How Would a Recession Impact Home Value? The Silver Lining for Buyers

Kristina Hubbard, CMA, Branch Manager / Sr. Mortgage AdvisorOctober 19, 2023 — 6 min read

It’s a tough question that’s been nibbling at the back of the minds of homeowners, prospective buyers, and investors for over a year now—how would a recession impact home values?

Recent headlines highlight volatile markets and the ripple effects of global events, including multiple interest rate hikes, contributing to a growing concern about the stability of home values and where mortgage rates are headed in the face of a negative economic shift.

If the United States were to enter a recession, rest assured, there is a silver lining for clients: during periods of prolonged and significant economic decline, you always see mortgage rates drop.

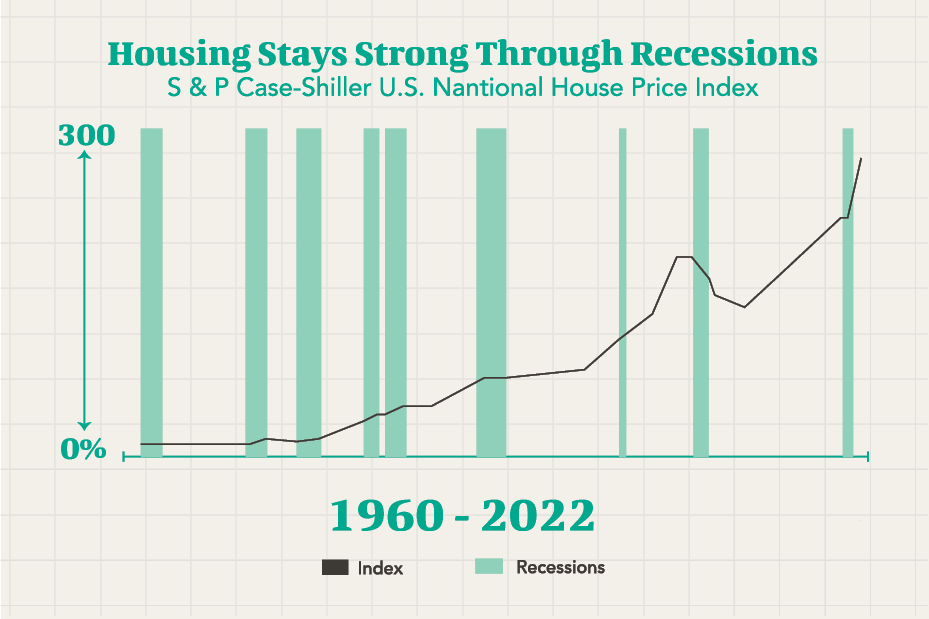

Additionally, if we take a holistic approach to the market, we see that time and time again, housing remains strong through recessions, despite many of today’s headlines.

Below, we explore how a recession could impact real estate today and review facts and figures that you can use to inspire clients to take a confident next step.

Navigating Recession Realities

The way we measure "economic decline" can differ, but researchers typically look at metrics like the nationwide unemployment rate and income. These factors “trickle down” to affect the rest of the economy—things like the hospitality industry, the government, healthcare, and real estate.

For people looking to buy a home, a recession can bring some advantages.

When the economy is not doing well, home prices often drop, which can be good news for those who want to find a good deal; plus, during recessions, mortgage rates usually stay low, meaning buyers can get a home with lower monthly payments.

On the other hand, for those looking to sell their home during a recession, things might not be as positive.

When the economy isn't doing well, more people can lose their jobs, which can make it tough for homeowners. People usually try to cut back on spending when things are tough, and this can mean struggling to pay things like car loans, utility bills, and their mortgages.

If someone can’t keep up, they may decide to sell their home and find a cheaper place to live, like an apartment or a smaller house. When a lot of people are selling their homes, it can put downward pressure on home prices do to supply and demand principles.

Additionally, if people are feeling pressure to sell quickly, they might not have the time or money to fix up their homes; when a home is sold as-is, it means the seller doesn't make any improvements, and this can make the home sell for less money, too. When homes are sold for less money, it can affect the prices of other similar homes that are for sale, and this can keep pushing prices down until the economy gets better.

Rent often remains high during recessions

During most recessions, the cost of renting usually goes in the opposite direction of buying a home; rent prices usually push higher due to increased demand for renters, especially those who have sold their homes and need a temporary place to live until the economy and their finances improve.

What Does This Mean for Mortgage Rates?

