Debt-Free Dreams: How to Help Clients Manage Student Debt & Pay it Off Faster

Venessa Eck, Sr. Mortgage AdvisorJuly 31, 2023 — 9 min read

Recent college graduates know better than most—nowadays, the costs associated with attending a college or university are undeniably steep. From tuition fees and textbooks to housing and living expenses, the weight of student debt can feel overwhelming and may hinder graduates’ ability to pursue their dreams, buy a home, or save for future goals.

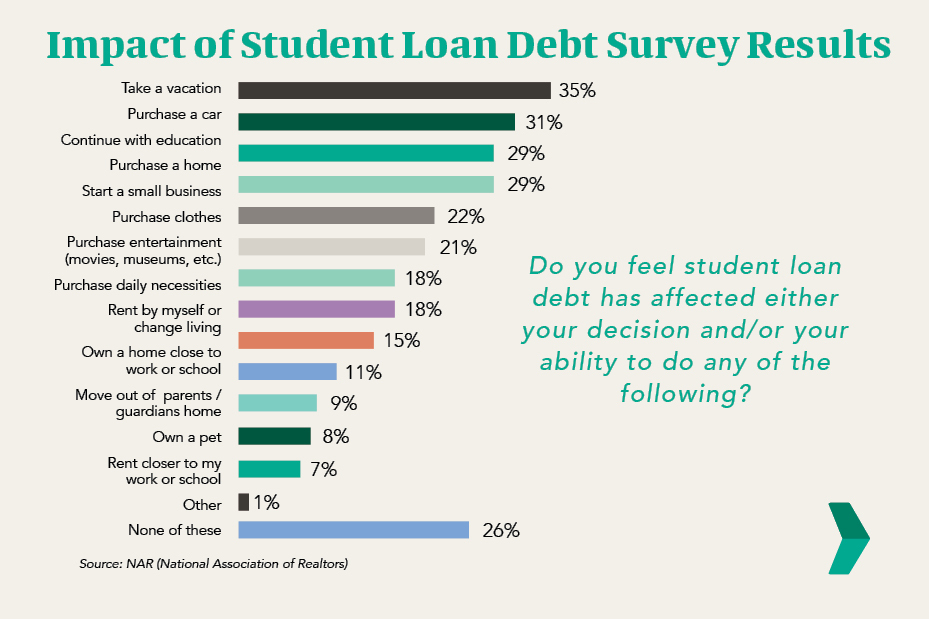

In fact, according to a recent report, more than a quarter of student loan debt holders say their debt has negatively impacted their ability to buy a home, take a vacation, or purchase a vehicle.

Furthermore, the reports indicate that most recent graduates—about three quarters—aren’t fully aware of the costs involved in a college or university education and do not understand what their earning potential could be post-graduation.

With a new school year approaching, now is the time to equip young homebuyers and their families with the tools and knowledge they need to manage their student debt effectively and pay it off faster. Use these strategies and tips

from industry experts to help current and future clients secure a strong financial future, no matter what they’re working towards.

Understanding Today’s Student Loan Landscape

Currently, the average cost of attendance for a student living on campus at a public 4-year in-state college or university is approximately $103,000, or just under $26,000 per year; on average, out-of-state students pay around $44,000 per year, and students attending private schools pay about 54,500 per year. These figures include the total cost of tuition and fees, books and supplies, as well as room and board; they do not include transportation costs, daily living expenses, student loan interest, etc.

To put these numbers in context, the average cost of attendance across all schools has increased by about 20 percent over the past decade and has more than doubled over the past 30 years. This has led to a surge in student loan borrowing to meet the rising costs associated with tuition, fees, books, supplies, and room and board. Now, many borrowers find themselves burdened with substantial loan balances upon graduation, and that can have long-term consequences, such as delaying major life milestones and hindering individuals' ability to save for retirement or invest in their future.

The Power of Early Action

By taking proactive steps early on, clients can set themselves up for long-term financial success and expedite their path toward a debt-free future. However, to fully harness the benefits of early action, it is essential for clients to start planning and taking proactive steps toward repayment as soon as possible.

One of the most compelling reasons to do this is the power of compounding interest. Student loans accrue interest over time, and the longer it takes to pay them off, the more interest accumulates. Every payment made reduces the principal balance, which, in turn, reduces the amount on which interest accrues; by chipping away at the loan balance sooner, borrowers can save a substantial amount in interest payments over the life of the loan.

