From Fright to Freedom: Exorcising This Year’s Top Mortgage Fears

Don Layman, Sr. Mortgage AdvisorOctober 9, 2023 — 12 min read

Wasn’t it just yesterday we were stopping to smell roses? Now, there’s a chill in the air, and through the crunch of colorful leaves, we stop to admire dazzling hues of red, orange, and gold.

Similar to the changing of the season, the rise and fall of our economy can cast a shadow over the housing market and give rise to a concerning question—how will this impact what is probably one of the largest investments of my life? It's a query that creeps at the corners of our minds, especially as headlines tell tales of financial woes.

However, just as falling leaves pave a path for new growth, we’re here to dispel myths that have taken root, allowing you to embrace a clearer understanding of the complex relationship between recessions and home values.

Understanding Home Buyers’ Top Mortgage Fears

If you’re preparing to take the next step in your homeownership journey, it’s natural for a chorus of concerns to hum in the background. From down payment to credit score, these concerns extenuate apprehensions that accompany the decision to take on a mortgage.

However, it’s important to keep the bigger picture in mind:

There is no secret to homebuying success, and if you’re feeling fearful about next steps, the best way move forward is to address concerns head on through knowledge, preparation, and support from industry experts.

In general, experts have identified three factors that underpin most homebuying concerns today: these include talk of an impending recession, high interest rates, and a shortage of available homes.

By breaking these factors down into their simplest form, you’ll be able to better grasp how they relate to your homebuying journey and use the following insights to navigate today’s real estate market with confidence.

Exorcise Your Mortgage Fears: Recession & Rates

How does a recession impact real estate?

Before we can exorcise this fear, it’s important to understand what a recession is and how it might influence the housing market.

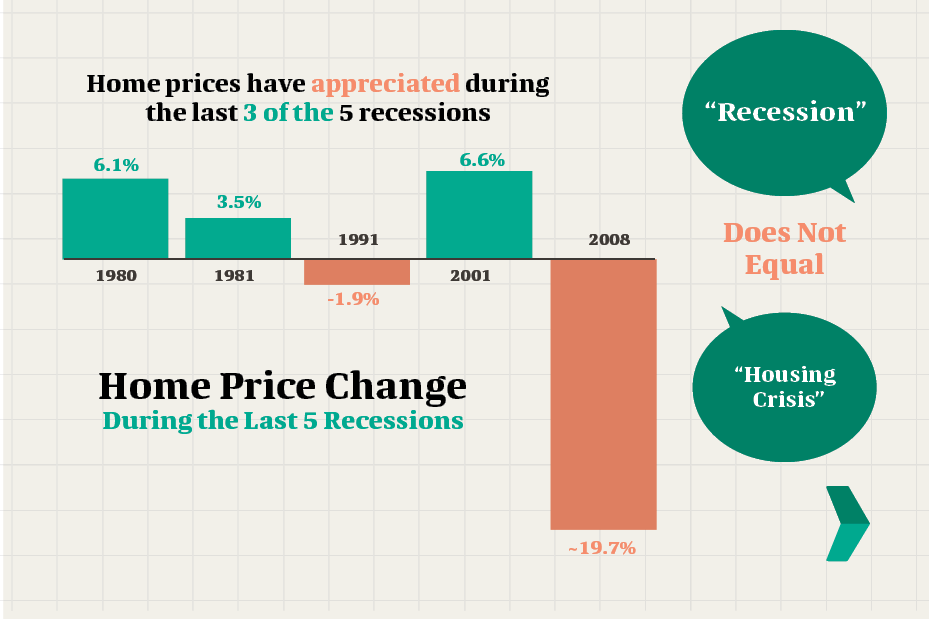

In short, a recession is a period of economic decline characterized by a decrease in gross domestic product (GDP), increased unemployment rates, and reduced consumer spending. The mere mention of a recession may stir anxiety and conjure images of plummeting home values, but history gives a more nuanced picture. Previous economic downturns have shown us something interesting: while there might be pockets where home prices dip, the broader real estate market has proven its resilience time and again.

RELATED: Not Your Dad’s Note: How Have Mortgages Changed Over the Years?

In the course of a conventional recession, mortgage rates tend to decrease, accompanied by a potential decline in home prices due to a reduced pool of eligible buyers and decreased competition in the housing market. It's like weathering a storm; the housing market often bounces back even stronger once the clouds clear.

Inflation drives mortgage rates

Today’s high inflation has triggered aggressive moves from the Federal Reserve, which has many people concerned we’re headed toward a recession. This concern comes at a time when home prices are steeper and mortgage rates are higher than they have been over the past several years.

