Homeownership: The Ultimate Back-to-School Investment for Your Family's Future

August 14, 2023 — 9 min read

Homeownership isn’t just about having a place to call your own—in fact, it may hold the key to a brighter and more secure financial future for you and your family.

With summer ending and a new school year almost here, it's crucial to recognize the profound influence that homeownership can have on your children's educational journey and your financial stability now and in the future.

From fostering educational opportunities to laying the groundwork for long-term wealth building through home equity, homeownership stands as a powerful investment that goes far beyond mere ownership of a property. Let’s step back into the classroom and explore how you can harness the benefits of homeownership for your family's future.

The Role of Homeownership in Creating Stability for Kids

Unlike rental properties, where lease renewals and potential relocations loom, owning a home offers a sense of security and control. This stability translates into a consistent living environment for your family, allowing you to establish roots in a community and forge lasting connections with neighbors, schools, and local organizations. Here are a few tangible ways that can have an impact on your family’s life.

Academic performance

One of the key advantages of stable housing is the ability for children to attend the same schools consistently. Unlike families who experience frequent relocations due to renting or unstable housing situations, owning a home provides the stability necessary for children to remain in the same school throughout their academic journey; this consistency fosters stronger connections with teachers, classmates, and the broader school community. Children have the opportunity to build lasting relationships with educators who can better understand their unique learning needs, provide targeted support, and nurture academic growth.

When children remain in the same school, they benefit from the familiarity of the curriculum, teaching styles, and expectations. This familiarity allows them to fully engage in their studies, as they are not constantly adjusting to new educational settings. In fact, intradistrict school mobility is associated with lower reading achievement scores in the short term and over time; on the other hand, consistent school attendance promotes continuity in learning, ensuring that children do not miss critical instruction or fall behind due to disruptive transitions.

Emotional well-being

In addition to its impact on academic success, homeownership can contribute to a child’s overall emotional well-being. The sense of belonging and security that stems from owning a home and putting down roots in a community creates a stable and comforting environment that positively influences their development.

In general, children living in long-term homes experience fewer disruptions to their daily lives, allowing them to feel more secure and settled; this stability reduces the stressors associated with constantly adapting to new environments, schools, and social circles. As a result, children are better equipped to manage their emotions and navigate challenges more effectively, equipping them to make more informed and confident choices into the future.

Social development

Moreover, when families own their homes, they tend to establish long-term connections with their neighbors and become active participants in local communities. This sense of belonging creates a supportive social environment that contributes to the overall well-being of children, encouraging them to form lasting friendships. The consistency of homeownership allows children to grow up alongside their peers, forging bonds that can extend beyond childhood and creating a support system that promotes healthy social interactions, empathy, and cooperation.

Creating an Environment Conducive to Academic Success

One of the often-overlooked advantages of homeownership is the ability to create a dedicated study space for young kids. Having a designated area within the home for studying and completing homework can greatly enhance a child's academic success. Whether it’s a separate room or a corner of a quiet living area, the key is to provide a space that is free from distractions and interruptions, allowing children to immerse themselves in their homework and learning activities.

RELATED: Home Soundproofing: How to Make Your House Quieter

In addition to providing a quiet space, it's important to organize study materials and resources in a way that promotes efficiency and productivity. Consider investing in storage solutions such as shelves, bins, or cabinets to keep textbooks, notebooks, and school supplies neatly organized and easily accessible.

Moreover, consider the lighting and overall ambiance of the study area; natural light is ideal for promoting alertness and a positive learning environment, so position the study space near a window, if possible. If natural light is limited, opt for well-placed desk lamps or overhead lighting that provides ample illumination without causing strain on the eyes.

Beyond physical design, consider incorporating supportive elements that inspire and motivate children academically. Display educational artwork, inspirational quotes, or a bulletin board where they can showcase their achievements and goals. Personalize the study area with items that reflect their interests and passions, creating an environment that encourages them to take ownership of their learning journey.

Furthermore, encourage a culture of learning throughout the entire home. Engage in conversations about schoolwork, ask about their progress, and show genuine interest in their academic pursuits. By creating a home environment that values education and supports academic achievement, you’ll instill a strong foundation and desire for lifelong learning and success.

Adapting Spaces for Changing Educational Needs

As your children progress through their educational journey, their study requirements and learning styles may evolve; fortunately, as a homeowner, you have the freedom to repurpose rooms or create multi-functional spaces that can accommodate these evolving needs.

If needed, you can repurpose a spare bedroom or an underutilized area of your home. Furthermore, multi-functional spaces can be created to accommodate various educational activities. For example, a corner of the living room can be transformed into a reading nook, complete with comfortable seating, a bookshelf, and soft lighting. Additionally, a well-designed kitchen area can serve as a space for hands-on science experiments, cooking lessons, or even as a study group meeting place.

The Financial Advantages of Homeownership for Education

Homeownership also provides significant financial benefits that can contribute to your children's educational endeavors now and into the future. By understanding and leveraging these opportunities, you can create a solid foundation to support their educational expenses.

