How to Get a Mortgage While Building Credit: Tips for First-Time Buyers

Timm Ready, CMA, Sr. Mortgage AdvisorMay 22, 2023 — 9 min read

Did you know that more than 60% of first-time homebuyers have a credit score below 700, according to a recent report from FannieMae? If you're planning to buy your first home, it's crucial to understand what you must do to secure the best mortgage for your life and long-term goals, and your credit score plays an important role.

However, it works in tandem with other factors—including your debt-to-income ratio, employment history, and savings—to impact your mortgage eligibility and interest rate. By taking steps to understand your credit score and how it works in conjunction with these factors, you can take a confident next step to improve your chances of securing a mortgage that works for you, even if you're still building credit.

How Good Does Your Credit Score Have to Be to Buy a Home?

Your credit score is a three-digit number that represents your creditworthiness and is used by lenders to assess your ability to repay a loan. In general, the higher your score, the better your chances of getting approved for a mortgage and securing a lower interest rate.

Generally, a good credit score is considered to be approximately 620 or higher; however, it's important to note that lenders have different requirements and will consider other factors, such as your income, savings, and debt-to-income ratio.

If your credit score is lower than the recommended threshold, don’t worry—there are many different loans options designed to help first-time homebuyers move quickly and easily into a new space! Additionally, there are actions and habits you can take to help boost your score and qualify for the perfect mortgage starting today. With some patience and dedication, these steps can help increase your chances of securing a loan and fulfilling your dream of homeownership.

RELATED: How to Build a Good Credit Score and Maintain It

Improving Your Credit Score: Tips for Success

To improve your credit score, there are several easy steps you can take: the first and most important is to pay your bills on time every month. Late payments can have a significant negative impact on your credit score, so it's essential to stay on top of what you owe and when it is due. For a lot of borrowers, it’s helpful to set up automatic payments or reminders.

Here are a few other tips that you can use to help boost your score:

Keep credit utilization low: Credit utilization is the amount of credit you're using compared to your total credit available. Many financial experts recommend keeping Keep your credit utilization low: Credit utilization is the amount of credit you're using compared to your total credit limit. To optimize your credit score, your target for credit card debt utilization is 20% or less of available credit.

For example, if you have a credit card with a $10,000 limit, try to keep your balance below $2,000; if you consistently use a high percentage of your limit, it can signal to lenders that you're relying too heavily on credit.

Check credit report for errors and dispute inaccuracies: Your credit report is a record of your credit history and contains information used to calculate your credit score. It's important to review it regularly or errors and inaccuracies, such as accounts that don't belong to you or incorrect payment history. Dispute any errors you find with the credit bureau to have them removed from your report.

RELATED: How to Dispute an Error on Your Mortgage

Remember: Through December 2023, you can get a free credit report every week from Equifax, Experian, and TransUnion? Click here to request your free reports.

Don’t open too many new credit accounts at once: When you apply for credit, it results in a “hard inquiry” on your credit report, which can temporarily lower your score. Try to limit credit applications to those you really need and space them out over time. Opening too many new credit accounts at once can signal to lenders that you're taking on too much debt.

RELATED: Hard vs. Soft Credit Inquiries: Understanding the Difference

Maintain a diverse credit mix: Having a mix of credit types, such as credit cards, installment loans, and other types of credit, shows that you can manage different types of debt responsibly; however, be cautious not to overextend yourself, and only take on credit that you can manage.

Get a loan with a co-signer: If you’re just starting out, getting a loan with a co-signer can be a great option; a co-signer agrees to share the responsibility of the loan with you and make payments if you're unable to. While a cosigner is liable for the debt, they don’t have legal rights to the property, items, or services purchased with the money.

RELATED: Can Credit Pulls Affect Your Credit Score? Here's What You Need to Know

Finding Your Perfect First-Time Homebuyer Mortgage

If you’re a first-time homebuyer, it may feel overwhelming to try and sift through all of the different mortgage options available; however, there are specific loan products designed to help homebuyers from all different walks of life, including those who are still building their credit.

FHA loans

FHA loans are backed by the government and, in general, come with lower interest rates and more flexible repayment terms, which makes them a popular choice for first-time homebuyers still building their credit; additionally, FHA loans allows you to put down as little as 3.5% of the home's purchase price and, in general, have more lenient debt-to-income (DTI) ratio requirements. Click here to find out if you’re eligible.

USDA loans

USDA loans are another great option for first-time homebuyers still building their credit, particularly for those who live in rural areas and have low-to-moderate incomes. These loans are backed by the U.S. Department of Agriculture and require no down payment; however, there are eligibility requirements that must be met to take advantage of this program. These include:

- The property must be located in a qualifying rural area as defined by the USDA

- The borrower's income must fall within certain limits based on the area where the property is located and the size of the household

VA loans

VA loans are also a great option for first-time homebuyers still building their credit; these loans are backed by the U.S. Department of Veterans Affairs and offer more flexible credit score requirements and more lenient debt-to-income (DTI) ratio requirements. Additionally, VA loans allow you to put down as little as 0% of the home's purchase price, making them a popular choice for those who may not have a lot of cash on hand. However, to be eligible for a VA loan, you must be a current or former member of the U.S. military, National Guard, or Reserve, and you must meet certain service requirements. Click here to find out if you’re eligible.