RELATED: Why Isn't the Housing Market Crashing? Watch Wiley's Weekly Wisdom

In essence, inflation serves as a marker of the diminishing value of the dollar, and the most effective way for the Federal Reserve to contain inflation involves raising the federal funds rate—that is, the interest rate at which banks lend to one another overnight.

By increasing the federal funds rate, the Federal Reserve aims to make borrowing more expensive, curbing spending and reducing the demand for goods and services; this, in turn, helps to put the brakes on inflationary pressures.

How we can use this information to learn from the past

History offers us valuable lessons—while a recession can send ripples through the real estate landscape, it doesn't write the final chapter. Many different factors, including location, market conditions prior to the recession, and government responses, all influence the outcomes. In the wake of past recessions, the real estate market has displayed a remarkable ability to adapt and rebound. Here are a few of the biggest reasons why:

Housing is a basic necessity, and people will always require shelter. Regardless of economic conditions, people require shelter. This inherent demand for housing helps to provide resilience to the real estate market. While economic downturns can impact the housing market, the consistent and universal need for housing helps to prevent extreme crashes.

Government policies and interventions often play a significant role in mitigating the impact of a recession on real estate. Government actions can have a profound impact on the real estate market, especially during periods of economic turmoil. Policymakers often implement strategies to counteract the negative effects of a recession on the housing sector; for instance, during the 2008 financial crisis, governments introduced programs to help homeowners facing foreclosure and implemented policies to boost housing activity, preventing a deeper market collapse.

During periods of economic distress, distressed properties may enter the market due to foreclosures or financial hardships. Economic downturns can lead to homeowners facing financial difficulties that result in foreclosures or the need to sell their properties at lower prices. These distressed properties can enter the market at reduced prices, creating opportunities for buyers. While this influx can initially put downward pressure on property values, it can also attract investors and first-time buyers looking for affordable opportunities.

Should you buy now or wait for a recession?

Unfortunately, there’s no “one-size-fits-all” answer to this question—the correct choice is specific to your life and long-term financial goals.

Unlike the last recession in 2008, which was caused by the financial crisis, we're currently dealing with high inflation, and the job market remains strong.

Additionally, the actions taken by the Federal Reserve are much different than they were in 2008, when the government reduced rates from 5.25 percent in September 2007 to 2 percent by April 2008. This was an attempt to stimulate the economy and prevent the country from sliding into a recession.

In fact, if we turn the clock back even further, we see over the course of the last 5 recessions in U.S. history, 3 experienced increases, with 2 seeing prices appreciate faster than the historical average.

In the end, the decision of when to buy a home rests with you. In general, if you’re eager to become a homeowner and can meet the following criteria, you should feel confident to start house-hunting journey:

Stable income. Having a dependable source of income is crucial when considering buying a home. The ability to consistently cover mortgage payments, property taxes, insurance, and maintenance costs is essential to maintain your financial stability. This stability ensures that you can meet your financial obligations even during unexpected or uncontrollable circumstances.

Sufficient savings. Buying a home involves more than just a down payment. You should have sufficient savings to cover not only the down payment but also the closing costs associated with buying a home, which can include fees for inspections, appraisals, and legal processes. Furthermore, it’s important to have a safety net of emergency funds, as homeownership can bring unforeseen repairs and maintenance expenses.

RELATED: 3 Smart Money Habits to Help You Save for a Home

Budget consciousness. It's tempting to stretch your finances to purchase your dream home, but overextending yourself can lead to financial stress. Be realistic about your budget limitations and calculate how much you can comfortably afford without sacrificing your quality of life. Consider not only the monthly mortgage payment but also utilities, property taxes, homeowner association (HOA) fees, and possible future expenses.

RELATED: How Much House Can I Afford? The Answer Is Different for Everyone

Long-term plan. Buying a home is an investment that pays off better with time. To recoup the upfront costs associated with buying a home, it's generally a good idea to live in the home for approximately five years. This gives you time to build equity and potentially benefit from appreciation in the home's value.

Do your research. Understanding the local real estate market is vital. Research recent property sales, trends in property values, and the overall health of the real estate market in your area. This knowledge empowers you to make informed decisions about whether it's a good time to buy or if waiting might be more advantageous.

RELATED: How to Pick the Right Neighborhood for You

Job stability. Evaluate your job stability and the overall outlook for your industry. While no one can predict the future, having a secure job and promising prospects can provide a safety net in case unexpected financial challenges arise.

Exorcise Your Mortgage Fears: Low Inventory

Housing inventory, in simple terms, refers to the number of homes available for sale at any given time within a particular market. When this inventory dwindles, fears about finding the perfect home can amplify, leading to increased competition, higher prices, and limited options.

