The Blueprint to Building Credit for First-Time Homebuyers

February 14, 2024 — 5 min read

It’s go time—your client has done research and feels confident about next steps. This is an exciting time, and if they’ve been wise with their finances, they may be in a great position to buy. However, a big question remains: do they have the credit necessary to purchase a home? Generally, a strong credit history makes a trustworthy borrower, and the higher your client’s score, the lower their rate.

If you’re wondering how to help first-time buyers in today’s market, there are options available. Learn about what lenders are looking for and what you can do to give clients a leg up.

Understanding Credit Scores

Credit scores are critical to the mortgage approval process and wield significant influence over a borrower's eligibility. In short, a credit score is a representation of an individual's creditworthiness, condensing their credit history into a three-digit number between 300 and 850.

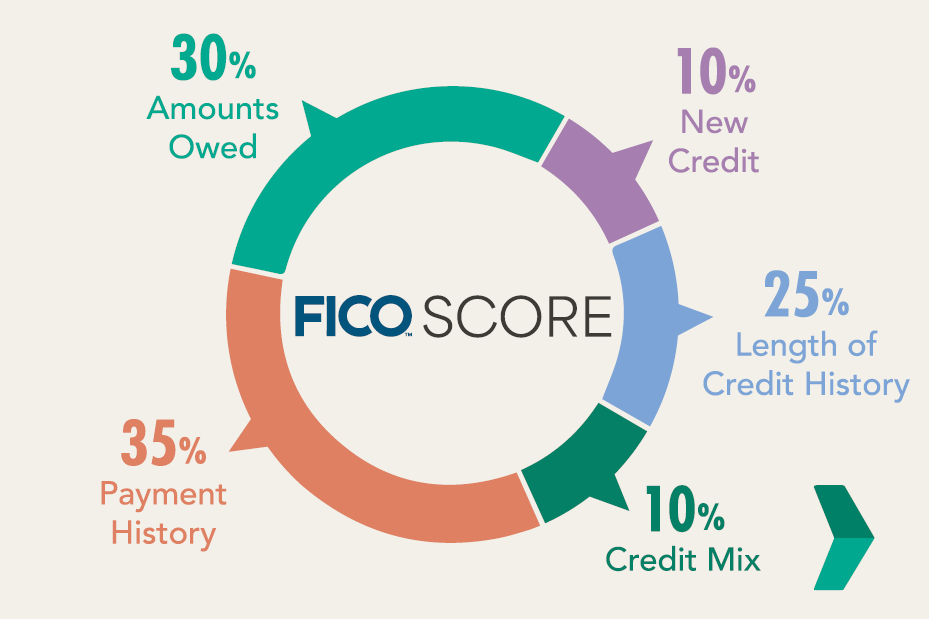

What factors go into a credit score?

Payment history. This is the most important piece. It reflects how consistently a borrower meets their financial obligations.

Credit utilization. This gauges the ratio of used credit to available credit; generally, a borrower should keep this ratio low, as a high ratio can negatively impact the credit score. A good

Length of credit history. The longer a credit history, the more information a lender has to go on; a well-established record showcases a borrower's ability to manage credit responsibly over time.

Type of credit. Diverse credit types, such as credit cards, installment loans, and mortgages, can positively impact the credit score. It demonstrates the borrower's ability to handle different types of credit responsibly.

New credit. This factor considers the number and recency of newly opened credit lines. Opening multiple credit accounts in a short span may be perceived as risky behavior.

RELATED: How to Get a Mortgage While Building Credit: Tips for First-Time Buyers

How to Build Credit to Get a Home

To build or improve a client’s credit score for homeownership, suggest or encourage the following steps:

Secured credit cards

Secured credit cards are an entry point for first-time homebuyers aiming to build their credit or repair it. These cards require a cash deposit as collateral, which mitigates risk for the lender.

When considering a secured credit card, select one with low fees and a reporting mechanism to major credit bureaus. This ensures that responsible usage is reflected in the individual's credit history.

Practical tips on responsible usage include making small, regular purchases, paying the balance in full each month or having the revolving balance under 50% of the high credit limit, and avoiding maxing out the credit limit.

Authorized user status

One other avenue to build credit is to become an authorized user on a trusted person's credit account. Typically, that means a family member or close friend. This involves being added to their existing account, with the account holder's payment history reflecting on the authorized user's credit report.

While this can be an effective strategy for establishing credit, potential risks include inheriting negative marks if the primary account holder misses payments or accumulates debt.

Other tips to build or improve a client’s credit score for homeownership:

Pay bills on time

This advice is a no-brainer, especially when you consider that "payment history" holds the most significant weight (35%) in determining your overall credit score.

Late payments, reported when 30 days or more overdue, can significantly impact credit. On the flip side, consistently making on-time payments will have the opposite effect, gradually boosting a client’s score over time. Setting up an automatic payment on bills and debts is a good idea to help ensure a client doesn’t miss a payment.

Keep balances low and cards open

Maintaining low credit card balances and keeping accounts open can positively influence your client’s credit score. A lower credit utilization ratio and a longer credit history demonstrate responsible credit management and contribute positively to their overall creditworthiness.

Review credit report for errors

Your client must regularly review their credit report for errors or inaccuracies. Disputing and rectifying any discrepancies promptly ensures that their credit report accurately reflects their financial responsibility, potentially improving their credit score.

Maintain a mix of credit types

Encourage clients to diversify their credit portfolio by holding a mix of credit types. This could include credit cards, installment loans, or retail accounts. This demonstrates versatility in managing different types of credit, contributing positively to their overall creditworthiness.

What Other Factors Do Lenders Consider to Determine Eligibility?

Credit history plays a pivotal role in determining mortgage eligibility, but lenders also assess other factors to gauge how reliable a potential borrower is. Here's a rundown of the key financial considerations lenders consider (specific criteria may vary depending on the loan type):

Income. Lenders want to be confident that a borrower’s income supports their monthly mortgage commitments with ease.

Employment history. Stable employment history, preferably within the same job or industry for the past two years, is generally favorable in the eyes of a lender.

Tax returns. Typically, lenders review a borrower’s tax returns from the past two years to gain insight into their financial stability.

RELATED: The First-Time Buyer’s Guide to Tax Credits & Deductions

Debt-to-income ratio (DTI). This measures the percentage of a borrower’s income used to service debt. Typically, lenders prefer monthly debts not to exceed 43% of the borrower’s gross monthly income.

RELATED: How Debt to Income (DTI) Ratio Can Affect a Borrower's Mortgage

Savings balance. Lenders want to see a savings balance equivalent to at least two months' worth of mortgage payments. This reserve demonstrates an ability to handle unexpected expenses.

Give Clients a Free, Customized Quote Today

It’s safe and easy—click here to give clients clarity and peace of mind today, or connect with a neighborhood Mortgage Advisor today.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.