Debunking Mortgage Myths: Learn the Truth Before Buying a Home

March 20, 2023 — 6 min read

Even if this is your first time buying a home, you have likely heard or received advice about mortgages before. Some guidelines may have changed over time, but other tips may have never been accurate in the first place. While advice can be helpful, it's important to ensure that it is based on fact when making such a significant financial decision. Read through the most common mortgage myths below to feel confident as you begin your next home purchase.

You Must Have Perfect Credit to Buy a Home

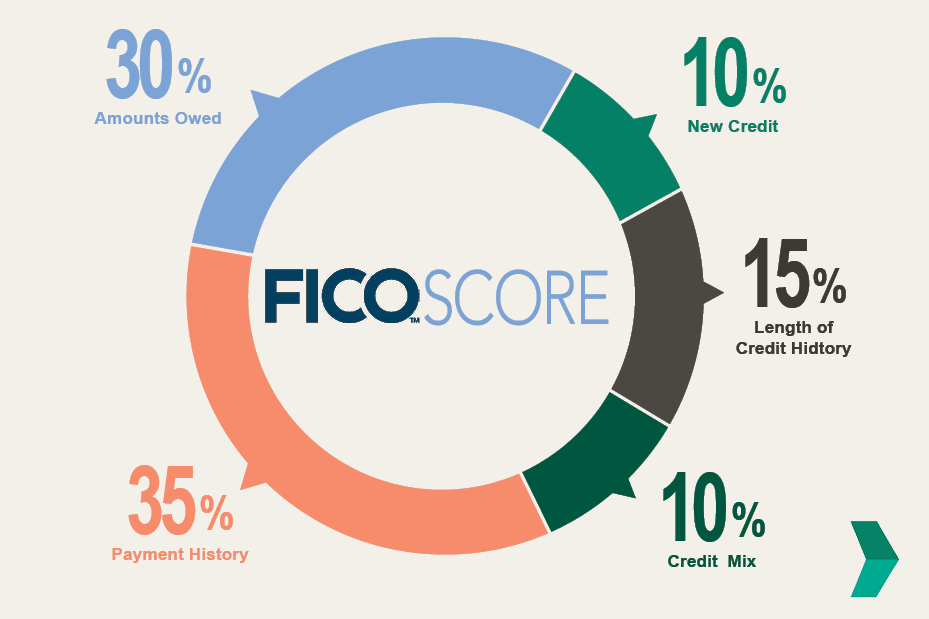

Your credit score plays a significant role in your ability to secure a mortgage, but it doesn’t have to be perfect to find the right loan for your budget. Several factors go into determining your scores, such as debt or credit utilization, credit history, timely payments, and more.

RELATED: How to Build a Good Credit Score and Maintain It

It's easy to assume that you have just one credit score, but that isn't the case; most borrowers have up to three different credit scores, and the middle score of the three, or the lowest score of two, is the credit score used in qualifying for a mortgage. Mortgage lenders typically use the Fair Isaac Corporation (FICO) model. There are loan programs available through PacRes for borrowers who are still building their credit. Depending on other key factors, like income, existing debt, and where you live, you may qualify for a home loan through one of the options detailed below.

FHA loans

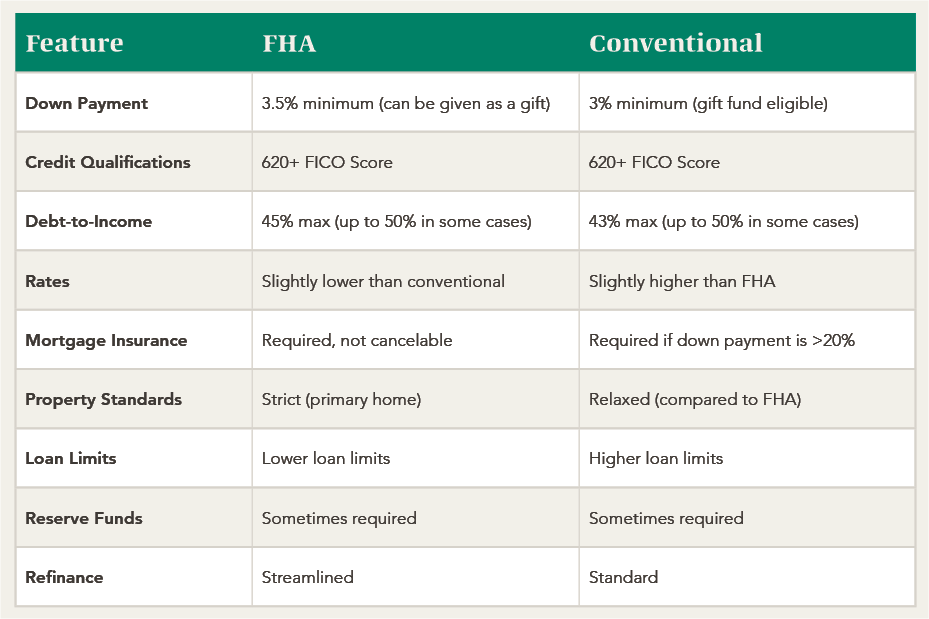

The Federal Housing Administration (FHA) insures home loans backed by the government. Because these loans come with less stringent requirements, they can be a good option for homebuyers who are unable reach the threshold required by conventional loans or who are struggling to afford closing costs.

