Empowering Veterans: The Role of VA Loans in Post-Service Life

November 14, 2023 — 8 min read

The transition from service to civilian life can feel liberating and daunting for our nation’s heroes. It’s a time when they trade in uniforms and camaraderie for a civilian identity, seeking new opportunities, and oftentimes, a place to settle down and call home.

It’s a period brimming with potential, where they can harness their skills and experiences to forge a rewarding post-service life. They can also harness unique homebuying benefits, courtesy of the Department of Veterans Affairs.

If you or a loved one has proudly served our country, you've already shown resilience and determination; the next step in your journey is to explore how VA homebuying benefits can pave the way for a strong financial future.

Brief History of the VA Home Loan Program

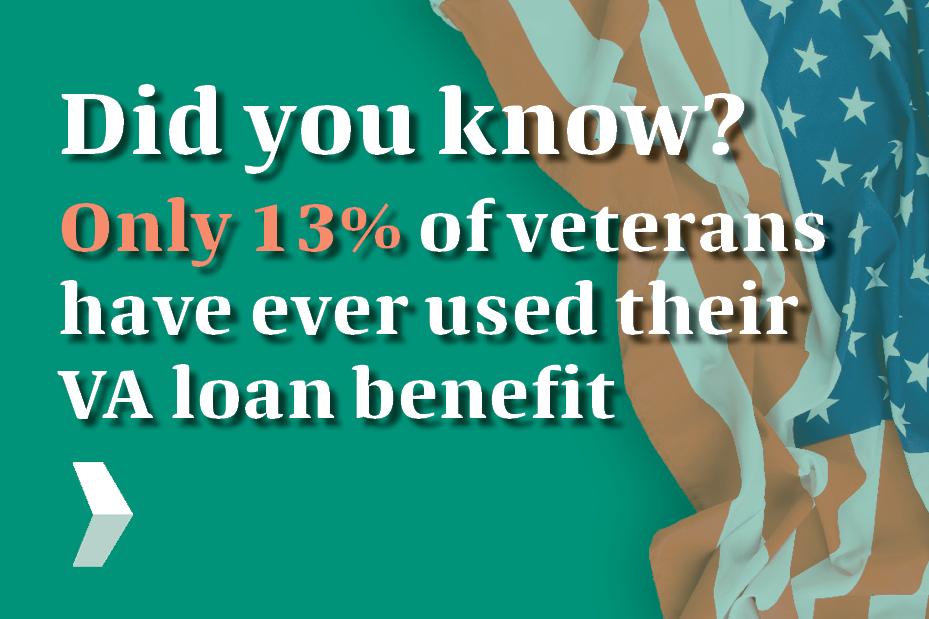

The VA home loan program, established in the 1940s, was designed to provide equitable opportunities for service members and veterans seeking home financing; over the years, it has enabled over 24 million veterans to realize their homeownership dreams, though sadly, many people don’t use it or aren’t aware of the benefit.

With nearly half of all veterans in the United States devoting 50% or more of their monthly incomes to cover housing expenses, this raises a fair question: could they be saving substantially more if they were to choose a VA loan instead of another mortgage type or monthly rental payment?

During the post-World War II period, the VA home loan program saw a surge in popularity, offering veterans a means to ease their transition into civilian life through homeownership. The program's advantages were later extended to veterans of the Korean War and the Vietnam War.

In the 1970s, eligibility criteria were expanded to include National Guard and Reserve members, as well as certain categories of military spouses. The program continues to evolve to meet the changing needs of veterans, including updates to loan limits, increased flexibility in terms, and efforts to streamline the application and approval process.

How the VA Home Loan Program Helps Today’s Veterans

How much down payment do I need to save?

