Pumpkin Spice & Property Price: The Difference Between Appreciation & Median Home Price

September 22, 2023 — 11 min read

In the ever-changing world of real estate, it’s important for homebuyers and investors to stay informed and adept at deciphering housing trends. The market is subject to fluctuations influenced by economic, social, and demographic factors, and being able to recognize these trends helps you make more informed decisions, whether it's buying your dream home or making a profitable investment choice.

Two fundamental concepts at the core of this analysis are price appreciation and median home price; while appreciation highlights the potential for property value growth over time, median home price provides a snapshot of the market's current standing. By grasping the unique insights offered by these two metrics, it’s possible to strategize better and negotiate deals with confidence.

Price Appreciation in Real Estate

Price appreciation refers to the increase in the value of a property over time. This growth can result from various market conditions, economic influences, and external factors that affect the desirability and demand for real estate in a particular region. Price appreciation is a key indicator of the potential return on investment for homeowners and investors, making it an essential metric to monitor and understand.

What factors influence price appreciation?

Supply and demand. In regions where demand outpaces the availability of homes for sale, prices tend to rise as buyers compete for limited housing inventory; on the other hand, an oversupply of homes can lead to slower price growth or even a decline in property values.

Economic indicators and trends. Economic factors, such as the overall health of the national and local economies, interest rates, and employment rates, also impact price appreciation. A robust economy with low unemployment and favorable interest rates tends to stimulate housing demand and drive property prices upward. Conversely, economic downturns can slow down price appreciation or lead to temporary declines

Demographic shifts. Demographic changes, including shifts in age groups, family sizes, and lifestyle preferences, can influence housing demand and, subsequently, price appreciation. For instance, an influx of millennials entering the housing market may increase the demand for starter homes and condominiums, impacting the appreciation rates of these property types.

Neighborhood attributes. The location of a property plays a critical role in price appreciation. Desirable neighborhoods with proximity to amenities, schools, transportation hubs, and recreational facilities tend to experience stronger price appreciation; conversely, areas with higher crime rates, limited infrastructure, or declining neighborhoods may experience slower price growth.

Infrastructure. Infrastructure developments, such as the construction of new highways, public transportation, or commercial centers, can enhance accessibility, convenience, and overall appeal, leading to increased property values in surrounding areas.

Calculating price appreciation percentage

Price appreciation percentage is a measure used to quantify the growth in a property's value over a period of time. It’s a valuable tool for homeowners and investors because it provides holistic insights into the property's performance and overall market trends.

To calculate price appreciation percentage:

- Subtract the property's original purchase price from its current market value;

- Divide the result by the original purchase price;

- Multiply by 100 to express it as a percentage

The number you get represents the rate of appreciation over a specific time frame.

Over time, price appreciation leads to increased home equity, or the actual dollar value of your ownership in the property. If you need quick cash, you can access and withdraw this money using loans or refinancing.

RELATED: Harness the Value Within: Your Smart Guide to Using Home Equity

Median Home Price: Understanding the Metric

Median home price is a fundamental metric in real estate that signifies the midpoint of all home prices in a particular area; it’s determined by arranging the recorded home sale prices in ascending order and identifying the middle value.

How does median home price differ from average home price?

Generally, unlike the average home price, which is calculated by summing all prices and dividing by the total number of properties sold, the median home price offers a more balanced representation of the market.

Median home price is less influenced by extreme high-end or low-end sales, providing homebuyers and investors a more accurate and reliable reading of the typical property value inside a specific neighborhood.

- Median home price provides potential homebuyers with a realistic understanding of the cost of housing in a specific region.

- On the other hand, it can help real estate investors identify markets that align with their investment budget and strategy.

Factors that impact median home prices

Local economic conditions. The overall economic health of a region or neighborhood significantly influences median home prices. Factors such as job growth, wage levels, and economic stability impact demand. In prosperous areas, higher median home prices are often observed due to increased purchasing power and housing demand.

Housing inventory levels. The supply of homes available in a specific market also plays a crucial role in determining median home price. Limited housing inventory relative to demand tends to drive up prices, as buyers compete for fewer available properties. Conversely, an excess of available homes can lead to decreased prices due to increased competition among sellers.