VA loans

VA loans from the U.S. Department of Veterans Affairs are available to current, retired, or disabled members of the military and/or their surviving spouses. These loans usually do not require a down payment, like FHA loans, however, they may include additional fees such as a funding fee, which can range between 1.4% to 3.6% of the loan amount. This fee can be less for those who make a larger down payment and are applying for their first VA loan.

Non-Qualifying Mortgages (Non-QM)

Non-qualifying mortgages, also known as non-QM loans, are intended to assist borrowers who do not meet the requirements for a traditional mortgage, such as having a high debt-to-income ratio, irregular income, or not meeting the income verification standards set forth by the Dodd-Frank Act. These loans do not comply with the consumer protection regulations established by the Consumer Financial Protection Bureau. As a result, individuals with these types of financial backgrounds may not be able to qualify for a standard mortgage but may be able to qualify for a non-QM loan.

Who May Benefit

- Self-employed workers, freelancers, and gig workers

- Borrowers who are still building their credit

- Borrowers with substantial assets

- Borrowers from other countries

- Real estate investors

- Borrowers with unique properties

RELATED: What is a Non-Qualifying Mortgage (Non-QM)? Your Complete Guide

You Must Have a 20% Down Payment to Buy a Home

The idea that a 20% down payment is necessary to purchase a home is a lingering misconception from the post-2007 housing crisis when access to credit became more restricted due to widespread defaults on mortgage loans. However, current options for lower down payments have made homeownership more accessible, and in some cases, it's possible to buy a home with no down payment at all. Additionally, mortgage insurance is required for those without a full down payment, and while it may add an extra monthly payment, it can help borrowers purchase a home and begin building equity for future investments. PacRes offers a wide range of low- or no-down payment loan options, including:

- FHA loans

- VA loans

- HomeReady

- Home Possible

- Conventional 97 loan

Pre-Qualification Is the Same as Pre-Approval

Both prequalification and preapproval are ways for borrowers to get an estimate of how much they can afford for a home. However, preapproval is a more formal step that involves the lender verifying the borrower's financial information and credit history. Documents such as pay stubs, W-2’s, tax returns, and even a Social Security card may be required for preapproval.

This makes preapproval a stronger indication of what a borrower can afford and gives more credibility to their offer than prequalification. Additionally, borrowers can present a preapproval letter to sellers to demonstrate that their financial information has been vetted and that they can afford a mortgage. However, it's important to check with the lender for specific requirements.

RELATED: Pre-Approval vs. Pre-Qualification: What is the Difference?

In the pre-approval process, we:

- Collect earnings history

- Verify credit report

- Examine assets

- Analyze current debt levels

- May contact employer

This in-depth understanding of your finances gives us an accurate dollar amount of what you are approved for, and gives a better idea of what your interest rate will be. Although not set in stone, pre-approvals are much more accurate than pre-qualification. Reach out to your neighborhood Mortgage Advisor today to learn more or get started.

Renting is Cheaper Than Buying

The idea that renting is cheaper than buying a home is a common misconception. While it may be true in some cases, buying a home can save you more money in the long run than renting. Additionally, homeowners have more control over their property and can make improvements that can increase the property's value, which can benefit them when they choose to sell.

RELATED: Homeowner Costs That Renters Might Forget About

There are several crucial factors to consider when deciding whether to buy or rent, such as property values, tax breaks, equity, and quality of life. Homeowners can deduct mortgage interest payments, which can lower their federal income tax and reduce their taxable income. They also build equity in their home over time, which can be used for loans or home improvements. Renting, on the other hand, does not build equity for the renter and renters do not have control over their living space.

RELATED: Signs That You’re Ready to Become a Homeowner

You Should Choose the Lowest Interest Rate When Comparing Loan Options

Interest rates are important to consider; however, to fully understand the cost of a loan, it is important to consider the annual percentage rate (APR), which includes additional expenses such as closing costs, origination fees, and private mortgage insurance. Comparing the APR of a loan provides a more comprehensive view of the costs associated with the loan, rather than just looking at the interest rate alone. By reviewing the APR, you can ensure you are getting the best overall loan and making an informed decision.

Had Enough “Myth” Information?

Now that you know the truth behind these common mortgage myths, you’re ready to start planning your home purchase with confidence. If you have additional questions, reach out to your local Mortgage Advisor, or check out our blog page for additional information.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.