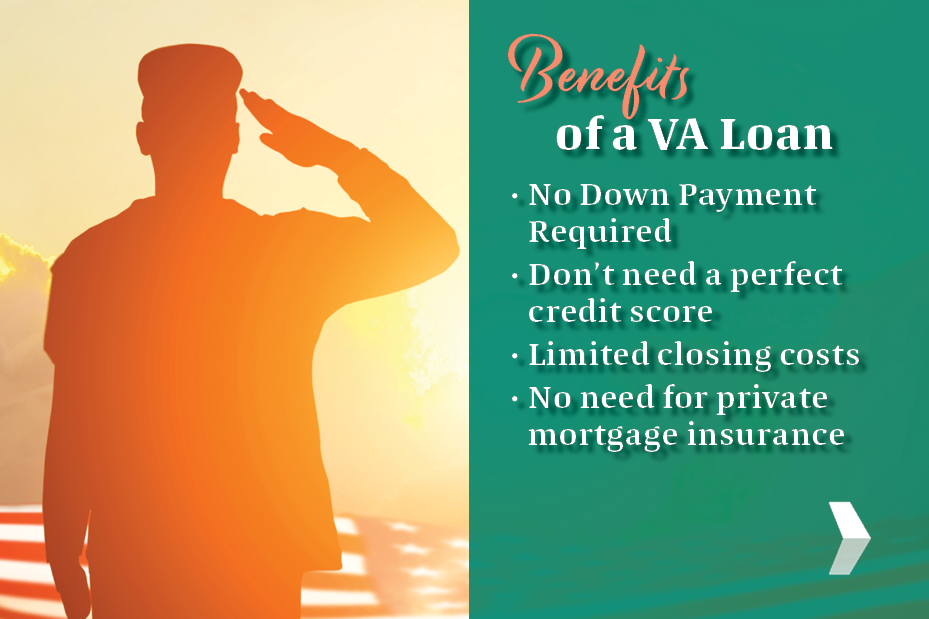

For many hopeful buyers, coming up with sufficient funds for a down payment is the biggest hurdle to homebuying. Luckily, your veteran homebuying benefits allow for 100% financing of a property, which means no down payment is required for eligible applicants.

RELATED: The Down Payment Dilemma: How to Save Smart

Typically, buyers with conventional or FHA-backed loans must save for a percentage of the purchase price, with some striving for as much as 20% to avoid private mortgage insurance (PMI).VA home loans come with a 25% lender guarantee, which means private mortgage insurance is not required.

Do I need a perfect credit score?

Credit score can also be a major hurdle for buyers, especially if they’re just starting out; however, the Department of Veterans Affairs does not establish a minimum credit score and allows lenders to set their own criteria. For example, at PacRes Mortgage, we maintain a minimum credit score requirement of 580.

This flexibility increases the likelihood of applicants qualifying. Keep in mind that comprehending your credit score's role in influencing your interest rate and loan terms is crucial—a higher score enhances the likelihood of being offered more favorable rates and conditions.

To obtain a real-time credit score, you can request a complimentary report by clicking here.

RELATED: How to Build a Good Credit Score and Maintain It

Do I need to set aside funds for closing costs?

Similar to other loan programs, VA loans come with standard closing costs and associated fees. These typically include appraisal costs, title search fees, title insurance charges, and recording fees, among others.

However, there's one specific fee unique to VA home loan program, called the VA funding fee. This fee is paid directly to the VA and to help keep the loan program running smoothly. The exact amount of the funding fee hinges on several factors and is contingent on the loan amount, not the purchase price of the home; moreover, if you're using your benefit for the first time, the funding fee is lower compared to subsequent uses. Buyers have the option to negotiate with the seller to cover this expense or roll the fee into their mortgage to spread the cost over the entire loan term.

In certain circumstances, the buyer is exempt from having to pay the fee; these include receiving VA compensation for a service-connected disability, being on active duty, and providing proof before finalizing the loan, among other qualifying factors.

RELATED: From Offer to Ownership: How to Navigate Closing Costs Like A Pro

Can I use this benefit more than once?