Interest rates. Changes in interest rates can affect median home prices. Lower interest rates make borrowing more affordable, driving up demand and potentially leading to higher median home prices; conversely, rising interest rates may curb demand and lead to more moderate price growth.

RELATED: Planning to Buy a Home? Strategies to Deal with Rising Rates

Housing market competitiveness. The level of competition among buyers and sellers in the housing market directly impacts median home prices. In periods of competitive seller's markets, where demand exceeds supply, prices tend to rise; in contrast, buyer's markets, where supply outweighs demand, can lead to more favorable prices for purchasers.

LEARN MORE: Simple & Safe Strategies to Help You Win in a Seller’s Market

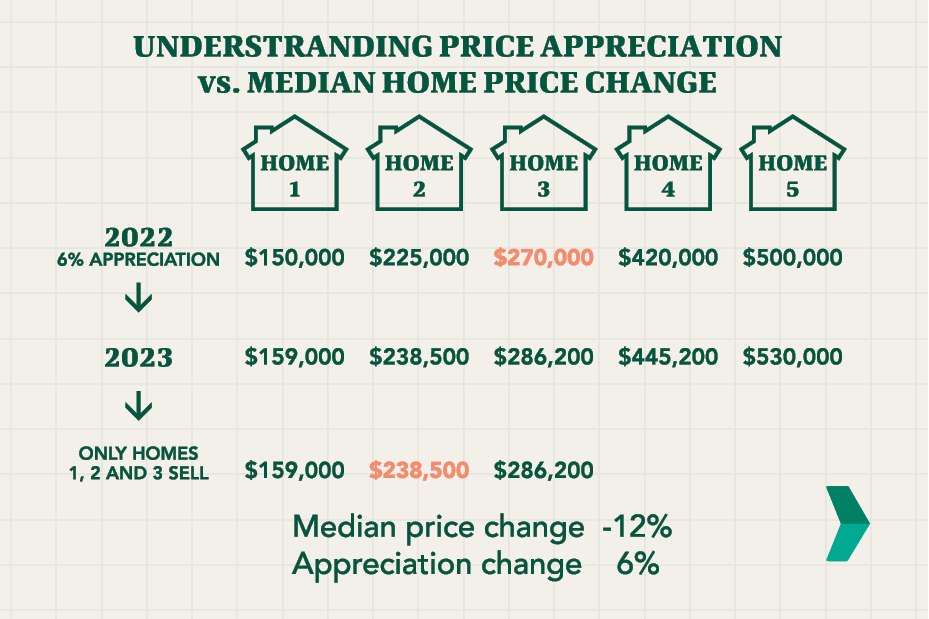

In a recent partnership with PacRes Mortgage, Barry Habib, of MBS Highway, provided a detailed explanation of why median doesn’t track appreciation using recent housing data as an example:

Price Appreciation vs. Median Home Price: Key Differences

Focus and scope

Price appreciation primarily focuses on the increase in a property's value over time, providing insights into its historical growth and potential for future appreciation. On the other hand, median home price concentrates on the midpoint value of all homes in a specific area, reflecting the current market conditions and the typical property value within that location. While price appreciation highlights long-term trends, median home price offers a snapshot of the immediate market status.

Timeframe for measurement

Price appreciation is concerned with changes in property value over an extended period, which can span several months to years, and requires historical data to calculate the percentage change. Median home price analysis is more immediate, typically capturing current market conditions and reflecting the most recent sales data. Homebuyers and investors can use median home price data to make decisions based on the present market scenario.

Relationship between price appreciation and median home price

Price appreciation and median home price are interrelated but convey distinct aspects of the housing market. While price appreciation contributes to fluctuations in median home price, they are not directly interchangeable.

- Median home price considers all property values in an area, including both appreciated and depreciated properties, to determine the middle value;

- Price appreciation focuses specifically on the growth of individual property values over time.

Insights provided by each metric

For homebuyers, median home price helps in gauging the affordability of a specific area, as understanding the typical property value in a neighborhood enables buyers to make informed decisions that align with their budget. On the other hand, price appreciation offers valuable insights to long-term investors seeking to build equity. By analyzing historical price appreciation trends, investors can identify potentially lucrative opportunities for future returns on investment.