Here are some other reasons why the power of compounding interest and the advantages of starting early should not be ignored:

- The earlier clients begin the repayment process, the more time they have to make consistent payments and reduce their outstanding balance. This allows them to make a significant dent in their debt before other financial responsibilities pile up.

- Early action provides an opportunity to develop a well-thought-out repayment strategy. This strategy may include exploring options such as income-driven repayment plans, refinancing, or aggressively paying down high-interest loans first.

- By making consistent payments from the beginning, clients establish good financial habits and set a positive trajectory for their overall financial well-being. This discipline can extend beyond student loans and positively impact other areas of personal finance, such as budgeting, saving, and investing.

Strategies to Help Clients Pay off Student Debt Faster

- Use a Debt Consolidation Loan for Easier Management

Debt consolidation is a highly effective strategy for borrowers facing multiple high-interest debts, such as student loans. It involves merging these debts into a single monthly payment with a lower interest rate. By consolidating their debts, borrowers can save quite a bit of money and accomplish the following objectives:

- Eliminating higher interest debt

- Removing the stress of minimum payments

- Enabling one (and only one) payment monthly at a lower rate

- Providing a fixed rate, fixed payment loan (no compounded interest)

If the ease of a debt consolidation loan doesn't appeal to a client, there are alternative debt management strategies out there. These strategies offer different approaches to managing debt and can be tailored to meet your client's specific financial needs and goals.

RELATED: Take Control: Smart Strategies for Consolidating Debt

- The Snowball Method

This method involves tackling smaller loans first, regardless of interest rates, to build momentum. By targeting the loans with the lowest balances, clients can quickly eliminate them and create a sense of accomplishment; as the small loan is paid off, the freed-up monthly payment can then be redirected towards the next loan, creating a snowball effect that gains traction with each successful payment. This approach not only provides psychological motivation but also frees up additional funds to tackle larger loans more aggressively.

Some pros of this method include:

- Structure for success. More people are more likely to follow through on a debt management plan if they have specific goals to reach and a clear idea of how to get there.

- Practicality. Clients with limited financial resources may discover that the snowball method offers greater affordability on a month-to-month basis compared to the avalanche approach.

- Motivation boost. The satisfaction of seeing each small debt vanish can serve as powerful motivation to persistently tackle the remaining larger debts.

Some cons include:

- Potential higher costs: By prioritizing smaller loans instead of higher-interest debts, the Snowball Method may result in paying more in interest over the long term.

- Longer time frame: Leaving larger debts for later may extend the overall repayment timeline, keeping clients in debt for a longer period compared to alternative strategies.

- The Avalanche Method

In this method, borrowers prioritize loans with the highest interest rate for maximum savings. In contrast to the snowball method, it focuses on the loans that accrue the most interest over time. It involves making minimum payments on all loans while allocating any extra funds towards the loan with the highest interest rate; once that loan is paid off, the payment amount, including the extra funds, is redirected to the loan with the next highest rate. This strategy optimizes cost savings and reduces the overall interest paid over the life of the loans.

Advantages of this method include:

- Efficiency: The Avalanche Method is a highly cost-effective debt management strategy, as it can significantly reduce the overall interest payments a client would have to make.

- Speed: Once the debt with the highest interest rate is paid off, momentum is gained, leading to faster progress in tackling remaining debts and achieving solvency sooner.

Two potential drawbacks to consider:

- Discipline: The Avalanche Method demands a high level of self-control and discipline since even one late payment on a high-interest rate debt could undermine progress.

- Motivation: Results from the Avalanche Method may not be immediately apparent, making it challenging to stay motivated throughout the debt repayment journey.

- Combining Strategies to Tailor Repayment Plans to Each Client’s Finances

While the snowball and avalanche methods are effective on their own, they can also be tailored and combined to meet individual needs. For example, clients can start with the snowball method to build momentum and gain a sense of progress, then transition to the avalanche method to maximize interest savings. Alternatively, clients may choose to prioritize loans based on factors other than interest rates, such as emotional factors or specific financial goals.

The Power of Budgeting & Making Extra Payments

Creating a realistic budget is a key component to accelerating loan payments. By carefully analyzing income, expenses, and debt obligations, borrowers can identify areas where adjustments can be made to allocate more funds toward debt repayment.