For eligible borrowers who qualify with an approved lender, there’s no limit on the number of times you can use a VA loan benefit in your lifetime; as long as you have remaining entitlement, you will always have the option to use it again.

What is entitlement and how is it used?

Entitlement refers to the specific dollar amount the Department of Veteran Affairs will repay a lender if the veteran, active-duty service member, or surviving spouse defaults on their loan. Whenever a veteran, active-duty service member, or surviving spouse purchases a home, they apply some or all of their entitlement to the loan; generally, the VA guarantees a quarter of the loan amount, meaning borrowers will use a quarter of their available entitlement.

What Is a VA Loan Certificate of Eligibility and How Do I Get It?

Your VA Loan Certificate of Eligibility, often referred to as a COE, is a crucial document that confirms eligibility for a VA home loan. To obtain this certificate, veterans, active-duty service members, or surviving spouses need to follow specific steps outlined by the Department of Veteran Affairs:

Eligible individuals can apply for a COE through the VA's official website or by mailing a completed Form 26-1880 to the VA Eligibility Center, along with proof of military service. Alternatively, many lenders can request the certificate on behalf of the borrower, often streamlining the approval and financing process.

What is acceptable proof of military service?

If you are currently serving on active duty, you must submit an original statement of service signed by the adjutant, personnel officer, or commander of your unit or higher headquarters. This statement should include your name, social security number, date of entry into your current active duty period, and any periods of time lost. For more information, click here.

This statement of service is a fundamental requirement and is usually accompanied by a Certificate of Eligibility (COE) to confirm the borrower's military service and eligibility for the VA loan program. Obtaining the COE can be done through the VA's eBenefits portal, by mailing a request form, or by collaborating with a VA-approved lender such as PacRes, who can access it electronically. Additionally, the borrower must provide a DD214 or Reservist DD256.

You Can Refinance Down the Road

The Department of Veteran Affairs offers several refinancing options for eligible borrowers, including the Interest Rate Reduction Refinance Loan (IRRRL).

The IRRRL offers borrowers the opportunity to benefit from lower loan term years or reduced interest rates without the need for a new appraisal or credit check; as a result, the loan application process is typically faster and less complex compared to a standard refinance.

Benefits of a VA Interest Rate Reduction Refinance (IRRRL)

- Reduced monthly mortgage payments.

- The possibility of lower loan term years.

- Elimination of the need for an appraisal or credit check.

- Potential for a faster and more straightforward loan application process.

- The possibility of securing a lower interest rate.

- Flexibility to switch from an adjustable-rate mortgage to a fixed-rate mortgage.

- The option to customize the loan term to align with your specific requirements.

- No penalties for early loan repayment.

Additional Facts About VA Home Loans

VA loans must be used on a primary residence.

VA loan benefits cannot be utilized for the purchase of vacation homes or investment properties, as there are residency requirements set by the government that make these properties ineligible.

Only certain properties are eligible.

These benefits do not include co-ops, and on its own, vacant land isn’t eligible, either. However, it may be eligible if it’s used in conjunction with a construction loan; other properties, like modular or manufactured homes, are subject to lender approval.

Government-backed loans typically offer lower interest rates compared to conventional mortgages.

In fact, it's typical for VA loan rates to be 0.5 to 1 percent lower than the average conventional loan rate. This reduced interest rate, along with potential monthly PMI savings, can significantly reduce your monthly mortgage payment.

There are no pre-payment penalties.

You have the freedom to make additional payments at your discretion throughout the loan's duration, enabling you to pay off your loan faster without incurring any penalties. These supplementary payments, which can be made whenever you choose, have the potential to save you thousands of dollars in interest over time.

Have More Questions? We’re Here to Help

Don’t let fear of the unknown hold you back from asking questions and taking advantage of the benefits you’ve earned from your time in the service. Connect with your neighborhood Mortgage Advisor today, or click here to receive a personalized quote.

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.