Family, Feast, and Finances: Balancing Mortgage and Holiday Expenses

December 11, 2023 — 7 min read

Some say it’s the happiest time of the year—for others, it’s the most expensive.

No matter how you slice it, figuring out an appropriate holiday budget can feel overwhelming, especially when you’re juggling it between several other important financial commitments.

However, there are realistic strategies you can employ to keep holiday costs in check and in perspective beside things like your monthly mortgage payment.

Below, we delve into these strategies and provide a roadmap to help you successfully manage your finances during the holiday season while meeting your mortgage obligations.

The Financial Strain of the Holiday Season

From mouth-watering food, to opportunities to connect with family members and friends, the holidays offer many benefits that go beyond the exchange of gifts. The shared experiences, whether through decorating a tree, singing carols, or sharing stories around a fireplace, create lasting memories and deepen our relationships.

However, it's important to acknowledge the financial strain that can accompany these festivities. The desire to make this time of year special and memorable can lead to overspending, leaving many individuals and families facing post-holiday financial stress.

RELATED: Too Much Holiday Spending? How to Consolidate Debt

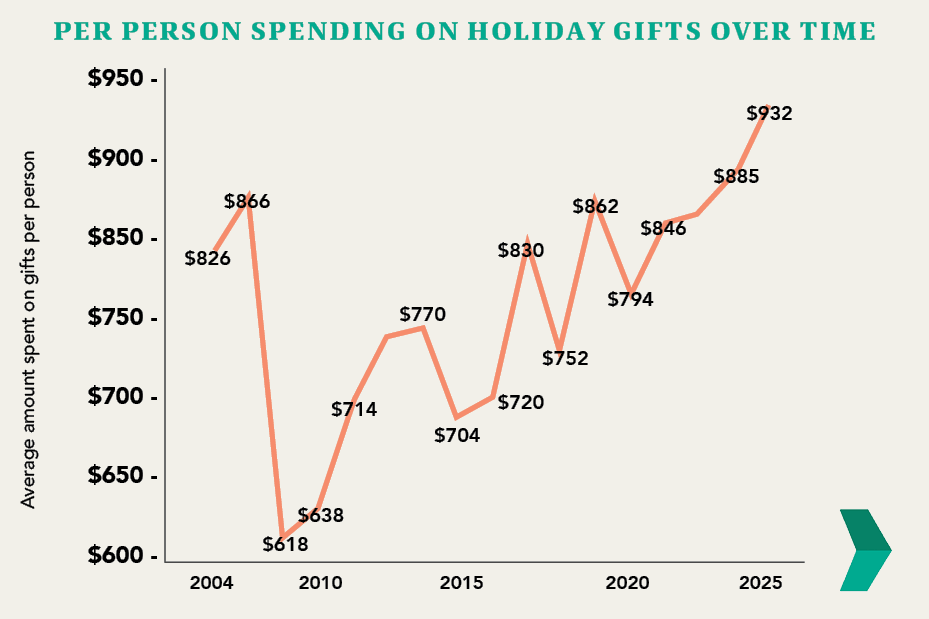

From purchasing gifts and decorations to planning elaborate feasts and travel expenses, costs can add up quickly. In fact, just recently, overall holiday spending reached $889 billion, a new record in the United States.

More specifically, we can see that most people are expected to spend close to $1,000 each this holiday season, according to researchers.

How to Balance Your Mortgage with Holiday Expenses

Your mortgage is one of the most significant financial commitments you have, and it's essential to ensure that you can meet this obligation while enjoying the holiday festivities. Here are some strategies to help strike that balance:

Prioritize your mortgage.

Before you allocate funds for holiday expenses, make sure you've set aside enough to cover your mortgage. Falling behind on mortgage payments can lead to serious consequences, including potential foreclosure, which can have long-lasting repercussions on your financial stability.

Incorporate holiday expenses into your budget.

When planning your holiday budget, factor in mortgage payments as a non-negotiable expense. Allocate funds for your mortgage first, then determine how much you can comfortably spend on holiday-related costs.

Explore refinance options.

If your current mortgage payments are stretching your budget, it may be worth exploring mortgage refinancing options, including a cash-out refinance. Refinancing can lower your monthly mortgage payment, giving you more flexibility to allocate funds towards holiday expenses. Opting for a cash-out refinance means replacing your existing mortgage with a new one of a higher value, and you'll receive the surplus amount in cash during the closing process. Click here to learn more.

Maintain an emergency fund.