One of the primary financial benefits of homeownership is the opportunity to build home equity. As you make mortgage payments over time, you gradually increase your ownership stake in the property; over the years, as property values appreciate, your home equity can grow substantially. This increased equity can be tapped into to fund educational expenses when the need arises, whether it's financing college tuition, vocational training programs, or other pursuits.

RELATED: Your Complete Guide to Using Home Equity

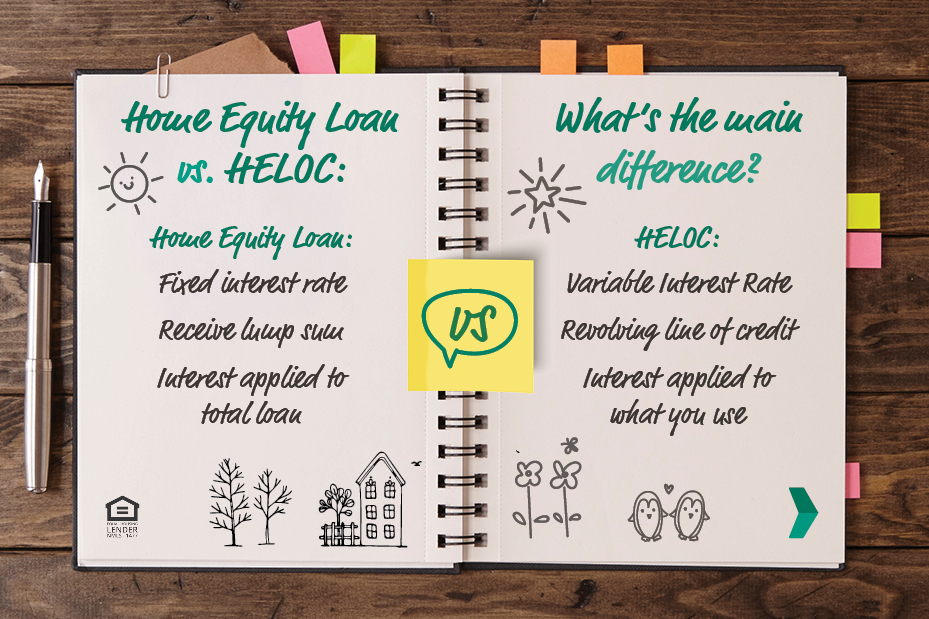

One option for accessing funds from your home equity is through a home equity loan. With a home equity loan, you receive a lump sum of money upfront, which you can then use to finance educational expenses. The loan is secured by your home and repayment terms are typically structured over a fixed period with regular monthly payments. Another option is a home equity line of credit (HELOC). Unlike a home equity loan, where you receive a lump sum, a HELOC allows you to borrow funds as needed up to a predetermined credit limit. This flexibility can be advantageous when it comes to educational expenses, as you can withdraw funds as required throughout your children's educational journey.

RELATED: Unlock Potential: How a HELOC Can Help You Invest in Real Estate

Homeowners may also consider refinancing their existing mortgage to access funds for education. By refinancing, you can borrow additional funds based on your home's increased value or accumulated equity. This option allows you to take advantage of lower interest rates, extend the repayment term, or adjust the loan structure to meet your financial needs. Click here to learn more.

Additionally, homeownership can offer tax advantages that can free up financial resources. In many cases, homeowners can deduct mortgage interest and property taxes from their income taxes, resulting in reduced tax liability. These tax deductions can provide significant savings, allowing you to allocate more funds toward education-related expenses. Consult with a tax professional or financial advisor to understand the specific tax benefits of homeownership in your area.

RELATED: Tax Breaks for Homeowners: Your Yearly Guide to Credits and Deductions

Moreover, homeownership provides a solid financial foundation that can contribute to long-term financial security. Owning a home builds financial discipline and fosters a mindset of investment and asset accumulation. As you make regular mortgage payments, you are essentially building savings in the form of home equity. This disciplined approach to managing finances can extend to planning for your children's education. By prioritizing homeownership and diligently managing your mortgage payments, you can instill a sense of financial responsibility and create a solid financial footing to support their educational journey.

Homeownership can serve as collateral for obtaining educational loans or lines of credit. Should your children need additional financial assistance to pursue higher education, owning a home can provide the leverage needed to secure favorable loan terms. Lenders often view homeownership as a sign of financial stability and responsibility, making it easier to access educational financing options. By utilizing the value of your home, you can provide your children with access to the necessary funds to pursue their educational goals without incurring excessive debt burdens.

RELATED: Student Loans and Getting a Mortgage: What You Need To Know

Homeownership as an Investment in Lifelong Learning

Beyond its practical benefits, owning a home provides individuals with a sense of pride and accomplishment. The process of purchasing and maintaining a home instills a sense of responsibility, financial discipline, and perseverance. By overcoming the challenges and milestones of homeownership, individuals develop essential life skills and grow personally.

By embracing the opportunities and advantages of homeownership, you create a space that nurtures not only academic success but also personal development and a lifelong commitment to learning.

Ready to take a confident next step?

Click here to connect and discuss options with your neighborhood Mortgage Advisor today, or explore other recent blogs by clicking here.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.