< Back to News & Insights

What are Interested Party Contributions?

July 30, 2018 — 4 min read

Mortgage closing costs range from 2-5% of the home's purchase price, which can add up quickly for any buyer. However, many buyers aren't aware that there are options available to them if they don't have enough funds for their mortgage closing costs.

There are other people who can help you pay them!

Don't wait to find out during the home loan process; know your options before you buy. At PRM, it's our goal to empower you before, during, and after your home buying journey. So here is some information on the basics of Interested Party Contributions.

What are Interested Party Contributions?

Often referred to as Seller Contributions (if only the seller is contributing), Interested Party Contributions (IPCs) are costs that normally are the responsibility of the property purchaser. They can be paid directly or indirectly by someone who has a financial interest in or can influence the terms and the sale or transfer of, the property being purchased. IPCs are only used towards the buyer's closing costs. They can't be used for the buyer's down payment, or any other uses such as repairs, new appliances, or debt payoff.Who is considered an interested party?

Interested parties to a transaction are, but are not limited to:- The property seller

- The builder/developer

- The real estate agent or broker

- An affiliate who may benefit from the sale of the property at a higher purchase price

How does the contribution work?

First, a home buyer and home seller reach an agreement on a sales price for a home. After the first agreement is made, the buyer and seller both agree to raise the sales price of the home above its original level, with an interested party agreeing to concede the entire "raised amount" toward the buyer's closing costs at settlement. For example: a buyer wants to purchase a home for $400,000. Total closing costs are about $5,000. Either the buyer or an interested party could suggest increasing the purchase price from $400,000 to $405,000, and the buyer would receive a $5,000 credit. The seller's net proceeds would remain the same, and the interested party (whether it's the seller or a 3rd party) would be assisting the buyer with upfront fees. *The fees in this example are for illustrative and educational purposes only and are not based on actual amounts you would pay.IPC Limitations