RELATED: The Insider's Guide to VA Home Loans: 10 Must-Know Facts

203K Rehab loan

If you’re a first-time homebuyer looking to purchase a fixer-upper, the 203K Rehab loan may be the right option for you; this loan program allows you to finance the purchase price of the home and the cost of necessary repairs or renovations in one loan. Backed by the Federal Housing Administration (FHA), the 203K Rehab loan has more lenient credit score requirements and a low minimum down payment; however, there are limits on the total amount that can be borrowed and the types of repairs that can be made. Click here to find out if you’re eligible, or reach out to your neighborhood Mortgage Advisor today.

FannieMae HomeReady

HomeReady is a smart and extremely popular loan choice for first-time buyers with low-to-moderate income. It comes with a flexible credit score requirement, a low-down payment requirement, and the ability to finance the purchase price and any necessary repairs or renovations in one mortgage. It's important to note—there are limits on the total amount that can be borrowed and certain requirements for income and property location. Click here to learn more or find out if you’re eligible.

How Is My Credit Score Calculated?

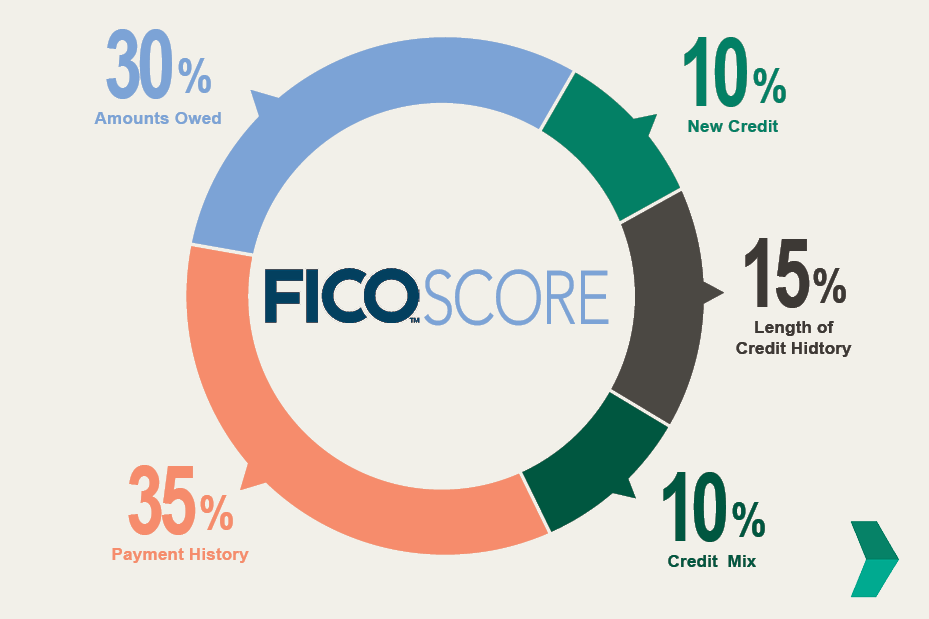

Understanding how your credit score is calculated will help you gain a more holistic understanding of your financial profile. Here’s a breakdown of the factors that make up your score and the amount of weight each item carries:

Payment history (35%): Making on-time payments is crucial to maintaining a good credit score; any payments made over 30 days late can negatively impact your score.

Amount owed (30%): This is based on the total amount you owe on loans and credit cards, the types of accounts you have, and the amount of credit you have available; The target percentage on credit cards and lines of credit excluding installment debt is (20%); high balances and reaching your credit card limit may lower your score, while smaller balances and timely payments can raise it.

Length of credit history (15%): Scoring models consider the average age of your credit when factoring in the length of your credit history; keeping accounts open and active can help maintain a good score.

Credit mix (10%): Having a healthy mix of accounts, such as a home loan and a retail and/or credit card, may also help to boost your score.

New credit (10%): If you’ve opened or applied to open new accounts recently, it could translate into a lower score; however, scoring models are created to recognize that recent loan activity does not mean a consumer is necessarily a risk.

Building Good Credit Takes Times

Developing a solid credit score is not an overnight achievement; rather, it’s step-by-step journey that involves other important considerations, including your debt-to-income ratio, employment history, and savings. However, taking steps to build your credit score now is one of the biggest things you can do to indicate that you are a trustworthy borrower down the road.

It you haven't taken steps to start building your credit, now is the time to start. With patience, diligence, and help from your neighborhood Mortgage Advisor, you can establish a solid credit score that will serve you well for years to come! Click here to receive a customized quote and get started today.

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.