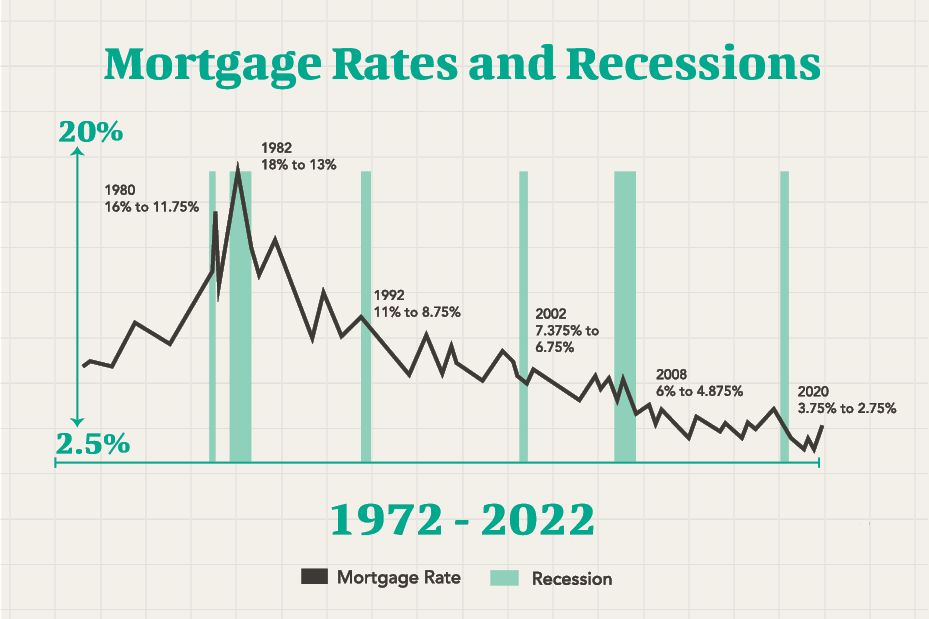

Sometimes, the most effective lessons are learned from looking to the past—over the course of the last several recessions in the United States, mortgage rates declined significantly.

The chart above tracks mortgage rates against recessionary periods from 1972 through last year; during our last recessionary period, rates dropped from 3.75 percent to 2.75 percent; before that, they dropped 6 percent to 4.8 percent.

The pattern is clear: during every recession, the economy slows, inflation comes down, and mortgage rates decline.

What Does This Mean for Home Values?

Beyond rates, there are a lot of people who worry if a recession occurs, it will force them to become upside down on the biggest investment of their life. Here’s why that is not expected to happen:

Many people believe a recession would push home prices down because they can remember the housing bubble of 2008 and mistakenly believe the recession caused the bubble.

However, it was actually the opposite—the housing bubble was so detrimental to the economy, it led the US into a recession. In the chart below, the green lines indicate recessionary periods going back to the 1960s; the black line is home values. In every single recession, home values actually either remained stable or increased during the recession. The one exception is the housing bubble in the late 2000s.

What Made the 'Great Recession' Different?

The recession that occurred in the US from late 2007 to 2009 stood out because it was created because of a huge problem in the housing market. Unlike regular tough times for the economy, when home prices stay the same or experience some growth, we saw home prices crashing down.

Several factors set the 'Great Recession' apart from other recessions:

Housing collapse. Many homeowners found themselves trapped in mortgages that exceeded the value of their homes, a situation commonly referred to as being "underwater." This was a direct consequence of the housing bubble's burst.

Financial crisis. The collapse of major financial institutions and the interconnectedness of global financial markets led to a severe credit crunch, making it difficult for businesses and consumers to access credit.

Global impact. The effects of the Great Recession extended far beyond the United States. It had a global impact, affecting economies and markets around the world. This was in contrast to typical recessions, which tend to have more localized impacts.

Job losses. The Great Recession led to substantial job losses across various industries, contributing to a significant increase in unemployment rates. This was a consequence of the economic turmoil caused by the housing market collapse and the subsequent financial crisis.

Government help. The response to the Great Recession involved unprecedented government intervention and monetary policy actions. Central banks and governments worldwide took measures to stabilize financial markets, stimulate economic activity, and prevent a deeper and prolonged recession.

RELATED: From Fright to Freedom: Exorcising This Year’s Top Mortgage Fears

The Power of Professional Guidance

In times of economic uncertainty, the significance of collaborating with seasoned real estate professionals and mortgage experts cannot be overstated. Our insights offer a sense of reassurance and peace of mind to clients that stems from having a well-informed, strategic plan. In the midst of economic turbulence, the value of such guidance becomes even more pronounced. With our assistance, the journey through uncertain economic times becomes less daunting, transforming what might be a nerve-wracking endeavor into a well-guided, informed pursuit of homeownership goals.

Let’s work together to make homeownership safe and easy for clients, no matter their life stage or long-term financial goals. Click here to provide clients with a customized quote today or explore additional blogs here.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.