The Impact of Price Appreciation and Median Home Price on Mortgages

Mortgage financing and price appreciation correlation

Generally, property values appreciate over time, so homebuyers may find it beneficial to enter the market sooner rather than later. Rising home prices can lead to higher down payment requirements, making it a better option for buyers to secure mortgages while prices are still relatively lower; moreover, price appreciation may impact interest rates, as lenders may adjust their rates based on the potential for increased property values. For current homeowners, price appreciation can be advantageous in securing favorable refinancing terms, unlocking opportunities for lower interest rates and reduced monthly mortgage payments.

Loan-to-Value Ratio (LTV)

Your loan-to-value (LTV) represents the proportion of the loan amount compared to the appraised value of the property. Here’s why that’s important—rising median home prices affects your LTV ratio. For homeowners seeking to refinance, a higher LTV ratio may affect eligibility for certain loan products or result in additional private mortgage insurance (PMI) costs.

Using market trends to determine the right time for refinancing

When property values appreciate, homeowners may find themselves with increased home equity, offering an opportunity to refinance and potentially secure more favorable terms. A higher median home price in the area may indicate a strong housing market, leading to potential interest rate adjustments that could benefit homeowners seeking to refinance.

Strategies for Homebuyers and Sellers

Homebuyer considerations

Understand price appreciation for long-term home value. Recognizing the potential for a property's value to increase over time can be a strong motivator for purchasing a home. In fact, a property in an area with a history of consistent price appreciation may offer an excellent opportunity to build equity and accumulate wealth. Buyers should research market trends, historical data, and future growth prospects to identify neighborhoods with strong price appreciation potential.

RELATED: The Road to Financial Freedom: How Homeownership Leads the Way

Make informed decisions based on median home price. The median home price serves as a practical tool for homebuyers to assess affordability and set realistic expectations. By understanding the typical property value in a given area, buyers can gauge whether a specific location aligns with their budget and long-term financial goals. Additionally, analyzing the median home price in relation to local amenities, school districts, and transportation access can aid in identifying the most suitable neighborhoods that meet their lifestyle preferences.

RELATED: How to Pick the Right Neighborhood for You

Balance investment potential and budget constraints. It is essential to set a realistic and manageable budget that aligns with your financial capacity and long-term goals. Overextending finances to purchase a property beyond your means can lead to financial stress, making it difficult to meet monthly mortgage payments and other essential expenses. Striking the right balance between investment potential and budget constraints ensures a prudent and sustainable home purchase decision. Homebuyers should work closely with a qualified real estate agent to identify properties that offer a promising investment while staying within their comfort zone financially.

Seller considerations

Leverage price appreciation to determine listing price. For sellers, leveraging price appreciation data is crucial in setting an appropriate listing price. With thorough analysis of how the property's value has appreciated over time, sellers gain valuable insights into current market trends and the overall trajectory of the local real estate market; armed with this knowledge, sellers can confidently determine a listing price that aligns with the property's true market worth and maximize potential returns on their investment.

Price competitively based on median home price. Setting an appropriate listing price that reflects the median home price in the neighborhood helps create a sense of value for the property. Buyers are often well-informed about the current market trends and have access to data that enables them to make educated decisions. Therefore, pricing the home in line with the median home price signals to potential buyers that the property is fairly valued and competitive within the market.

Competitively pricing the property has several advantages:

- It generates interest from a broader pool of buyers who are actively searching for properties within the median price range.

- This increased interest can lead to more showings and potential offers, creating a sense of urgency.

- Multiple offers may emerge, encouraging a competitive environment that can drive the selling price higher than the original listing price.

Adapt strategies for a buyer’s or seller’s market. In a buyer's market, where housing supply exceeds demand, sellers may need to be more flexible with pricing and consider negotiating incentives to attract buyers. Conversely, in a seller's market, where demand surpasses supply, sellers can have more leverage and may focus on maximizing their profit within reason.

RELATED: Inspect or Not to Inspect? Your Easy Guide to Property Inspection Waivers

Have More Questions?

Now that you understand the difference between price appreciation and median home price, you may have specific questions about how these factors impact your homeownership journey. Reach out to your neighborhood Mortgage Advisor today to learn more, or click here to receive a personalized quote.

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.