This acts as a safety net in case unexpected expenses arise, allowing you to avoid dipping into funds allocated for your mortgage. Prioritize building or replenishing your emergency fund to ensure you have a financial cushion during the holidays.

RELATED: 3 Smart Money Habits to Help You Succeed at Homeownership

Seek professional guidance.

If you're concerned about your ability to balance holiday expenses and your mortgage, don't hesitate to seek advice from your neighborhood Mortgage Advisor. They can provide personalized guidance based on your financial situation and help you create a plan to achiever your goals.

Tips to Help You Avoid Overspending Over the Holidays

Navigating the holiday season while staying within your budget requires thoughtful planning and smart strategies. Use these practical tips to avoid overspending and maintain financial stability during this festive time:

Set a realistic budget and stick to it.

Take time to figure out how much you want to spend and how much you can afford to spend before you start shopping. Consider the significant items you intend to purchase first, as they are likely to consume the biggest piece of your budget. This analysis will provide a clearer understanding of the remaining amount you can comfortably allocate for other costs.

Set a spending limit for each person.

It's a common scenario—you make an impulse purchase for one child, family member, or friend, which triggers the feeling that you should buy something similar for a different child, family member, or friend; this cycle of overspending then trying to compensate can quickly lead to surpassing your holiday budget.

To tackle this challenge, establish a specific budget for each person you're buying for; remember that the essence of gift-giving lies in the thought and sentiment behind the present and consider creative alternatives, such as a Secret Santa or a gift exchange.

Consider homemade gifts.

If your holiday budget is a little tight, the realm of homemade gifts offers limitless possibilities. Craft a personalized ornament or decoration, bake a batch of homemade cookies, or extend an invitation to take a friend out for a post-holiday dinner. These gestures, crafted from your time and effort, often carry greater significance and create lasting memories compared to commercial gifts.

Resist the temptation to buy on impulse.

Retail stores are designed to entice shoppers into purchasing more than their initial intent, a tactic that becomes especially pronounced during the holiday season. However, if you've committed to adhering to a holiday budget, it's crucial to recognize that impulse purchases can derail your financial plan. To safeguard your budget, adhere to your list of intended gifts; if you encounter an unexpected present that is too tempting to resist, consider purchasing it in lieu of something else.

Don’t forget about other holiday expenses.

In addition to gifts, there are many other additional costs that could pose a challenge to budgeting, including:

- If you’re taking on the role of a host, will you be preparing a holiday feast for family members and friends?

- If you’re planning to visit relatives, will you drive or fly? Will you need to hire a pet sitter?

These supplementary costs can accumulate quickly, often making the holidays more financially demanding than anticipated. Moreover, with recent inflation numbers, holiday expenses may appear even more burdensome. Last year, global inflation rose 8.8 percent, according to experts; this year, it’s expected to rise at least 6.5 percent.

Plan for after the holidays.

When creating your holiday budget, it's important to extend your financial planning to encompass at least the initial couple of months following the festivities. You might choose to dine out less frequently in January or opt for more budget-conscious entertainment options; alternatively, you could consider scaling back your gift budget. Ultimately, the objective should be to savor the holiday season and embrace the new year without the burden of financial stress.

Other Money-Saving Tips for the Holiday Season

Take advantage of Black Friday & Cyber Monday. Take advantage of the pre-holiday sales offered by many retailers during Black Friday and Cyber Monday. These sales events can be excellent opportunities to get a head start on holiday shopping if you know what you’re looking for and stick to your shopping list.

Shop online to compare deals. Opting for online shopping can be a budget-friendly and time-saving choice. It allows you to easily compare prices across different vendors, helping you find the best deals. Don't forget to search for free shipping codes and ensure you order gifts well in advance to account for delivery times.

Be proactive. One guaranteed way to spend too much is waiting until the last minute to buy all your gifts. Not only are you more likely to overspend, but it also adds extra stress during an already busy time of the year.

Start saving early. Begin setting aside money early in the year to cover your holiday expenses. Review your previous year's holiday budget to gauge your spending, and divide that total by 12 months. This monthly savings goal will help you prepare for next year's holiday season. Keep in mind that costs tend to rise over time, so adjust your savings plan accordingly.

What Other Questions Do You Have?

There’s a lot to talk about when it comes to home finances—whether you’re just starting out or have been managing your finances for a while, we’re here to provide the guidance and support you need to make informed decisions and achieve your financial goals. Reach out today or click here to receive a personalized quote.

Keywords:

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

I felt like I was treated like family, great communication and helping me with any questions I had.

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.