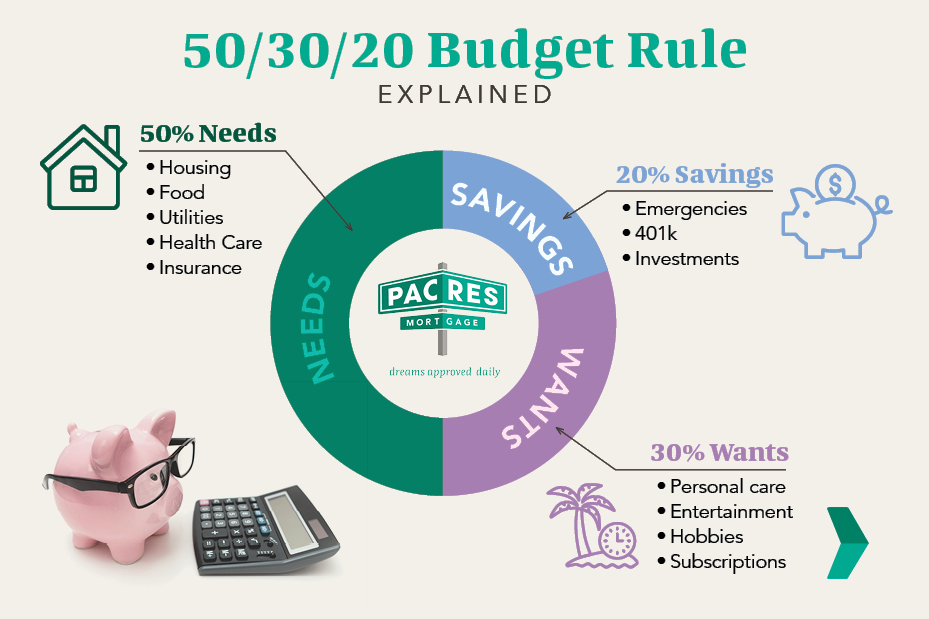

The 50/30/20 rule

This rule of thumb allocates a budget across three key categories: needs, wants, and financial goals. While it's not a rigid rule, it serves as a guideline to assist in creating a solid and balanced budget.

By following the 50/30/20 rule, a borrower allocates 50% of their income towards essential needs, such as housing, utilities, groceries, and transportation; the next 30% is dedicated to wants, including discretionary expenses like entertainment, dining, and leisure activities; the remaining 20% is directed towards financial goals, such as savings, debt repayment, and investments.

Making extra payments

Clients can also accelerate progress by making extra payments, even if it’s not on a regular basis. There may be occasions where a borrower receives an unexpected windfall, such as a tax refund or a work bonus, which can be utilized to reduce their loan balance.

There’s also the option to round up payments—for example, if a borrower’s monthly payment is $1,356, they can choose to round it up to $1,400 and apply the additional $44 towards the principal. These small additional payments can add up over time and make a significant impact in reducing the overall balance.

Luckily, there are no penalties for paying off student loans early or exceeding the minimum payment amount; however, it's important to ensure that the loan servicer applies the extra amount towards the principal balance.

RELATED: Strategies to Pay Off Your Mortgage Early: Achieving Financial Independence Sooner

Beyond Student Loan Repayment: Building Long-Term Financial Wellness

It's important to emphasize that paying off student loans does not mean neglecting other areas of financial well-being. While paying off student loans is a significant accomplishment, it's crucial for clients to think beyond debt freedom and envision their long-term financial goals. If appropriate, encourage clients to set specific and achievable targets, such as saving for a down payment on a house.

RELATED: How to Save for a Down Payment

In addition, you may encourage clients to establish emergency funds that can cover unexpected expenses and talk with them about the benefits of investing accumulate wealth and financial growth. By shifting the focus from solely student loan repayment to a holistic approach to financial wellness, we can empower clients to build a solid foundation for long-term financial security.

RELATED: 3 Smart Money Habits to Help You Save for a Home

Let’s Work Together to Help Clients Thrive

This blog touches on just some of the strategies and resources available to help students and recent graduates manage debt and establish healthy money habits. Reach out today if you have questions or want to hear more, or check out other recent blogs here.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.