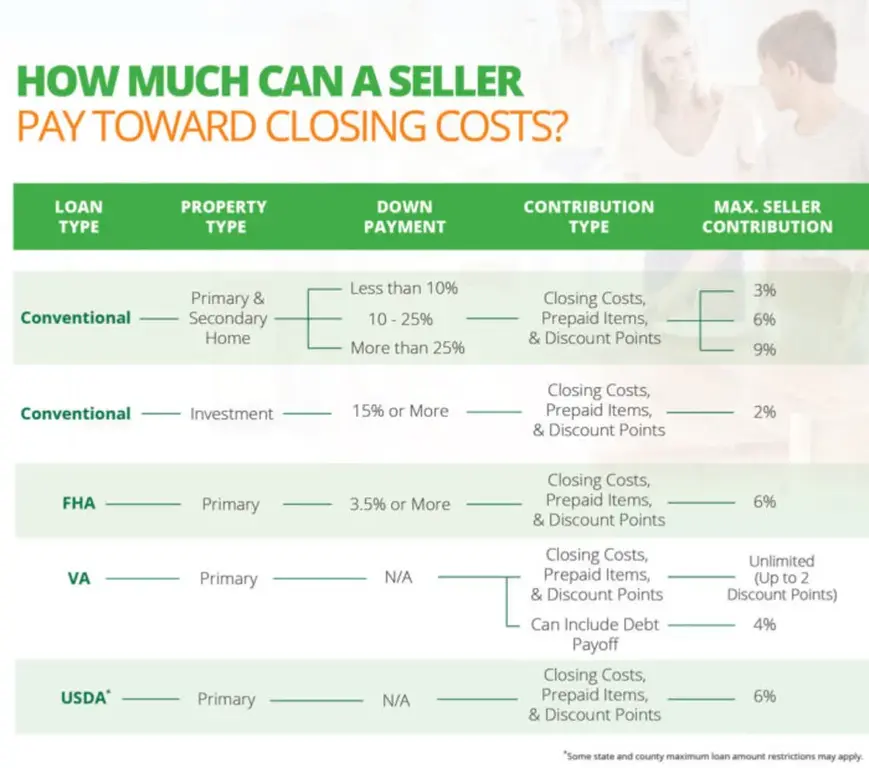

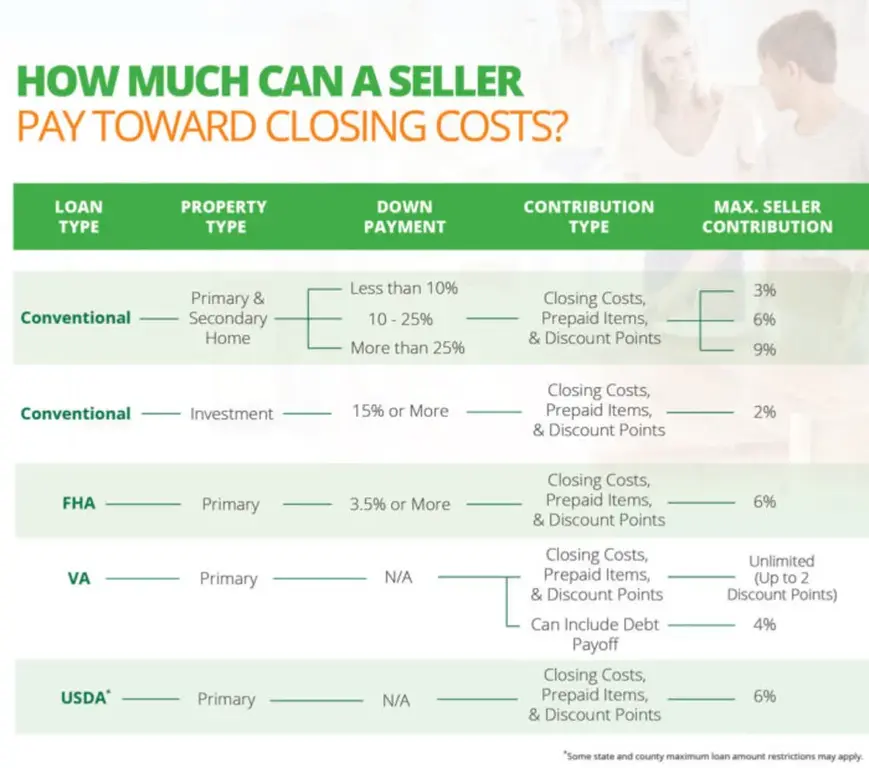

In many cases, there are limits to how much a buyer can receive in contributions. Government Agencies such as Fannie Mae, Freddie Mac, HUD, and others set these limits. The mortgage program a buyer uses to finance their home purchase typically caps the amount of closing costs an IPC can pay. For other information on IPC limits with different mortgage types, see our chart below.

Can the interested party contribute more than the actual closing costs?

Sometimes, IPCs will cover all of a buyer's cost, other times; they will only cover part of the costs. In any case, the amount of IPCs given to the buyer must never exceed the amount of closing costs charged to the buyer. The buyer cannot use IPCs to get "cash back" at closing, or for any other purpose than to pay for closing costs shown on a closing disclosure statement. Consult your mortgage banker Before agreeing to increase the purchase price of the home in order to receive more IPC funds towards closing, make sure you discuss with a trusted mortgage banker. We can help you with a cost-benefit analysis so that you understand your options from all angles. We will also make sure that receiving IPCs will be in your best interest and that your decision will get you to your goals.Contact us today to talk to a trusted mortgage advisor about your homeownership goals.

Categories

Archives

Recent Posts

- No Down Payment for First-Time Homebuyers

- How Does A 30-Year Mortgage Work: A Simple Guide

- Your Comprehensive Homebuying Checklist: A Step-By-Step Guide

- Mortgage Pre-Approval: Everything You Need to Know

- What Are the Benefits of a USDA Loan for Homebuyers?

- How Many People Can Be On A Home Loan? Your 2024 Guide

Getting started >

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

{ include "_components/button" with {

primary: false,

value: "Let's go get it",

link: '/mortgage-loans',

icon: true

} %}

What our clients say >

I felt like I was treated like family, great communication and helping me with any questions I had.

Getting started >

You bring the dream. We'll bring the diagram.

There’s a financing solution for just about every situation.

Find an advisor >

Where does your sun shine? Find your local advisor.

Enter your city or state to see advisors near you.