This imbalance can give rise to a challenging environment for individuals and families seeking appropriate and budget-friendly housing, leading to feelings of frustration and difficulty securing a home that aligns with their requirements.

Why is real estate inventory low right now?

Historically low interest rates

Record low rates played a pivotal role in shaping the current landscape of diminished housing inventory. One of the major driving forces behind this situation stems from the window of opportunity homeowners had in 2020 and 2021 to secure historically low interest rates.

However, this scenario has undergone a significant transformation recently, as mortgage rates have experienced a notable upswing; consequently, homeowners who had the advantage of acquiring or refinancing their properties at low rates now face a dilemma:

The significant increase in rates has made these homeowners hesitant to buy a new home with much higher rates, causing them to want to hold on to their current homes instead of taking out a new mortgage with a higher rate.

Fewer new construction homes

The low number of new homes being built is another reason for the current shortage of available housing. While new home builds hold significant sway over annual home sales, builders have encountered formidable obstacles, including unpredictable spikes in building material costs and a dearth of skilled labor for new construction projects; consequently, the issuance of permits for new home construction plummeted by 24 percent in 2020, and the recovery process continues into 2023, according to experts.

Remote work

The coronavirus pandemic ushered in a new era in the workplace, as the option of remote work became a lasting option for many homeowners. This change enabled families to move to communities that are more budget-friendly, provide a better fit for living space, or are closer to loved ones. Consequently, smaller suburban areas—once seen larger as places for commuters—witnessed a rise in residence. This surge has encouraged an intensely competitive market in these communities.

How does low inventory affect buyers and sellers?

Low housing inventory impacts both buyers and sellers, but it’s the buyers who often end up facing the greatest challenges. Limited housing choices have resulted in market competition, leaving many buyers vying for a small pool of available homes. This can trigger bidding battles and push up property prices.

Buyers

The scarcity of homes has led some buyers to compromise on their desired size and features. Many aspiring owners are set back by a lack of affordable housing options, and those working with tight budgets may face minimal room for negotiation and grapple with necessary repairs or improvements due to the lack of homes on the market.

PacRes Mortgage offers several down payment assistance programs to help make homeownership more affordable—click here to explore options.

Who can qualify for a down payment assistance program:

- First-time homebuyers

- Individuals with incomes below area median levels

- Borrowers with little to no money saved for a down payment

- Homebuyers living in rural areas

- Veterans and active military personnel

- Individuals with disabilities

- Homebuyers who meet credit and other eligibility requirements as determined by the program

Sellers

On the flip side, being a seller brings its own set of challenges. Many prospective sellers encounter a stumbling block when it comes to listing their homes. The financial constraints of affording a new property at current mortgage rates often hinder the process. Consequently, homeowners who intend to downsize, upgrade, or change location often opt to delay selling, leaving their homes out of the market pool.

While homeowners may achieve swift sales, the true trial emerges when the market lacks available houses. This difficulty is amplified as they search for a new home that fulfills their criteria and fits into their preferred timeline.

The key to navigating today’s real estate market

In the past, we've seen shortages in housing inventory in the real estate market. These shortages typically mean there aren't enough homes available to last about six months.

Usually, it takes around four to six months to recover the inventory and bring the balance back to the market. However, the coronavirus pandemic's impact on the housing market is expected to unfold over many years.

While lower rates could help, they may not completely solve the problem. Building more homes could also make a big difference, but challenges like high material costs and labor shortages continue to discourage builders from starting new projects.

However, while recovering from the current housing shortage in the U.S. may be a gradual process, remember that economic ups and downs don’t write the final chapter. The resilience of real estate has been demonstrated time and time again.

Community efforts, policy adjustments, and advancements in construction technologies could all play pivotal roles in accelerating the recovery. Moreover, the pandemic has also reshaped perspectives on remote work and lifestyle preferences, potentially leading to shifts in housing demand that could influence how the market rebounds.

In addition to equipping yourself with the knowledge provided in this blog, the key to navigating today’s real estate market is to seek guidance and support, particularly if you’re new to homebuying or investing.

In the world of mortgage fears, knowledge serves as the best antidote. Through knowledge and support, buyers can step into the world of homeownership with confidence, knowing that they are equipped with the tools to navigate the path ahead.

Ready to Get Started?

Reach out to your neighborhood Mortgage Advisor today if you have questions or want to take the next step in your homeownership journey, or click here

to receive a customized quote.

Keywords:

Categories

- Buyers

- First-Time Homebuyers

- Purchase Programs

- Purchase Products

- Refinance Programs

- Homeowner Knowledge

- Retirement

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.