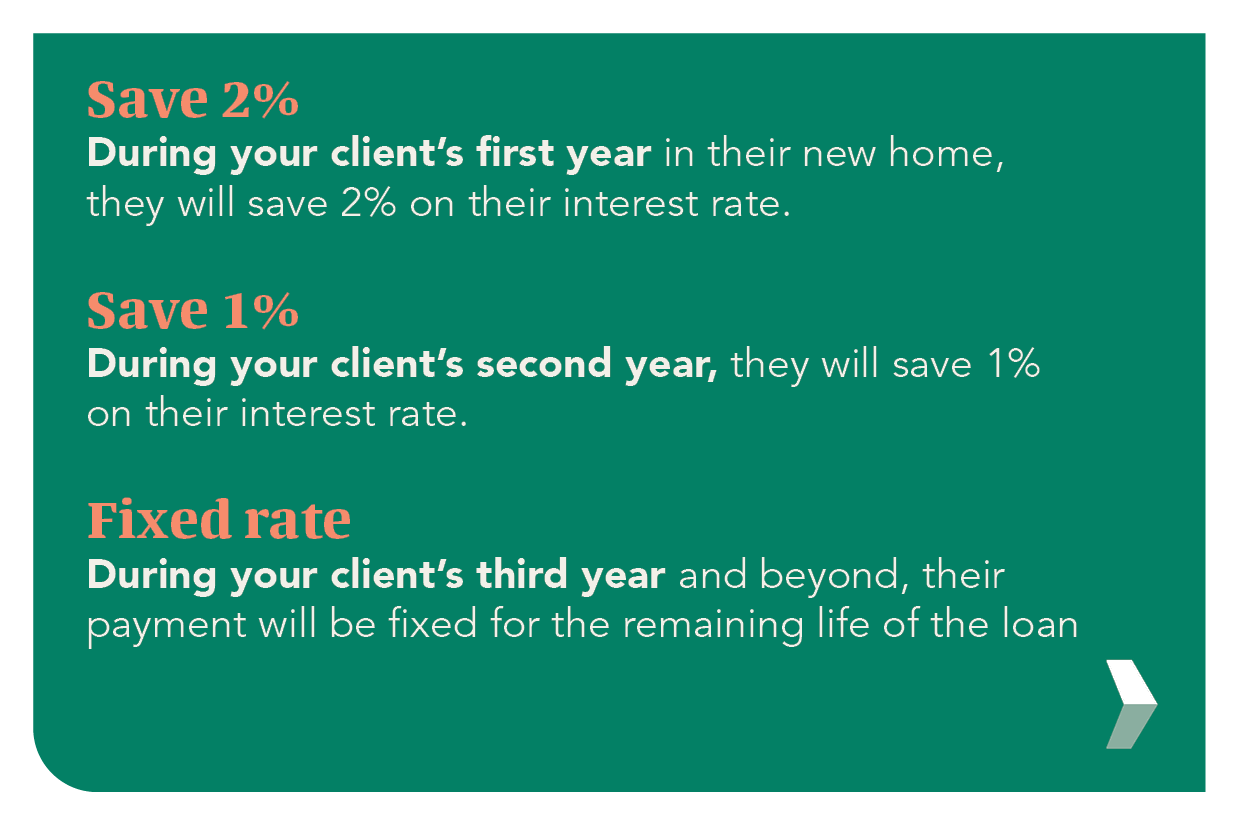

What's a 2-1 Buydown?

With a 2-1 buydown, the seller or builder may reduce the buyer's rate for the first two years of the mortgage. The buyer must pay a one-time fee at closing, called a buydown fee, which is built into the rate. During year one, the rate will be 2% less than the original rate; during year two, it will be 1% less than the original rate. In the third year, the payment will be fixed for the remainder of the mortgage.

Here's an example: If you lock in at 6.5 percent, our 2-1 buydown program would allow you to make payments at a 4.5% rate for the first year and at a 5.5% rate for the second year. Once year three arrives, your payments would increase to the originally agreed-upon 6.5% rate.

How is a Temporary Buydown Different from Paying Discount Points?

When a borrower pays for discount points, they're paying an upfront fee in exchange for a lower rate that will remain in effect throughout the entire life of their mortgage. The new rate will depend on the number of points they purchase--the more points, the more their mortgage rate will drop. In contrast, a temporary buydown will also lower the rate, but much more significantly, and only for a temporary period of time. This is a good option for a borrower who knows they will keep the loan for a long time.

Comparing Seller Concessions Options

To help all of this information take root, let's take a close look at a specific home purchase scenario. In this example, the seller must decide if they would like to drop their asking price or offer a temporary 2-1 buydown. While a reduction in the asking price may seem like the obvious choice, it's not--the 2-1 buydown makes more financial sense when you examine the numbers more closely.

Interested in buying, but like the idea of easing into payments?

If you want to purchase a new home and like the idea of easing into your mortgage payments, reach out to your neighborhood Mortgage Advisor today for information to help you get started. Click here to visit our blog for more homeowner tips and advice.

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.